Answered step by step

Verified Expert Solution

Question

1 Approved Answer

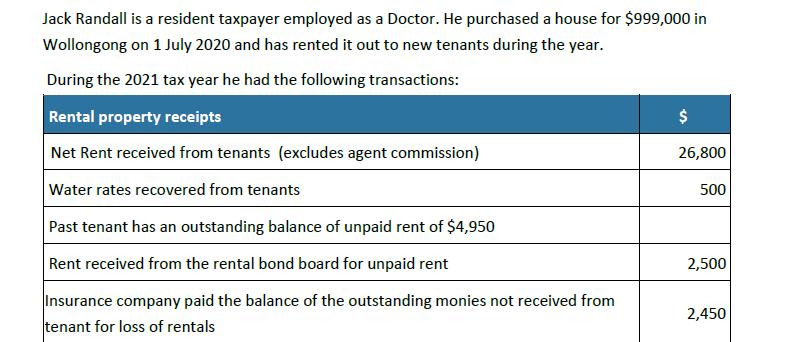

Jack Randall is a resident taxpayer employed as a Doctor. He purchased a house for $999,000 in Wollongong on 1 July 2020 and has

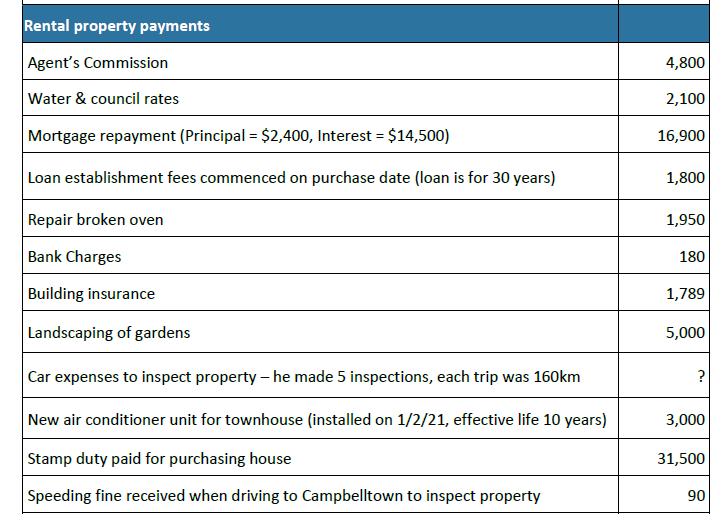

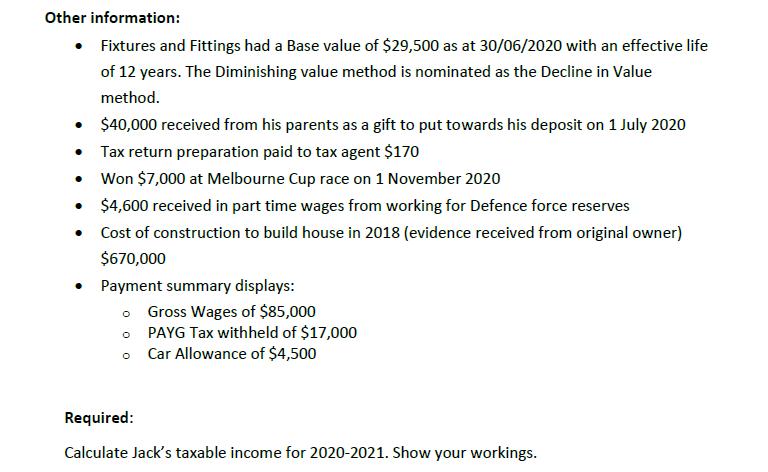

Jack Randall is a resident taxpayer employed as a Doctor. He purchased a house for $999,000 in Wollongong on 1 July 2020 and has rented it out to new tenants during the year. During the 2021 tax year he had the following transactions: Rental property receipts Net Rent received from tenants (excludes agent commission) Water rates recovered from tenants Past tenant has an outstanding balance of unpaid rent of $4,950 Rent received from the rental bond board for unpaid rent Insurance company paid the balance of the outstanding monies not received from tenant for loss of rentals $ 26,800 500 2,500 2,450 Rental property payments Agent's Commission Water & council rates Mortgage repayment (Principal = $2,400, Interest = $14,500) Loan establishment fees commenced on purchase date (loan is for 30 years) Repair broken oven Bank Charges Building insurance Landscaping of gardens Car expenses to inspect property - he made 5 inspections, each trip was 160km New air conditioner unit for townhouse (installed on 1/2/21, effective life 10 years) Stamp duty paid for purchasing house Speeding fine received when driving to Campbelltown to inspect property 4,800 2,100 16,900 1,800 1,950 180 1,789 5,000 ? 3,000 31,500 90 Other information: Fixtures and Fittings had a Base value of $29,500 as at 30/06/2020 with an effective life of 12 years. The Diminishing value method is nominated as the Decline in Value method. $40,000 received from his parents as a gift to put towards his deposit on 1 July 2020 Tax return preparation paid to tax agent $170 Won $7,000 at Melbourne Cup race on 1 November 2020 $4,600 received in part time wages from working for Defence force reserves Cost of construction to build house in 2018 (evidence received from original owner) $670,000 Payment summary displays: o Gross Wages of $85,000 o PAYG Tax withheld of $17,000 o Car Allowance of $4,500 Required: Calculate Jack's taxable income for 2020-2021. Show your workings.

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate Jacks taxable income for the 20202021 tax year we need to consider various income and expense components Heres the breakdown Ren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started