Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jackmar Inc. is preparing budgets for the upcoming quarter, April to June. Budgeted sales (in units) for the next five months are: April May

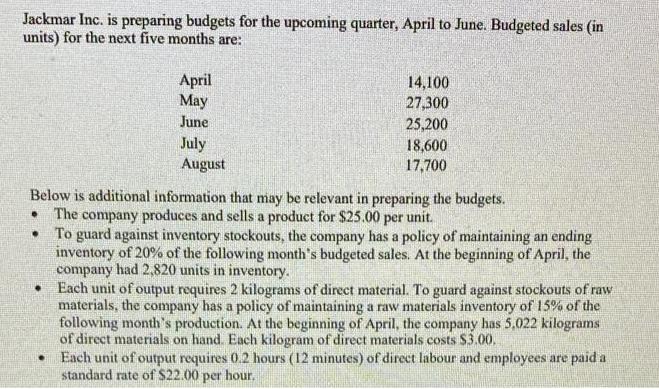

Jackmar Inc. is preparing budgets for the upcoming quarter, April to June. Budgeted sales (in units) for the next five months are: April May 14,100 27,300 June July August 25,200 18,600 17,700 Below is additional information that may be relevant in preparing the budgets. The company produces and sells a product for $25.00 per unit. To guard against inventory stockouts, the company has a policy of maintaining an ending inventory of 20% of the following month's budgeted sales. At the beginning of April, the company had 2,820 units in inventory. Each unit of output requires 2 kilograms of direct material. To guard against stockouts of raw materials, the company has a policy of maintaining a raw materials inventory of 15% of the following month's production. At the beginning of April, the company has 5,022 kilograms of direct materials on hand. Each kilogram of direct materials costs $3.00. Each unit of output requires 0.2 hours (12 minutes) of direct labour and employees are paid a standard rate of $22.00 per hour, The company applies overhead using a variable rate of $10.00 per direct labour hour. The fixed overhead is $22,500 per month. Fifty percent of sales are made in cash. The remaining 50% of sales are made on account. The company collects 60% of sales made on account in the month of the sale, 20% in the month following the sale, and 12% in the second month following the sale. The company had total sales revenue of $157,500 in February and $236,250 in March. The company pays of half of its direct materials purchases in the month of the purchase and the remaining half in the month following the purchase. At the beginning of the quarter, the company owed its creditors $34,002 for purchases of direct materials made in March. Required: (A) Prepare a sales budget for the months of April, May, and June and for the quarter-end. (B) Prepare a production budget for the months of April, May, and June, and for the quarter- end. [Note: you might want to compute the production needs for July, since you will need that information for subsection (C)] (C) Prepare the direct materials purchases budget for the months of April, May, and June, and for the quarter-end. (D) Prepare the direct labour budget for the months of April, May, and June, and for the quarter-end. (E) Prepare the overhead budget for the months of April, May, and June, and for the quarter- end. (F) Prepare the ending finished goods inventory budget for the quarter ending June 30th (G) Prepare a schedule showing cash collections (accounts receivable) from sales expected for the months of April, May, and June. (H) Prepare the cash payments on accounts payable schedule (case disbursements) for the months of April, May, and June. Jackmar Inc. is preparing budgets for the upcoming quarter, April to June. Budgeted sales (in units) for the next five months are: April May 14,100 27,300 June July August 25,200 18,600 17,700 Below is additional information that may be relevant in preparing the budgets. The company produces and sells a product for $25.00 per unit. To guard against inventory stockouts, the company has a policy of maintaining an ending inventory of 20% of the following month's budgeted sales. At the beginning of April, the company had 2,820 units in inventory. Each unit of output requires 2 kilograms of direct material. To guard against stockouts of raw materials, the company has a policy of maintaining a raw materials inventory of 15% of the following month's production. At the beginning of April, the company has 5,022 kilograms of direct materials on hand. Each kilogram of direct materials costs $3.00. Each unit of output requires 0.2 hours (12 minutes) of direct labour and employees are paid a standard rate of $22.00 per hour, The company applies overhead using a variable rate of $10.00 per direct labour hour. The fixed overhead is $22,500 per month. Fifty percent of sales are made in cash. The remaining 50% of sales are made on account. The company collects 60% of sales made on account in the month of the sale, 20% in the month following the sale, and 12% in the second month following the sale. The company had total sales revenue of $157,500 in February and $236,250 in March. The company pays of half of its direct materials purchases in the month of the purchase and the remaining half in the month following the purchase. At the beginning of the quarter, the company owed its creditors $34,002 for purchases of direct materials made in March. Required: (A) Prepare a sales budget for the months of April, May, and June and for the quarter-end. (B) Prepare a production budget for the months of April, May, and June, and for the quarter- end. [Note: you might want to compute the production needs for July, since you will need that information for subsection (C)] (C) Prepare the direct materials purchases budget for the months of April, May, and June, and for the quarter-end. (D) Prepare the direct labour budget for the months of April, May, and June, and for the quarter-end. (E) Prepare the overhead budget for the months of April, May, and June, and for the quarter- end. (F) Prepare the ending finished goods inventory budget for the quarter ending June 30th (G) Prepare a schedule showing cash collections (accounts receivable) from sales expected for the months of April, May, and June. (H) Prepare the cash payments on accounts payable schedule (case disbursements) for the months of April, May, and June.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Solution A SNo Particulars April May June Total a Sales in Units 1410000 2730000 2520000 6660000 b S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started