Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JacobCo is a small specialty machine shop that manufactures high-precision medical instruments. Each employee fills out a time card for each day they work

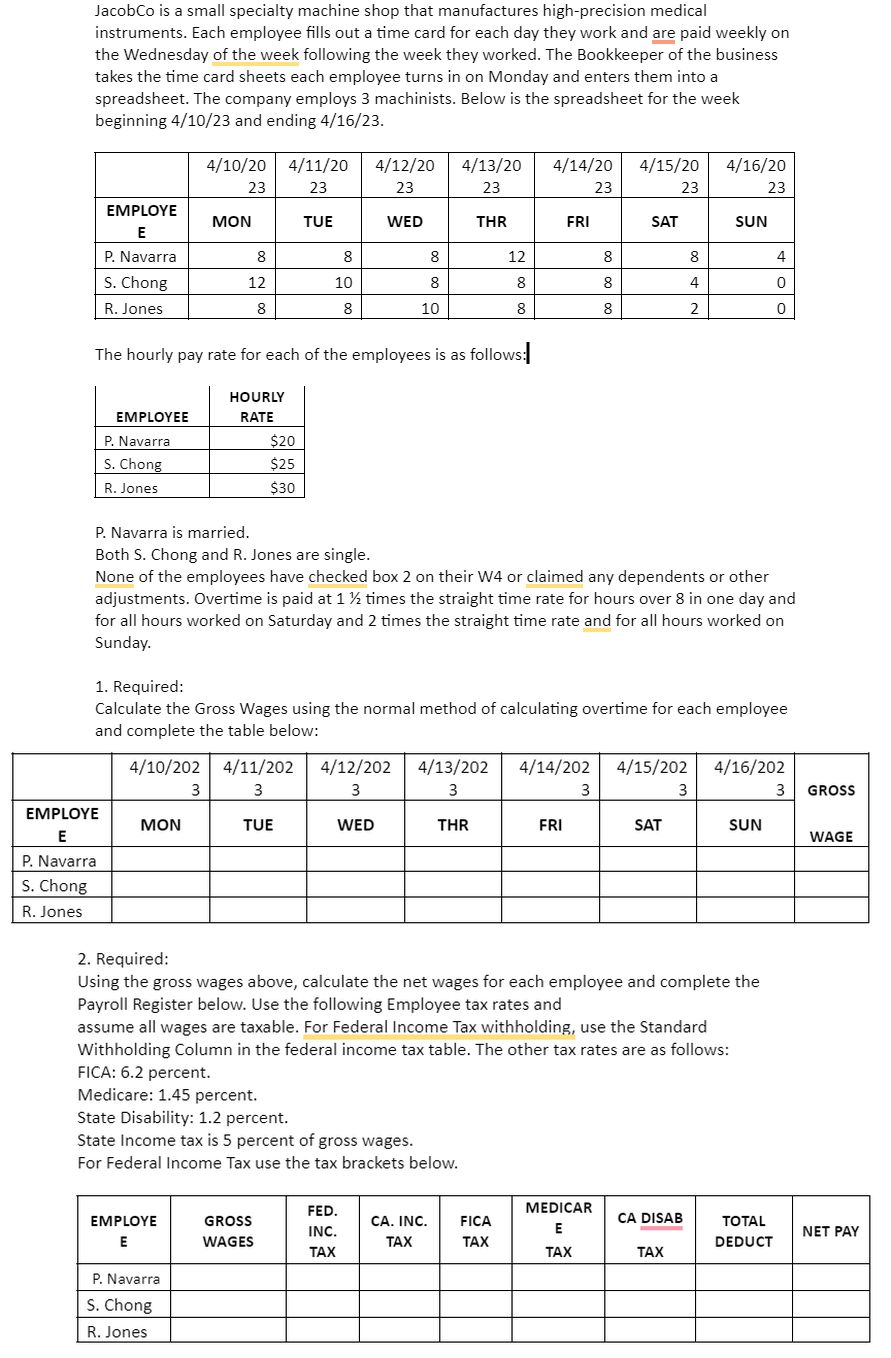

JacobCo is a small specialty machine shop that manufactures high-precision medical instruments. Each employee fills out a time card for each day they work and are paid weekly on the Wednesday of the week following the week they worked. The Bookkeeper of the business takes the time card sheets each employee turns in on Monday and enters them into a spreadsheet. The company employs 3 machinists. Below is the spreadsheet for the week beginning 4/10/23 and ending 4/16/23. 4/10/20 4/11/20 4/12/20 4/13/20 4/14/20 4/15/20 4/16/20 23 23 23 23 23 23 23 EMPLOYE E MON TUE WED THR FRI SAT SUN P. Navarra 8 8 8 12 8 8 4 S. Chong 12 10 8 8 8 4 R. Jones 8 8 10 8 8 2 0 0 The hourly pay rate for each of the employees is as follows: HOURLY EMPLOYEE RATE P. Navarra $20 S. Chong $25 R. Jones $30 P. Navarra is married. Both S. Chong and R. Jones are single. None of the employees have checked box 2 on their W4 or claimed any dependents or other adjustments. Overtime is paid at 1 times the straight time rate for hours over 8 in one day and for all hours worked on Saturday and 2 times the straight time rate and for all hours worked on Sunday. 1. Required: Calculate the Gross Wages using the normal method of calculating overtime for each employee and complete the table below: 4/10/202 4/11/202 4/12/202 4/13/202 4/14/202 4/15/202 4/16/202 3 3 3 3 3 3 3 GROSS EMPLOYE TUE WED THR FRI SAT SUN E WAGE P. Navarra S. Chong R. Jones 2. Required: Using the gross wages above, calculate the net wages for each employee and complete the Payroll Register below. Use the following Employee tax rates and assume all wages are taxable. For Federal Income Tax withholding, use the Standard Withholding Column in the federal income tax table. The other tax rates are as follows: FICA: 6.2 percent. Medicare: 1.45 percent. State Disability: 1.2 percent. State Income tax is 5 percent of gross wages. For Federal Income Tax use the tax brackets below. FED. EMPLOYE GROSS E WAGES INC. TAX CA. INC. TAX FICA MEDICAR E CA DISAB TAX TOTAL DEDUCT NET PAY TAX TAX P. Navarra S. Chong R. Jones

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started