Jack Liu, is a new client who has recently immigrated from China. He is seeking advice on

establishing a managed fund portfolio. As is the usual procedure with new clients, you

undergo the 'fact finding' process with Jack and you also decide to do an assessment of his

financial literacy as this will help to tailor your communication approach with Jack.

Explain how you would assess his financial literacy and how you would consider his cultural

background, as an aspect of behavioural finance, which might affect this assessment. (8

marks)

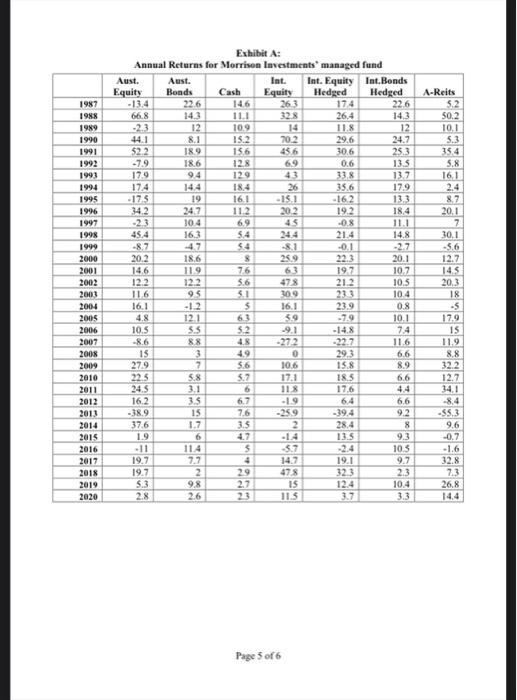

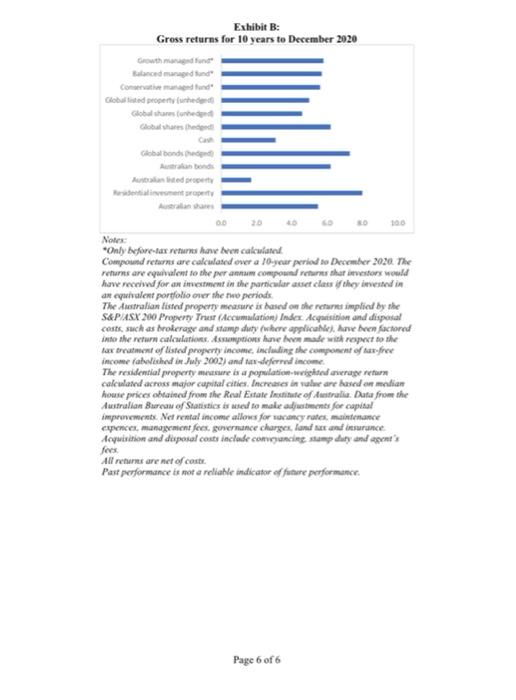

668 143 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Exhibit A: Annual Returns for Morrison Investments managed fund Aust. Aust. Int. Int. Equity Int.Bonds Equity Bonds Cash Equity Hedged Hedged -13.4 226 263 174 22.6 14.3 328 26.4 12 10.9 14 11.8 12 44.1 8.1 15.2 702 29.6 34.7 52.2 189 156 45.6 30.6 25.3 -7.9 186 128 69 0.6 13.5 179 94 1229 33,8 13.7 174 144 18.4 26 35.6 17.9 -175 19 16.1 .15.1 -162 133 342 247 112 202 19.2 18.4 -23 304 6.9 45 -08 45.4 16.3 5.4 21.4 14.8 -87 -47 54 -0.1 -2.7 20.2 18.6 8 25.9 22.3 20.1 146 11.9 61 197 10.7 122 5.6 478 212 116 95 30.9 233 104 16.1 -12 $ 16.1 23.9 0.8 12.1 -7.9 10.1 10.5 5.2 -148 -86 88 4.8 -272 -22.7 11.6 15 3 49 0 293 6.6 27.9 7 5.6 10.6 158 89 22.5 5.8 5.7 17.1 185 6.6 24.5 3.1 6 118 17.6 16.2 3.5 6.7 -1.9 6.4 6.6 -38.9 15 7.6 -259 -39.4 9.2 37.6 1.7 28.4 8 1.9 6 4.7 -1.4 13.5 9.3 114 -57 24 105 19.7 7.7 14.7 97 19.7 2 478 23 53 98 IS 124 10.4 28 2.6 23 115 37 3.3 A-Reits 52 50.2 10.1 5.3 35.4 5.8 161 2.4 87 20.1 7 30.1 -5.6 12.7 145 20,3 18 -5 179 15 11.9 88 32.2 12.7 34.1 8.4 -35.3 9.6 -0.7 76 122 105 48 67 $9 S.5 7.4 -11 2016 2017 2018 2019 2020 .1.6 19.1 323 32.8 7.3 26.8 Page 5 of 6 Exhibit B: Gross returns for 10 years to December 2020 Balanced and und Gobaited property funded Globales Global hashed Globalbonds the devement property 2020 Notes *Only before-lax unha calculate Compound returns are calculated over a 10-year period to December 2020. The returns are equivalent to the per amtum compound returns that investors would have received for an investment in the particular asset classif they invested in axequivalent portfolio over the the periods The Australian fisted property measure is based on the returnes implied by the S&P ASX 200 Property Trees (Accumulation Index Acquisition and disposal costs, such as brokerage and stamp duty where applicable), have been factored into the return calculations. Assumptionshme made with respect to the for treatment of listed property income, including the component of tax free income tabelached on July 2002) and deferred income. The residential property masure is a population-weighted average retur calculated across major capital cities. Increases in vare based on median house prices obtained from the Real Estate Institute of Australia. Data from the Australian Bureau of Statistics is used to make adjustments for capital improvement. Net rental income allows for wacancy rates, maintenance expence management fees governance charger land and insurance Acquisition and disposal costs include coming stump duty and agents fees All returns are net of cost. Past performance is not a reliable indicator of future performance Page 6 of 6