Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jacob Long, the controller of Arvada Corporation, is trying to prepare a sales budget for the coming year. The income statements for the last

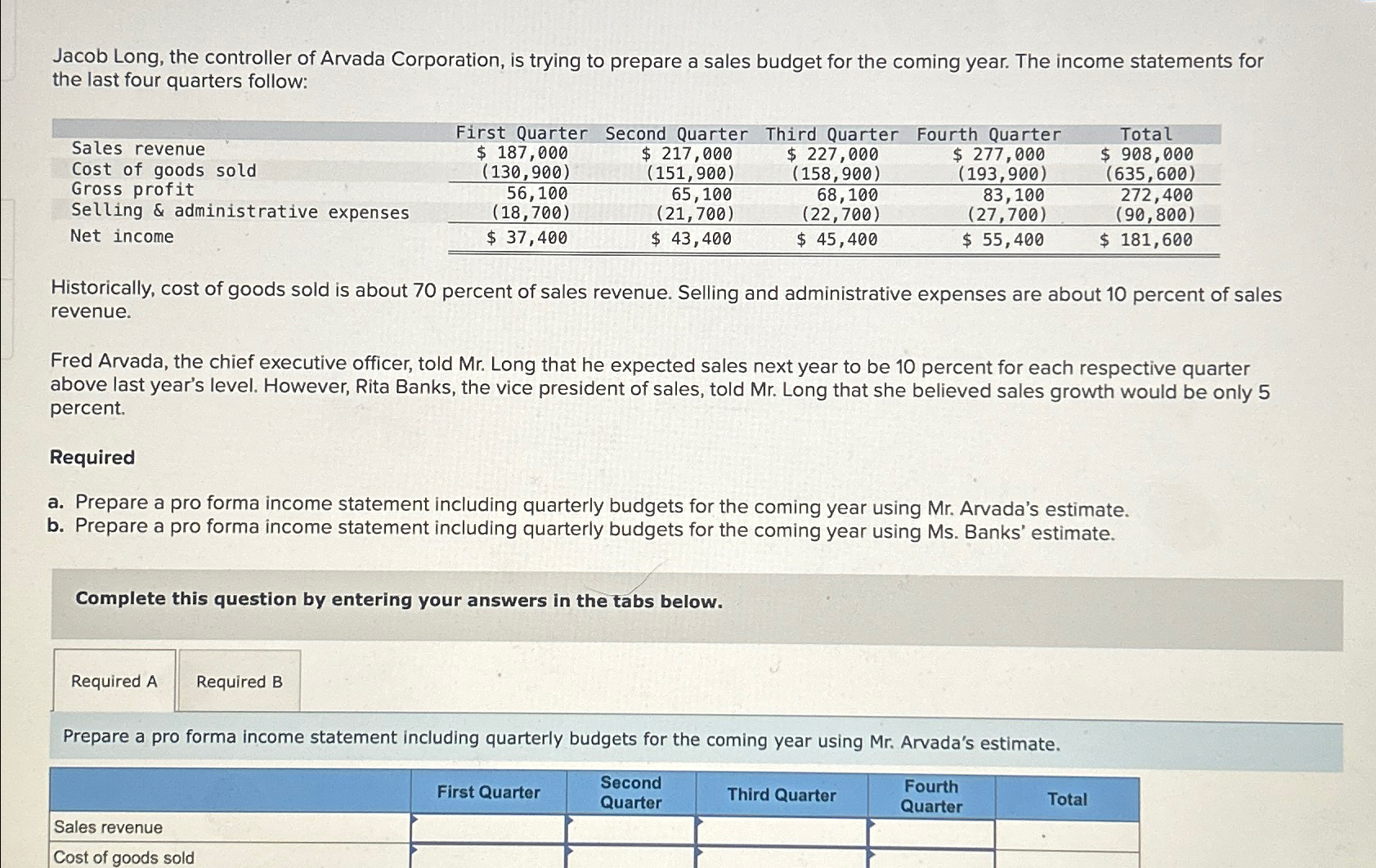

Jacob Long, the controller of Arvada Corporation, is trying to prepare a sales budget for the coming year. The income statements for the last four quarters follow: First Quarter Second Quarter Third Quarter Fourth Quarter Sales revenue Cost of goods sold Gross profit $ 187,000 (130,900) Selling & administrative expenses Net income 56,100 (18,700) $ 217,000 (151,900) 65,100 (21,700) $ 227,000 (158,900) $ 277,000 68,100 (22,700) $ 37,400 $ 43,400 $ 45,400 (193,900) 83,100 (27,700) $ 55,400 Total $ 908,000 (635,600) 272,400 (90,800) $ 181,600 Historically, cost of goods sold is about 70 percent of sales revenue. Selling and administrative expenses are about 10 percent of sales revenue. Fred Arvada, the chief executive officer, told Mr. Long that he expected sales next year to be 10 percent for each respective quarter above last year's level. However, Rita Banks, the vice president of sales, told Mr. Long that she believed sales growth would be only 5 percent. Required a. Prepare a pro forma income statement including quarterly budgets for the coming year using Mr. Arvada's estimate. b. Prepare a pro forma income statement including quarterly budgets for the coming year using Ms. Banks' estimate. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a pro forma income statement including quarterly budgets for the coming year using Mr. Arvada's estimate. Sales revenue Cost of goods sold Second First Quarter Quarter Third Quarter Fourth Quarter Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642bc64e07bc_975061.pdf

180 KBs PDF File

6642bc64e07bc_975061.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started