Question

Jacks Dog Sanctuary performs three services: housing and finding homes for stray and unwanted dogs, providing health care and neutering services for the dogs, and

Jacks Dog Sanctuary performs three services: housing and finding homes for stray and unwanted dogs, providing health care and neutering services for the dogs, and dog training services. One facility is dedicated to housing dogs waiting to be adopted. A second facility houses veterinarian services. A third facility houses the director, administration staff, and several dog trainers. This facility also has several large meeting rooms that are frequently used for classes conducted by the dog trainers. The trainers work with all the sanctuary dogs to ensure that they are relatively easy to manage. They also provide dog obedience classes for families who adopt dogs.

Estimated annual costs and services are as follows:

$

Director and administration staff salaries 60,000

Housing services employees salaries 100,000

Veterinarians and technicians salaries 150,000

Dog trainers salaries 40,000

Food and supplies 125,000

Building-related costs 200,000

On average, 75 dogs per day are housed at the facility, or about 27,375 (75 365) dog days in total. In addition, the trainers offer about 125 classes for about 30 weeks throughout the year. On average, 10 families attend each class. Last year the veterinarian clinic experienced 5,000 dog visits.

One of the administration staff, Joan, just graduated from an accounting program and would like to set up an ABC system for the sanctuary so that the director can better understand the cost for each of the sanctuarys services. She gathered the following information:

Square metres for each facility:

Housing service 5,000 m2

Director and training 3,000 m2

Veterinarian clinic 2,000 m2

Percentage of trainer time used in classes 50%

Portion of Supplies used for veterinarian services $75,000

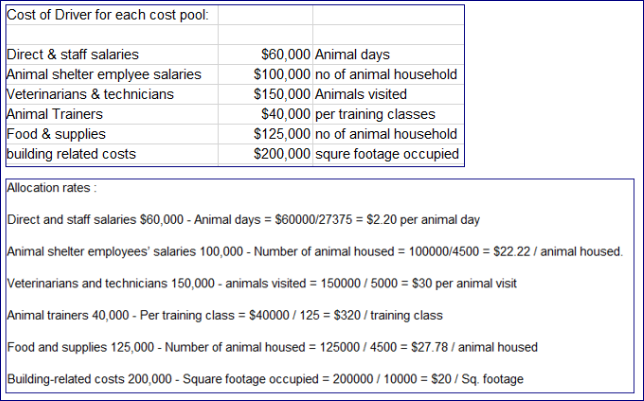

Part A - ALREADY ANSWERED (see image) - Identify three cost pools and assign costs to them, considering the three cost objects of interest. Explain your choice for each cost pool identified and how the costs are assigned to each of the cost objects. (Hint: Take the services provided into account when identifying a cost object. Assign the costs based on its traceability to the cost object).

TO BE ANSWERED Question (i) Determine an activity driver for each cost pool your group identified in Part A. Explain your choice. (10 marks)

TO BE ANSWERED Question (ii) Using the activity drivers, you identified in part (i) calculate the direct cost per unit of activity driver for each pool and explain what the cost per unit of activity driver for each pool means. Show ALL your workings. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started