Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jackson Co is a large manufacturing entity specializing in the construction of solar panels. Historically, the company has used only performance measures to assess

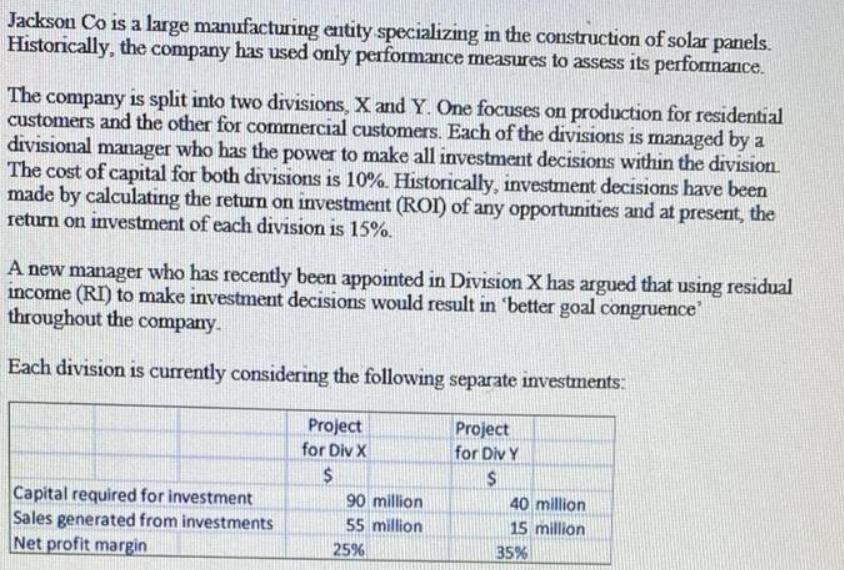

Jackson Co is a large manufacturing entity specializing in the construction of solar panels. Historically, the company has used only performance measures to assess its performance. The company is split into two divisions, X and Y. One focuses on production for residential customers and the other for commercial customers. Each of the divisions is managed by a divisional manager who has the power to make all investment decisions within the division. The cost of capital for both divisions is 10%. Historically, investment decisions have been made by calculating the return on investment (RO) of any opportunities and at present, the return on investment of each division is 15%. A new manager who has recently been appointed in Division X has argued that using residual income (RI) to make investment decisions would result in 'better goal congruence' throughout the company. Each division is currently considering the following separate investments: Project for Div X Project for Div Y Capital required for investment Sales generated from investments Net profit margin 90 million 55 million 40 million 15 million 25% 35%

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Question on Jackson Co ROI versus Residual income ROI and residual income for both the proposals are calculated below Residual income measures income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started