Question

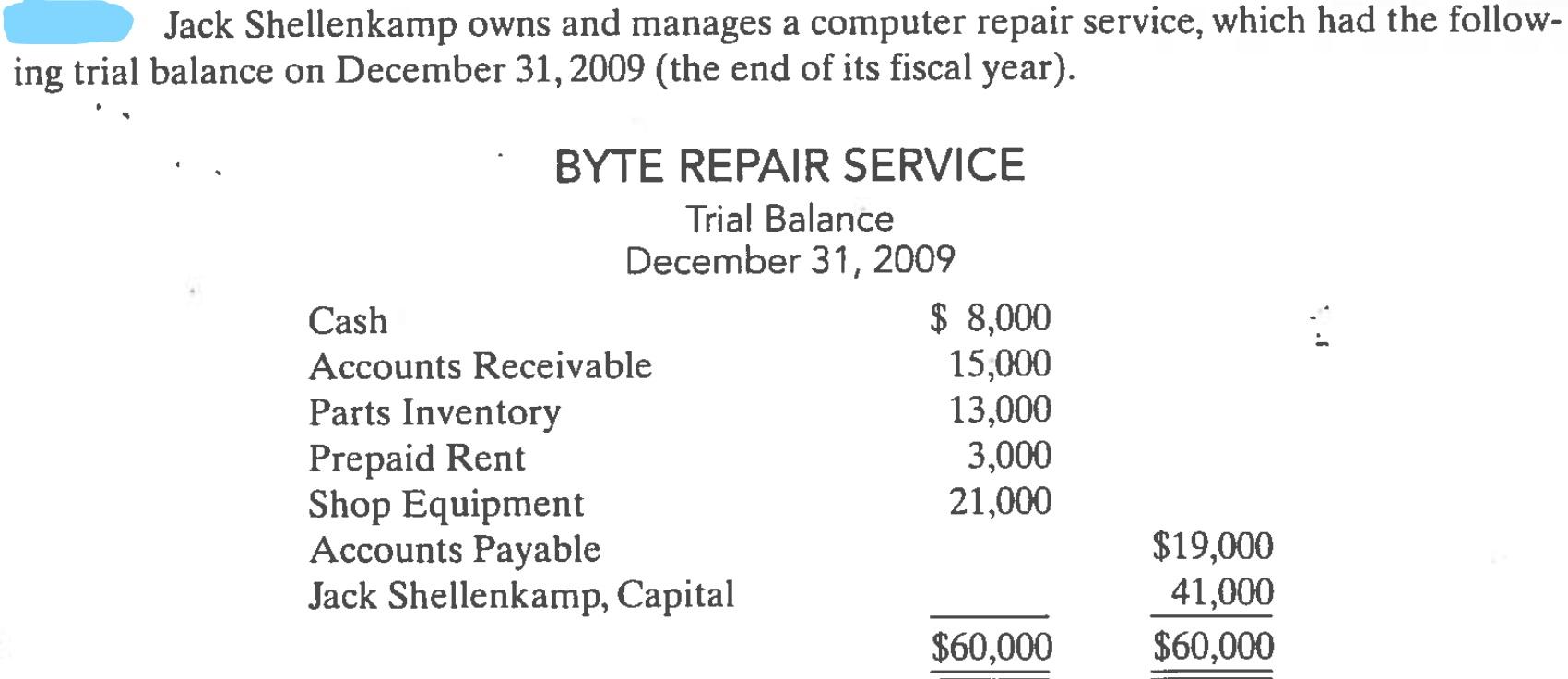

Jack Shellenkamp owns and manages a computer repair service, which had the following trial balance on December 31, 2009 (the end of its fiscal year).

Jack Shellenkamp owns and manages a computer repair service, which had the following trial balance on December 31, 2009 (the end of its fiscal year).

BYTE REPAIR SERVICE Trial Balance December 31, 2009

Cash $ 8,000 Accounts Receivable 15,000 Parts Inventory 13,000 Prepaid Rent 3,000 Shop Equipment 21,000

= $60,000

----- Accounts Payable $19,000

Jack Shellenkamp, Capital 41,000

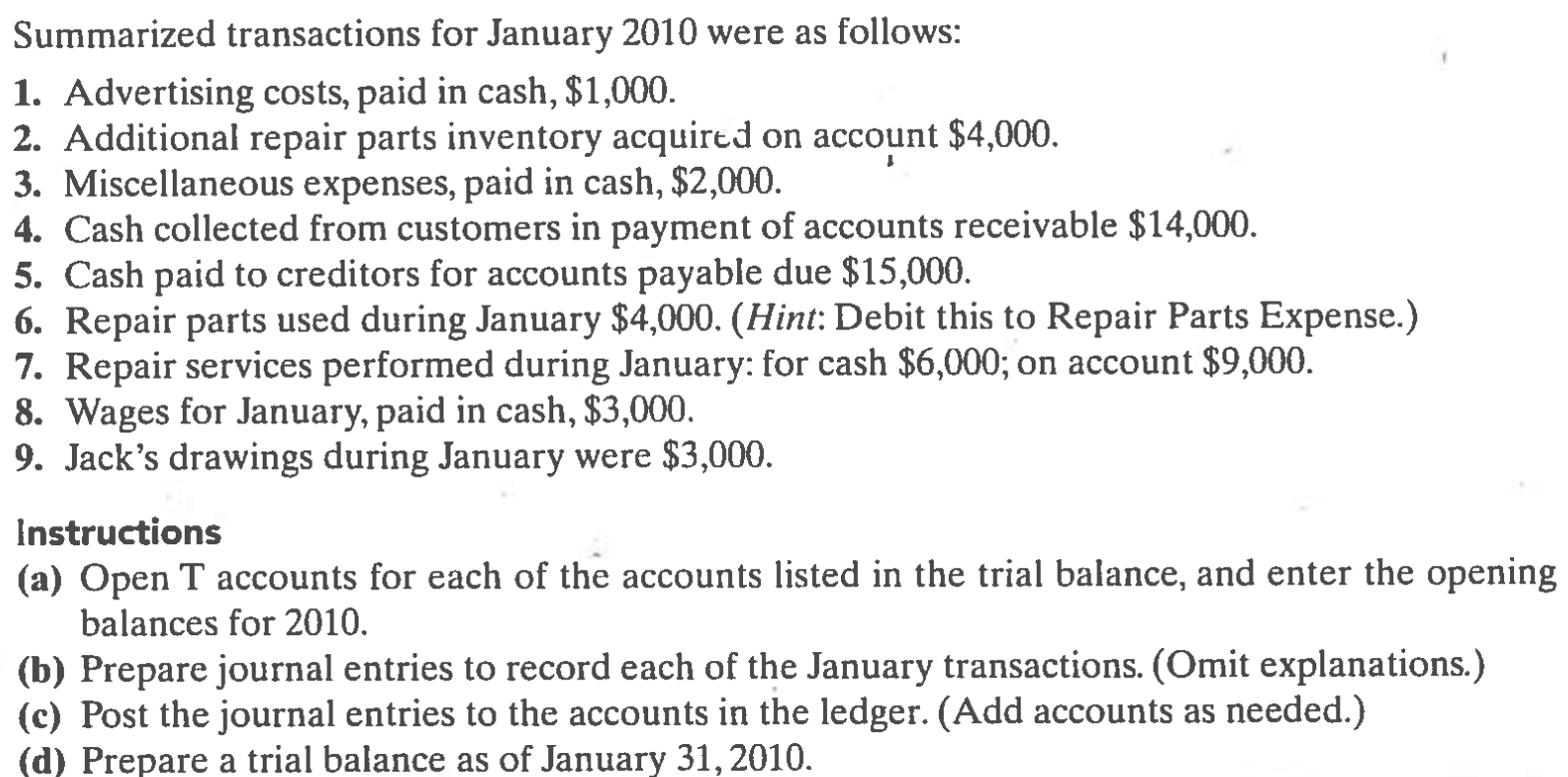

= $60,000 Summarized transactions for January 2010 were as follows: 1. Advertising costs, paid in cash, $1,000. 2. Additional repair parts inventory acquired on account $4,000. 3. Miscellaneous expenses, paid in cash, $2,000. 4. Cash collected from customers in payment of accounts receivable $14,000. 5. Cash paid to creditors for accounts payable due $15,000. 6. Repair parts used during January $4,000. (Hint: Debit this to Repair Parts Expense.) 7. Repair services performed during January: for cash $6,000; on account $9,000. 8. Wages for January, paid in cash, $3,000. 9. Jack's drawings during January were $3,000. Hint: Journalize and post transactions and prepare a trial balance. (SO 2, 4, 6, 7) Instructions (a) Open T accounts for each of the accounts listed in the trial balance, and enter the opening balances for 2010. (b) Prepare journal entries to record each of the January transactions. (Omit explanations.) (c) Post the journal entries to the accounts in the ledger. (Add accounts as needed.) (d) Prepare a trial balance as of January 31, 2010.

Jack Shellenkamp owns and manages a computer repair service, which had the follow- ing trial balance on December 31, 2009 (the end of its fiscal year). BYTE REPAIR SERVICE Trial Balance December 31, 2009 Cash $ 8,000 Accounts Receivable 15,000 Parts Inventory 13,000 Prepaid Rent 3,000 Shop Equipment 21,000 Accounts Payable Jack Shellenkamp, Capital $60,000 $19,000 41,000 $60,000 Summarized transactions for January 2010 were as follows: 1. Advertising costs, paid in cash, $1,000. 2. Additional repair parts inventory acquired on account $4,000. 3. Miscellaneous expenses, paid in cash, $2,000. 4. Cash collected from customers in payment of accounts receivable $14,000. 5. Cash paid to creditors for accounts payable due $15,000. 6. Repair parts used during January $4,000. (Hint: Debit this to Repair Parts Expense.) 7. Repair services performed during January: for cash $6,000; on account $9,000. 8. Wages for January, paid in cash, $3,000. 9. Jack's drawings during January were $3,000. Instructions (a) Open T accounts for each of the accounts listed in the trial balance, and enter the opening balances for 2010. (b) Prepare journal entries to record each of the January transactions. (Omit explanations.) (c) Post the journal entries to the accounts in the ledger. (Add accounts as needed.) (d) Prepare a trial balance as of January 31, 2010Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started