Question

Jackstone Company wants to raise $6 million for investing in a new outlet, which will give a 12% return on its investment. The money

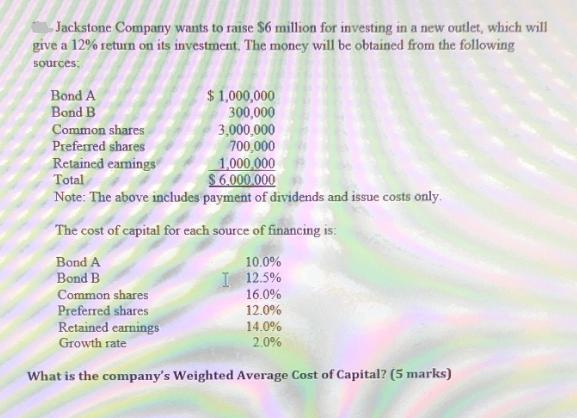

Jackstone Company wants to raise $6 million for investing in a new outlet, which will give a 12% return on its investment. The money will be obtained from the following sources: Bond A Bond B Common shares Preferred shares $ 1,000,000 300,000 3,000,000 700,000 Common shares Preferred shares Retained earnings Total Note: The above includes payment of dividends and issue costs only. 1,000,000 $6.000.000 The cost of capital for each source of financing is: Bond A 10.0% Bond B I 12.5% 16.0% 12.0% Retained earnings 14.0% Growth rate 2.0% What is the company's Weighted Average Cost of Capital? (5 marks)

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Weighted Average Cost of Capital WACC we need to multiply the cost of each source o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started