Answered step by step

Verified Expert Solution

Question

1 Approved Answer

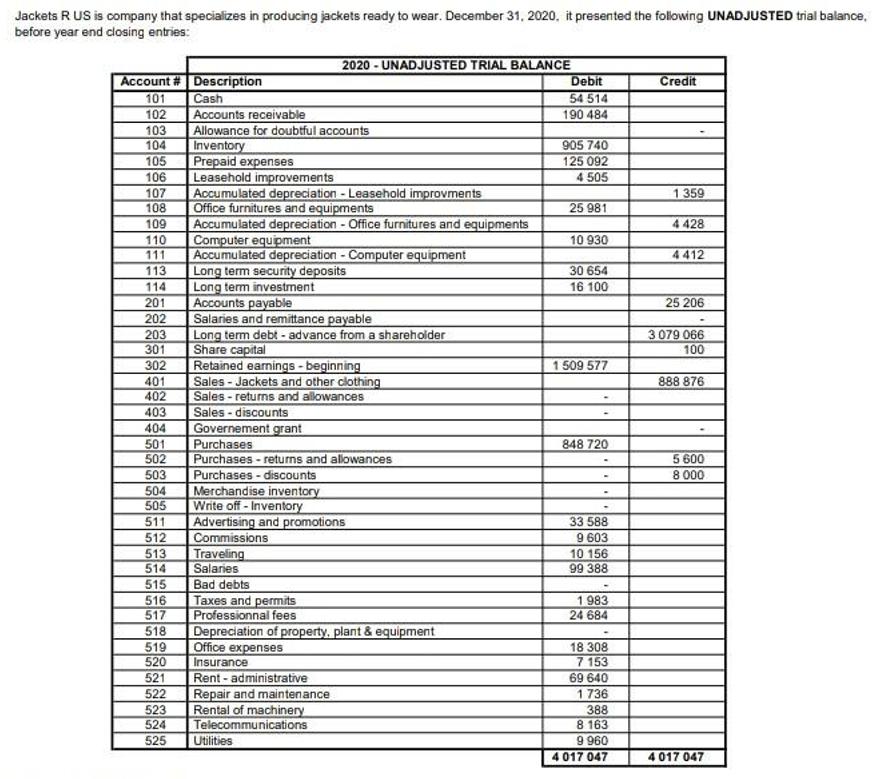

Jackets R US is company that specializes in producing jackets ready to wear. December 31, 2020, it presented the following UNADJUSTED trial balance, before

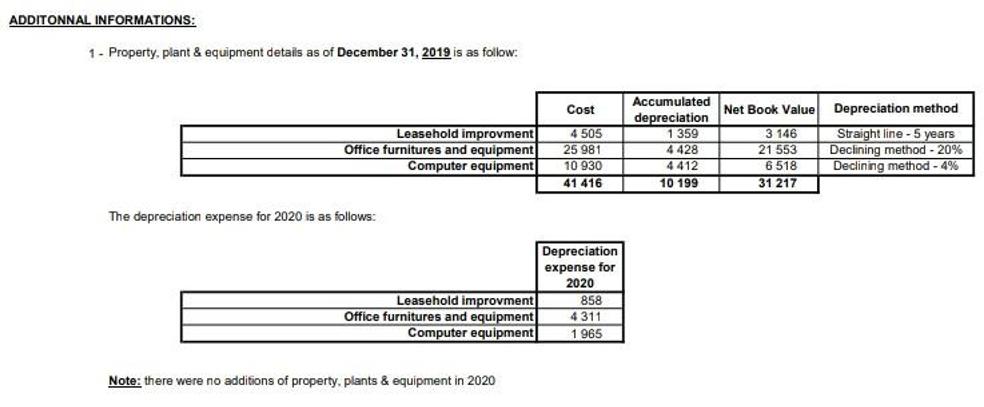

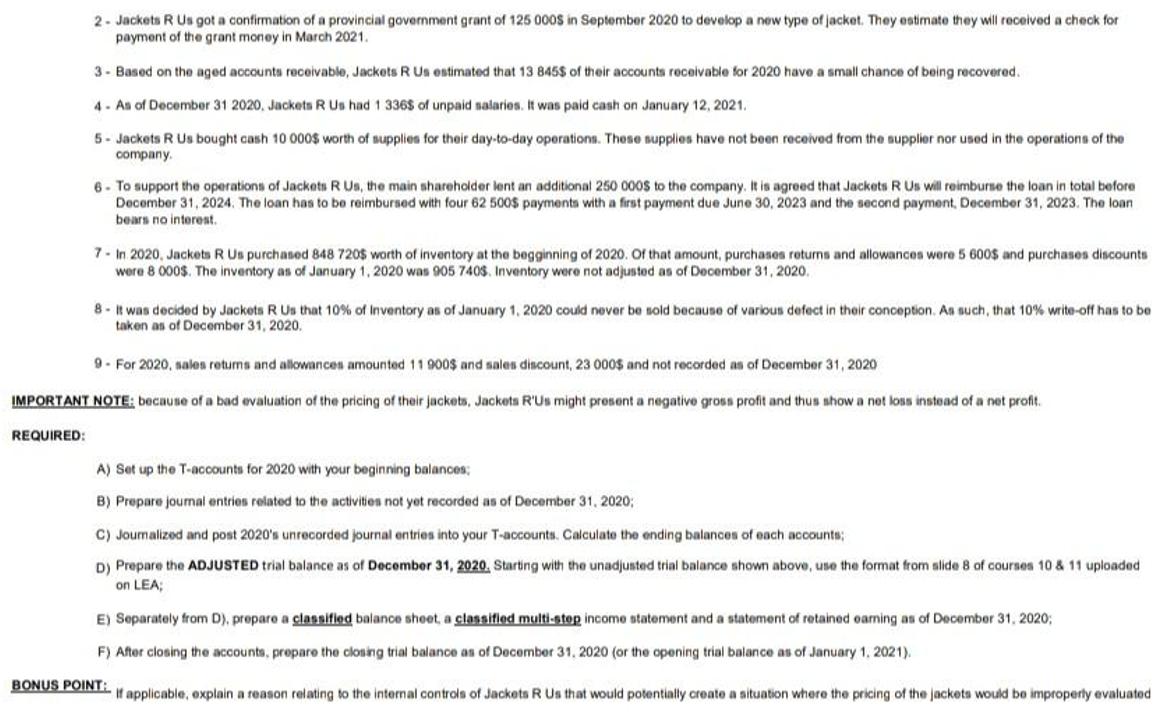

Jackets R US is company that specializes in producing jackets ready to wear. December 31, 2020, it presented the following UNADJUSTED trial balance, before year end closing entries: Account # Description 101 102 103 104 105 106 107 108 109 110 111 113 114 201 202 203 301 302 401 402 403 404 501 502 503 504 505 511 512 513 514 515 516 517 518 519 520 521 522 Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Leasehold improvements Accumulated depreciation - Leasehold improvments Office furnitures and equipments Accumulated depreciation - Office furnitures and equipments Computer equipment Accumulated depreciation - Computer equipment Long term security deposits Long term investment 2020-UNADJUSTED TRIAL BALANCE Accounts payable Salaries and remittance payable Long term debt - advance from a shareholder Share capital Retained earnings-beginning Sales-Jackets and other clothing Sales-returns and allowances Sales-discounts Governement grant Purchases Purchases-returns and allowances Purchases - discounts Merchandise inventory Write off-Inventory Advertising and promotions Commissions Traveling Salaries Bad debts Taxes and permits Professionnal fees Depreciation of property, plant & equipment Office expenses Insurance Rent-administrative Repair and maintenance Rental of machinery 523 524 Telecommunications 525 Utilities Debit 54 514 190 484 905 740 125 092 4 505 25 981 10 930 30 654 16 100 1 509 577 848 720 33 588 9 603 10 156 99 388 - 1983 24 684 18 308 7 153 69 640 1736 388 8 163 9 960 4 017 047 Credit 1359 4 428 4412 25 206 3 079 066 100 888 876 5 600 8 000 4 017 047 ADDITONNAL INFORMATIONS: 1 - Property, plant & equipment details as of December 31, 2019 is as follow: Leasehold improvment Office furnitures and equipment Computer equipment The depreciation expense for 2020 is as follows: Leasehold improvment Office furnitures and equipment Computer equipment Note: there were no additions of property, plants & equipment in 2020 Cost 4 505 25 981 10 930 41 416 Depreciation expense for 2020 858 4311 1965 Accumulated depreciation 1 359 4 428 4412 10 199 Net Book Value 3146 21 553 6518 31 217 Depreciation method Straight line-5 years Declining method -20% Declining method -4% 2- Jackets R Us got a confirmation of a provincial government grant of 125 000$ in September 2020 to develop a new type of jacket. They estimate they will received a check for payment of the grant money in March 2021. REQUIRED: 3- Based on the aged accounts receivable, Jackets R Us estimated that 13 845$ of their accounts receivable for 2020 have a small chance of being recovered. 4- As of December 31 2020, Jackets R Us had 1 336$ of unpaid salaries. It was paid cash on January 12, 2021. 5- Jackets R Us bought cash 10 000$ worth of supplies for their day-to-day operations. These supplies have not been received from the supplier nor used in the operations of the company. 6- To support the operations of Jackets R Us, the main shareholder lent an additional 250 000$ to the company. It is agreed that Jackets R Us will reimburse the loan in total before December 31, 2024. The loan has to be reimbursed with four 62 500$ payments with a first payment due June 30, 2023 and the second payment, December 31, 2023. The loan bears no interest. 7- In 2020, Jackets R Us purchased 848 720$ worth of inventory at the begginning of 2020. Of that amount, purchases returns and allowances were 5 600$ and purchases discounts were 8 000$. The inventory as of January 1, 2020 was 905 740$. Inventory were not adjusted as of December 31, 2020. 8- It was decided by Jackets R Us that 10% of Inventory as of January 1, 2020 could never be sold because of various defect in their conception. As such, that 10% write-off has to be taken as of December 31, 2020. 9- For 2020, sales returns and allowances amounted 11 900$ and sales discount, 23 000$ and not recorded as of December 31, 2020 IMPORTANT NOTE: because of a bad evaluation of the pricing of their jackets, Jackets R'Us might present a negative gross profit and thus show a net loss instead of a net profit. A) Set up the T-accounts for 2020 with your beginning balances; B) Prepare journal entries related to the activities not yet recorded as of December 31, 2020; C) Joumalized and post 2020's unrecorded journal entries into your T-accounts. Calculate the ending balances of each accounts; D) Prepare the ADJUSTED trial balance as of December 31, 2020, Starting with the unadjusted trial balance shown above, use the format from slide 8 of courses 10 & 11 uploaded on LEA; E) Separately from D), prepare a classified balance sheet, a classified multi-step income statement and a statement of retained earning as of December 31, 2020; F) After closing the accounts, prepare the closing trial balance as of December 31, 2020 (or the opening trial balance as of January 1, 2021). BONUS POINT: If applicable, explain a reason relating to the internal controls of Jackets R Us that would potentially create situation where the pricing of the jackets would be improperly evaluated

Step by Step Solution

★★★★★

3.34 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

2020ANUDJUSTED TERIAL BALANCE Debit Credit Account Cash 54514 101 Accounts recieveable 190484 102 Al...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started