Answered step by step

Verified Expert Solution

Question

1 Approved Answer

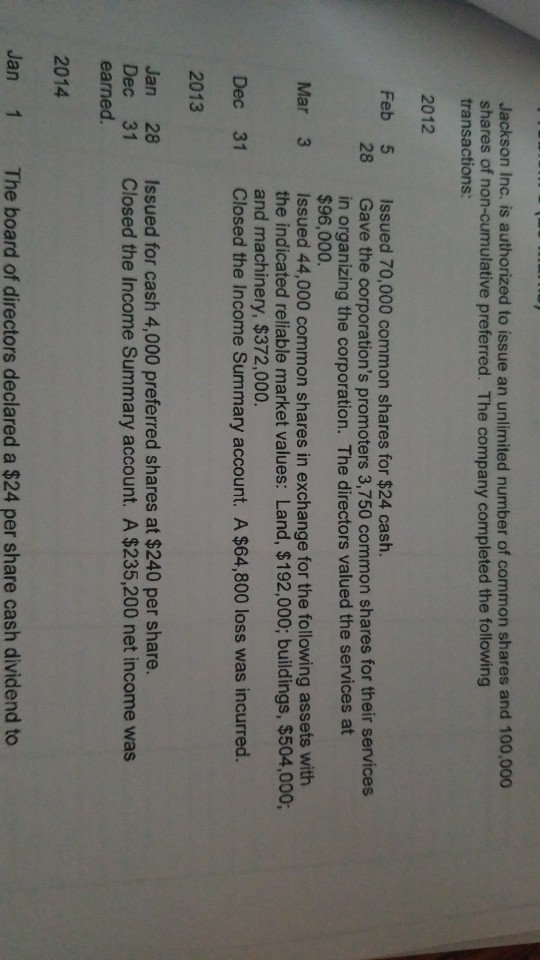

Jackson Inc. is authorized to issue an unlimited number of common shares and 100,000 shares of non-cumulative preferred. The company completed the following transactions: 2012

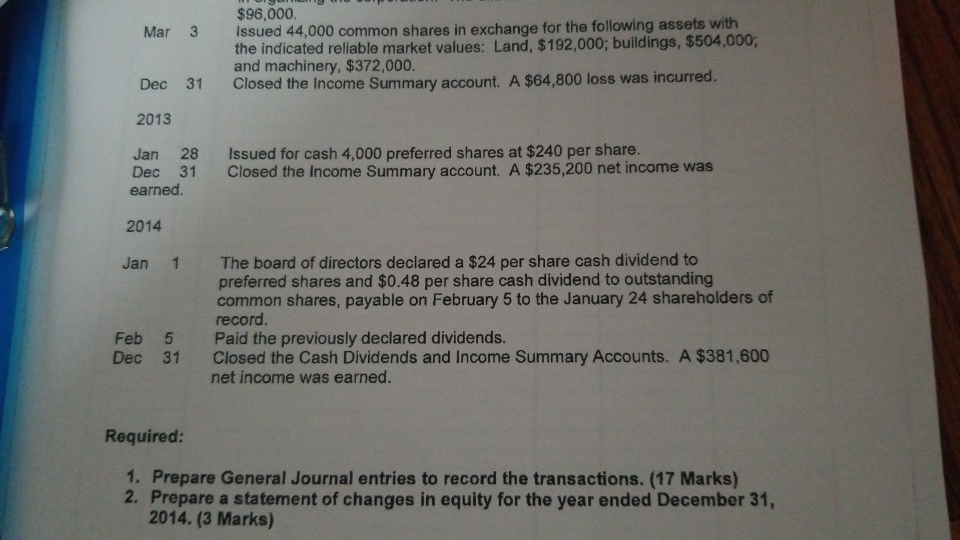

Jackson Inc. is authorized to issue an unlimited number of common shares and 100,000 shares of non-cumulative preferred. The company completed the following transactions: 2012 Feb 5 28 Mar 3 Issued 70,000 common shares for $24 cash, Gave the corporation's promoters 3,750 common shares for their services in organizing the corporation. The directors valued the services at $96,000. Issued 44,000 common shares in exchange for the following assets with the indicated reliable market values: Land, $ 192,000; buildings, $504,000; and machinery, $372,000. Closed the Income Summary account. A $64,800 loss was incurred. Dec 31 2013 Jan 28 Dec 31 earned. Issued for cash 4,000 preferred shares at $240 per share. Closed the Income Summary account. A $235,200 net income was 2014 Jan 1 The board of directors declared a $24 per share cash dividend to Mar 3 $96,000. Issued 44,000 common shares in exchange for the following assets with the indicated reliable market values: Land, $192,000; buildings, $504,000; and machinery, $372,000. Closed the Income Summary account. A $64,800 loss was incurred. Dec 31 2013 Jan 28 Dec 31 earned. Issued for cash 4,000 preferred shares at $240 per share. Closed the Income Summary account. A $235,200 net income was 2014 Jan 1 The board of directors declared a $24 per share cash dividend to preferred shares and $0.48 per share cash dividend to outstanding common shares, payable on February 5 to the January 24 shareholders of record. Paid the previously declared dividends. Closed the Cash Dividends and Income Summary Accounts. A $381,600 net income was earned. Feb 5 Dec 31 Required: 1. Prepare General Journal entries to record the transactions. (17 Marks) 2. Prepare a statement of changes in equity for the year ended December 31, 2014

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started