Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jack's grandparents have a 2-bedroom cottage near Bear Mountain State Park, about an hour north of Manhattan. Their cottage is listed on Airbnb through

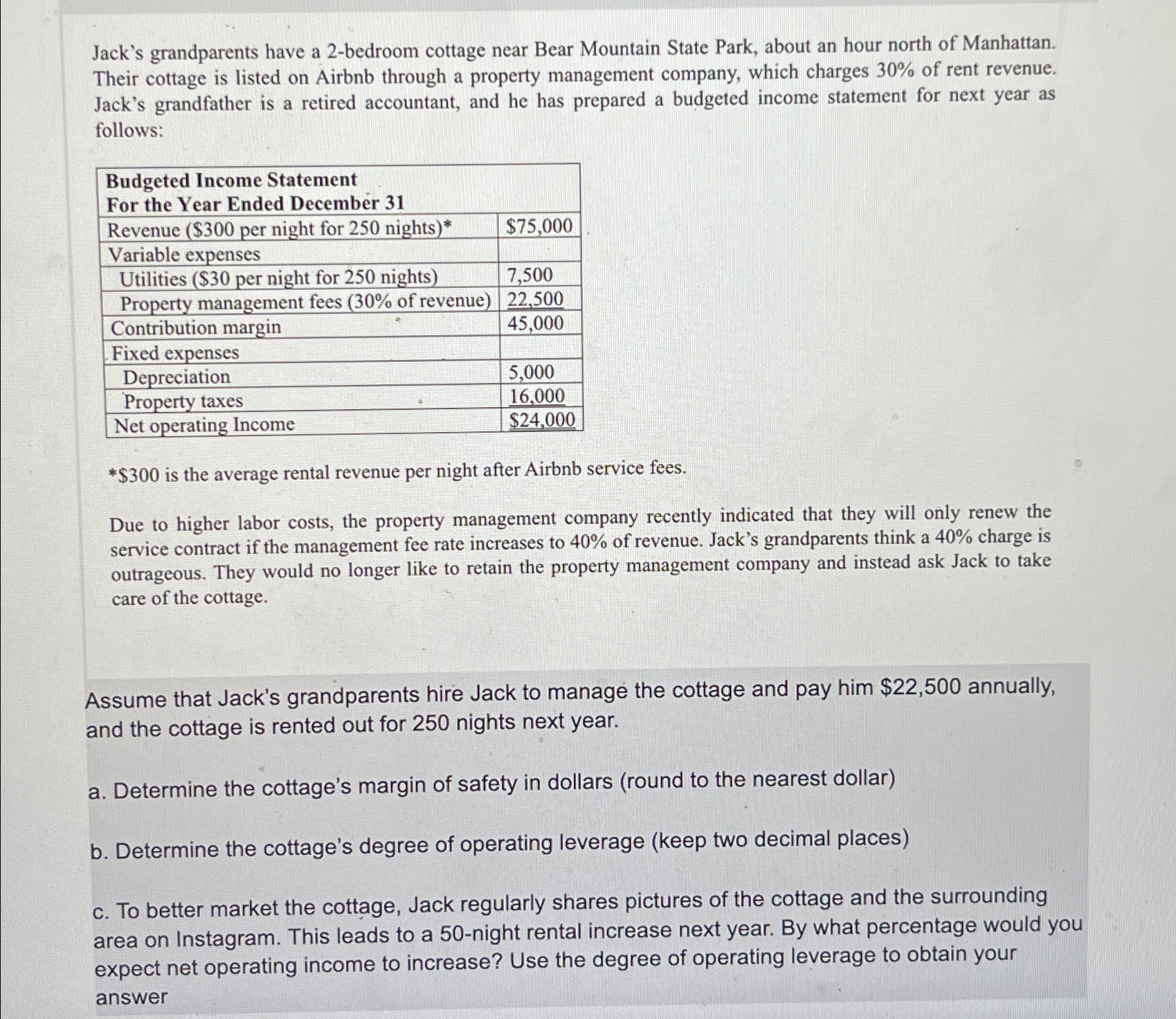

Jack's grandparents have a 2-bedroom cottage near Bear Mountain State Park, about an hour north of Manhattan. Their cottage is listed on Airbnb through a property management company, which charges 30% of rent revenue. Jack's grandfather is a retired accountant, and he has prepared a budgeted income statement for next year as follows: Budgeted Income Statement For the Year Ended December 31 Revenue ($300 per night for 250 nights)* Variable expenses Utilities ($30 per night for 250 nights) $75,000 7,500 Property management fees (30% of revenue) 22,500 Contribution margin Fixed expenses Depreciation Property taxes 45,000 5,000 16,000 $24,000 Net operating Income *$300 is the average rental revenue per night after Airbnb service fees. Due to higher labor costs, the property management company recently indicated that they will only renew the service contract if the management fee rate increases to 40% of revenue. Jack's grandparents think a 40% charge is outrageous. They would no longer like to retain the property management company and instead ask Jack to take care of the cottage. Assume that Jack's grandparents hire Jack to manage the cottage and pay him $22,500 annually, and the cottage is rented out for 250 nights next year. a. Determine the cottage's margin of safety in dollars (round to the nearest dollar) b. Determine the cottage's degree of operating leverage (keep two decimal places) c. To better market the cottage, Jack regularly shares pictures of the cottage and the surrounding area on Instagram. This leads to a 50-night rental increase next year. By what percentage would you expect net operating income to increase? Use the degree of operating leverage to obtain your answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started