Answered step by step

Verified Expert Solution

Question

1 Approved Answer

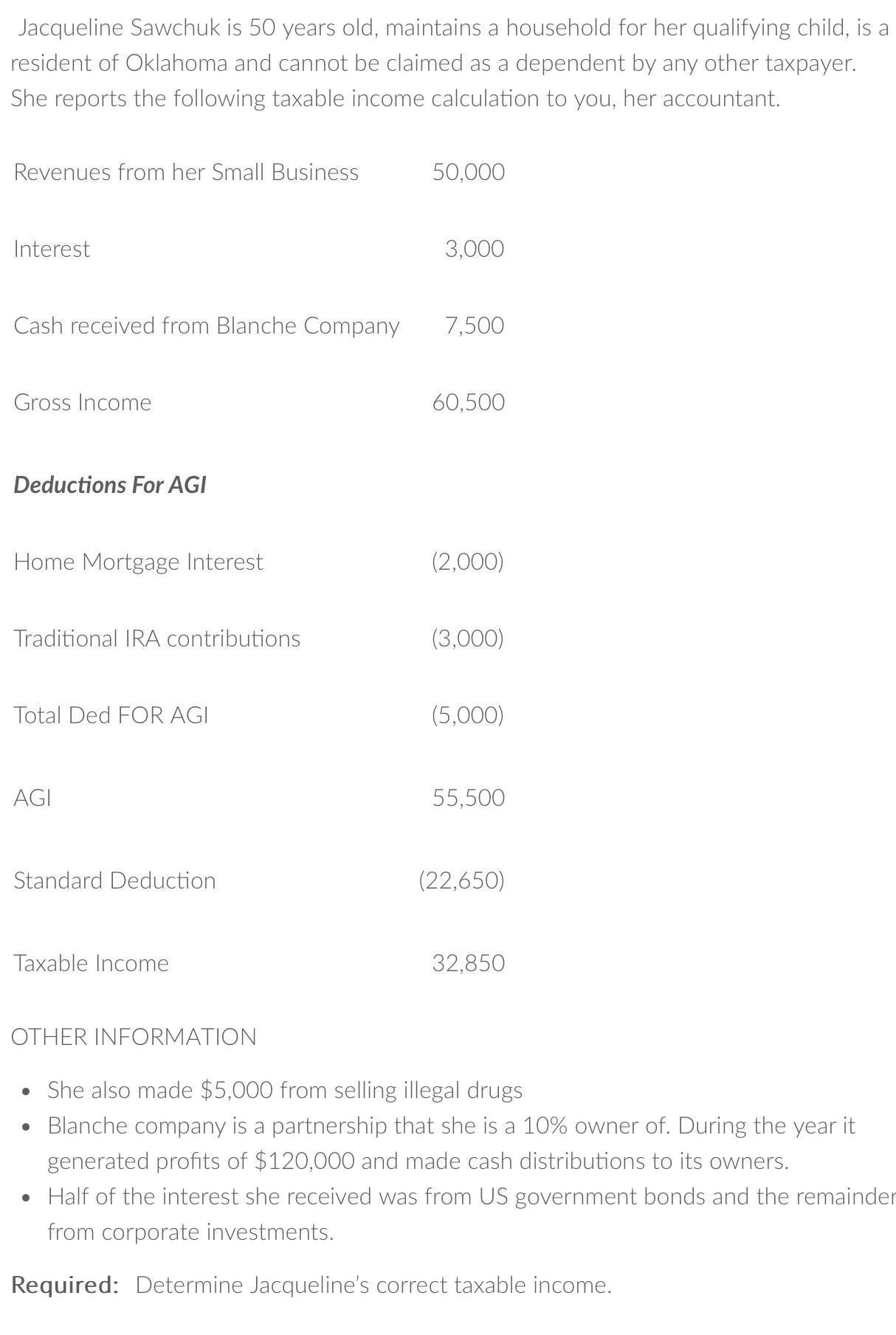

Jacqueline Sawchuk is 50 years old, maintains a household for her qualifying child, is a resident of Oklahoma and cannot be claimed as a

Jacqueline Sawchuk is 50 years old, maintains a household for her qualifying child, is a resident of Oklahoma and cannot be claimed as a dependent by any other taxpayer. She reports the following taxable income calculation to you, her accountant. Revenues from her Small Business Interest 50,000 3,000 Cash received from Blanche Company 7,500 Gross Income 60,500 Deductions For AGI Home Mortgage Interest (2,000) Traditional IRA contributions (3,000) Total Ded FOR AGI (5,000) AGI 55,500 Standard Deduction (22,650) Taxable Income 32,850 OTHER INFORMATION She also made $5,000 from selling illegal drugs Blanche company is a partnership that she is a 10% owner of. During the year it generated profits of $120,000 and made cash distributions to its owners. Half of the interest she received was from US government bonds and the remainder from corporate investments. Required: Determine Jacqueline's correct taxable income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started