Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jackson, who joins the market at the beginning of investment with an initial wealth To, plans to invest his wealth within two-period. He can

![(i) What is the optimal strategy of every period? (10 marks] (ii) What are values of E[x2) and Var(22) according to the optim](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/01/61d29adeeb97d_1641192160921.jpg)

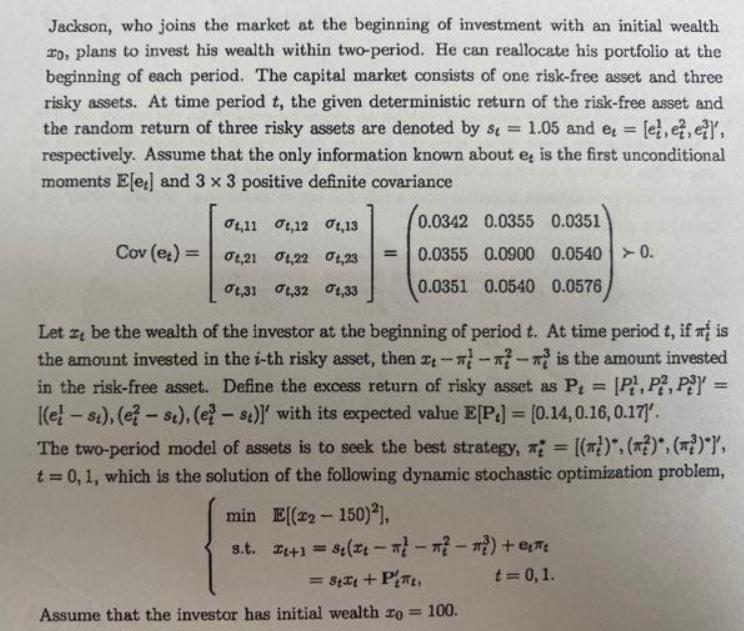

Jackson, who joins the market at the beginning of investment with an initial wealth To, plans to invest his wealth within two-period. He can reallocate his portfolio at the beginning of each period. The capital market consists of one risk-free asset and three risky assets. At time period t, the given deterministic return of the risk-free asset and the random return of three risky assets are denoted by st= 1.05 and et = [e, e, ]', respectively. Assume that the only information known about e, is the first unconditional moments E[et] and 3 x 3 positive definite covariance Cov (et) = 11 12 13 0,21 0,22 1,23 ot,31 0,32 1,33 |- = 0.0342 0.0355 0.0351 0.0355 0.0900 0.05400. 0.0351 0.0540 0.0576 Let z be the wealth of the investor at the beginning of period t. At time period t, if i is the amount invested in the i-th risky asset, then ,--?-? is the amount invested in the risk-free asset. Define the excess return of risky asset as P = [P1, P2, P3 [(el-st), (e? - st), (est)]' with its expected value E[P] = [0.14, 0.16, 0.17]. The two-period model of assets is to seek the best strategy, = [(?). (?)*, (i)*}', t = 0, 1, which is the solution of the following dynamic stochastic optimization problem, E[(22-150)2], min s.t. It+1=(---)+ = 8 + Pit, Assume that the investor has initial wealth ro= 100. t=0, 1. (i) What is the optimal strategy of every period? [10 marks] (ii) What are values of E[x2] and Var(x2) according to the optimal strategy? [10 marks]

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started