Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jackson Masonry Incorporated is a producer of masonry products, and the company supplies building materials including brick, pavers, and stone throughout a multi-county area

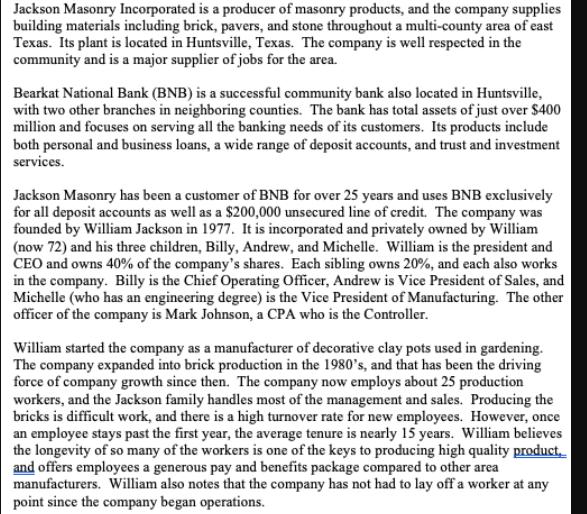

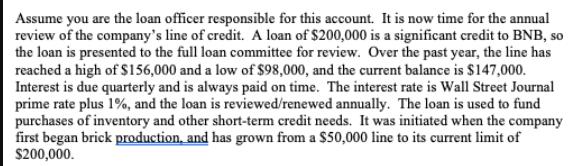

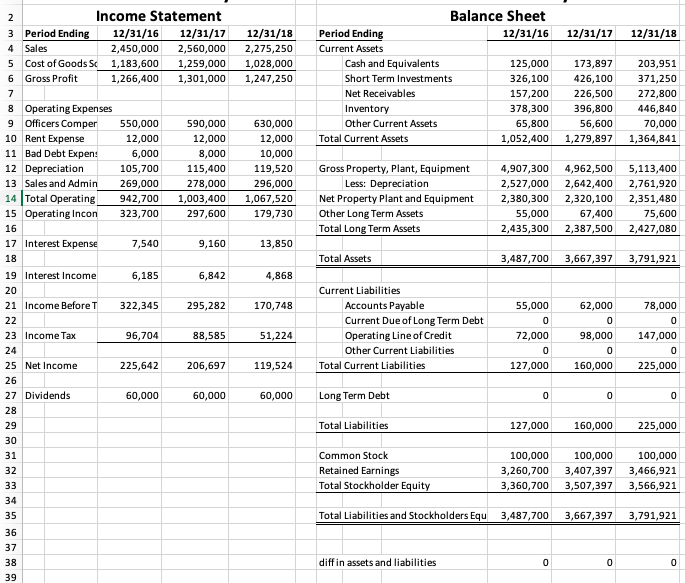

Jackson Masonry Incorporated is a producer of masonry products, and the company supplies building materials including brick, pavers, and stone throughout a multi-county area of east Texas. Its plant is located in Huntsville, Texas. The company is well respected in the community and is a major supplier of jobs for the area. Bearkat National Bank (BNB) is a successful community bank also located in Huntsville, with two other branches in neighboring counties. The bank has total assets of just over $400 million and focuses on serving all the banking needs of its customers. Its products include both personal and business loans, a wide range of deposit accounts, and trust and investment services. Jackson Masonry has been a customer of BNB for over 25 years and uses BNB exclusively for all deposit accounts as well as a $200,000 unsecured line of credit. The company was founded by William Jackson in 1977. It is incorporated and privately owned by William (now 72) and his three children, Billy, Andrew, and Michelle. William is the president and CEO and owns 40% of the company's shares. Each sibling owns 20%, and each also works in the company. Billy is the Chief Operating Officer, Andrew is Vice President of Sales, and Michelle (who has an engineering degree) is the Vice President of Manufacturing. The other officer of the company is Mark Johnson, a CPA who is the Controller. William started the company as a manufacturer of decorative clay pots used in gardening. The company expanded into brick production in the 1980's, and that has been the driving force of company growth since then. The company now employs about 25 production workers, and the Jackson family handles most of the management and sales. Producing the bricks is difficult work, and there is a high turnover rate for new employees. However, once an employee stays past the first year, the average tenure is nearly 15 years. William believes the longevity of so many of the workers is one of the keys to producing high quality product. and offers employees a generous pay and benefits package compared to other area manufacturers. William also notes that the company has not had to lay off a worker at any point since the company began operations. Assume you are the loan officer responsible for this account. It is now time for the annual review of the company's line of credit. A loan of $200,000 is a significant credit to BNB, so the loan is presented to the full loan committee for review. Over the past year, the line has reached a high of $156,000 and a low of $98,000, and the current balance is $147,000. Interest is due quarterly and is always paid on time. The interest rate is Wall Street Journal prime rate plus 1%, and the loan is reviewed/renewed annually. The loan is used to fund purchases of inventory and other short-term credit needs. It was initiated when the company first began brick production, and has grown from a $50,000 line to its current limit of $200,000. 2 Income Statement Balance Sheet 3 Period Ending 12/31/16 12/31/17 12/31/18 Period Ending 12/31/16 12/31/17 12/31/18 4 Sales 2,450,000 2,560,000 2,275,250 Current Assets 5 Cost of Goods Sc 1,183,600 1,259,000 1,028,000 Cash and Equivalents 125,000 173,897 203,951 6 Gross Profit 1,266,400 1,301,000 1,247,250 Short Term Investments 326,100 426,100 371,250 7 Net Receivables 157,200 226,500 272,800 8 Operating Expenses Inventory 378,300 396,800 446,840 9 Officers Comper 550,000 590,000 630,000 Other Current Assets 65,800 56,600 70,000 10 Rent Expense 12,000 12,000 12,000 Total Current Assets 1,052,400 1,279,897 1,364,841 11 Bad Debt Expens 6,000 12 Depreciation 105,700 8,000 115,400 13 Sales and Admin 269,000 278,000 10,000 119,520 296,000 14 Total Operating 942,700 1,003,400 1,067,520 15 Operating Incon 323,700 297,600 179,730 Gross Property, Plant, Equipment Less: Depreciation Net Property Plant and Equipment Other Long Term Assets 2,527,000 2,380,300 4,907,300 4,962,500 5,113,400 2,642,400 2,761,920 2,320,100 2,351,480 55,000 67,400 75,600 16 Total Long Term Assets 2,435,300 2,387,500 2,427,080 17 Interest Expense 18 7,540 9,160 13,850 Total Assets 3,487,700 3,667,397 3,791,921 19 Interest Income 20 6,185 6,842 4,868 Current Liabilities 21 Income Before T 322,345 295,282 170,748 Accounts Payable 55,000 62,000 78,000 22 23 Income Tax 96,704 88,585 51,224 24 Current Due of Long Term Debt Operating Line of Credit Other Current Liabilities 0 0 0 72,000 98,000 147,000 0 0 0 25 Net Income 225,642 206,697 119,524 Total Current Liabilities 127,000 160,000 225,000 26 27 Dividends 60,000 60,000 60,000 Long Term Debt 0 0 0 28 29 Total Liabilities 30 31 Common Stock 32 Retained Earnings 33 Total Stockholder Equity 127,000 160,000 225,000 100,000 3,260,700 100,000 3,407,397 100,000 3,466,921 3,360,700 3,507,397 3,566,921 34 35 Total Liabilities and Stockholders Equ 3,487,700 3,667,397 3,791,921 36 37 38 diff in assets and liabilities 0 0 0 39 Bearkat National Bank wwwwwwwww Credit Presentation Part 1: Executive Summary Borrower: Presented by: Case Number: Date: Amount: Rate: Amortization: (payout term) Loan Details Type: Loan Purpose: Maturity Date: Repayment Terms: Sources of repayment: + Collateral Loan Amount Collateral Summary Collateral Value Loan to Value Guarantors Amount of Guaranty Recommendation: (in this area, write your recommendation whether or not to make the make the loan) Subject to the following (conditions or covenants): (in this area, list any conditions or covenants)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started