Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Firm A currently has debt-to-equity ratio of 0.5, and Firm A is expanding its business and considering a $1 million non-scale enhancing project in

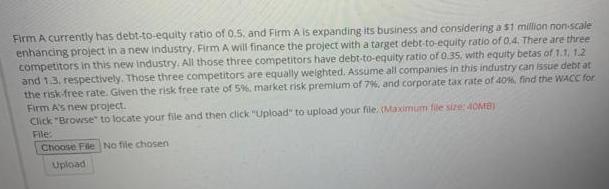

Firm A currently has debt-to-equity ratio of 0.5, and Firm A is expanding its business and considering a $1 million non-scale enhancing project in a new industry. Firm A will finance the project with a target debt-to-equity ratio of 0.4. There are three competitors in this new industry. All those three competitors have debt-to-equity ratio of 0.35, with equity betas of 1.1, 1.2 and 1.3. respectively. Those three competitors are equally weighted. Assume all companies in this industry can issue debt at the risk-free rate. Given the risk free rate of 5%, market risk premium of 7%, and corporate tax rate of 40%, find the WACC for Firm A's new project. Click "Browse to locate your file and then click "Upload" to upload your file. (Maximum file size: 40MB) File: Choose File No file chosen Upload

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

O Source Debt Equity Computation of LACe fave firm Als New perject bilven Information Target Deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started