Answered step by step

Verified Expert Solution

Question

1 Approved Answer

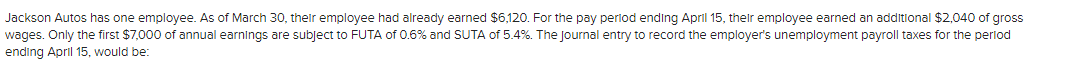

Jackson Autos has one employee. As of March 30, their employee had already earned $6,120. For the pay period ending April 15, their employee

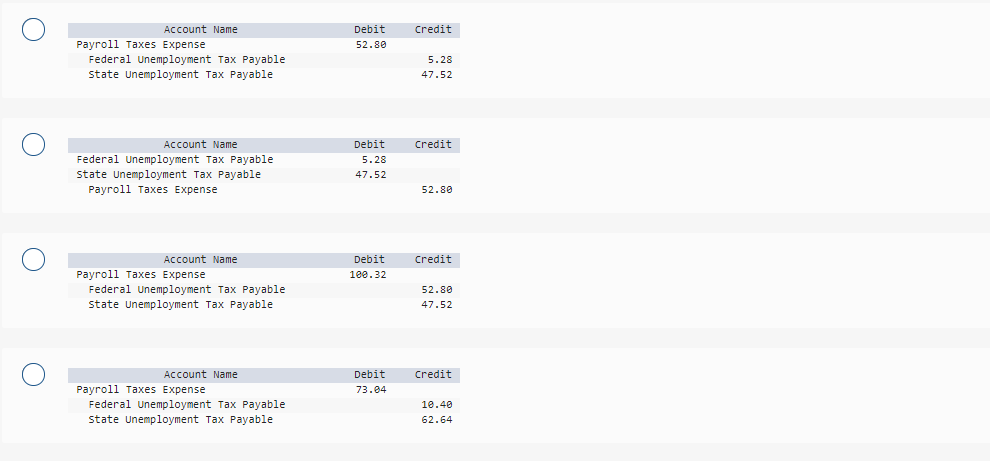

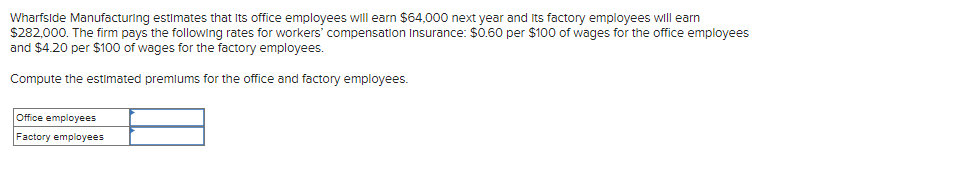

Jackson Autos has one employee. As of March 30, their employee had already earned $6,120. For the pay period ending April 15, their employee earned an additional $2,040 of gross wages. Only the first $7,000 of annual earnings are subject to FUTA of 0.6% and SUTA of 5.4%. The Journal entry to record the employer's unemployment payroll taxes for the period ending April 15, would be: Account Name Payroll Taxes Expense Federal Unemployment Tax Payable State Unemployment Tax Payable Account Name Federal Unemployment Tax Payable state Unemployment Tax Payable Payroll Taxes Expense Account Name Payroll Taxes Expense Federal Unemployment Tax Payable State Unemployment Tax Payable Account Name Payroll Taxes Expense Federal Unemployment Tax Payable State Unemployment Tax Payable Debit 52.80 Debit 5.28 47.52 Debit 100.32 Debit 73.04 Credit 5.28 47.52 Credit 52.80 Credit 52.80 47.52 Credit 10.40 62.64 Wharfside Manufacturing estimates that its office employees will earn $64,000 next year and its factory employees will earn $282,000. The firm pays the following rates for workers' compensation Insurance: $0.60 per $100 of wages for the office employees and $4.20 per $100 of wages for the factory employees. Compute the estimated premiums for the office and factory employees. Office employees Factory employees Record the following transactions for the month of April, 20X1 in the cash receipts Journal. Total, prove, and rule the cash receipts Journal as of April 30. April 3 Collected $468 from Margo Daub, a credit customer on account. April 8 Kevin Sharp, the owner, invested an additional $6,100 cash in the business. Received a cash refund of $85 for damaged supplies. April 9 April 15 Had cash sales of $6,600 plus sales tax of $495. There was a cash overage of $16. April 18 Received $1,350 from Brian Cobb, a credit customer, in payment of his account. April 20 Received a check from Phil Stout to pay his $1,250 promissory note plus interest of $53. April 30 Had cash sales of $4,900 plus sales tax of $376. There was a cash shortage of $16. Date April 3, 20X1 April 8, 20X1 April 9, 20X1 April 15, 20X1 April 18, 20X1 April 20, 20X1 April 30, 20X1 April 30, 20X1 Totals Description CASH RECEIPTS JOURNAL Accounts Receivable Credit Sales Tax Payable Credit Sales Credit Other Accounts Credit Title Amo Cash Debit

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal entry to record employers unemployment payroll taxes for the period ending April 15 Debit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started