Question

Jacquie is a qualified beauty therapist who operates her own business in a shopping center in Toowoomba. She employs 3 staff and has been in

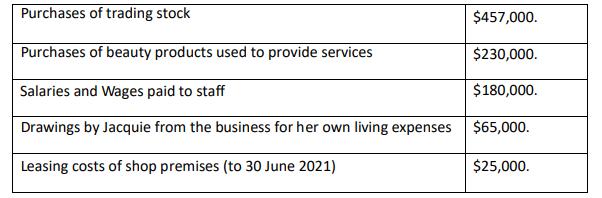

Jacquie is a qualified beauty therapist who operates her own business in a shopping center in Toowoomba. She employs 3 staff and has been in business for 6 years. Jacquie and her staff provide a range of beauty services using a range of equipment and also sell beauty and skin care products both in-store and online. Jacquie provides you with the following information in relation to her business expenses which are relevant to calculating her taxable income for the year ended 30 June 2021:

Additional information not included in the above figures:

● Jacquie pre-paid one year’s lease payments on 29 June 2021 of $27,000. The prepayment relates to the period 1 July 2021 to 30 June 2022. This amount is in addition to the amount shown in the table above

● Jacquie purchased a car to do deliveries for the business and to use for private purposes. The log book indicates that 70% of the use is for a taxable purpose. The car was purchased on 1 September 2020 for $85,000 (excluding GST) and the running costs in the current year were $5,600.

● During the Covid-19 lockdown period, Jacquie was unable to operate her business. She therefore took the opportunity to undertake repairs and upgrades to her beauty therapy rooms. She spend $4,000 to have all rooms repainted with a new color scheme and $15,000 on new therapy beds for each room. She also replaced all the downlights in the ceilings with dimmable Wifi lights. This cost $2,500.

● During the Covid-19 lockdown Jacquie worked from home processing online orders. She set up her computer in the dining room and calculates she spent around 6 hours per day on weekdays working. The lockdown lasted for 3 months of the 2021 income tax year. All computer equipment and consumables Jacquie used were from her business and their costs have already been deducted.

Required:

Provide advice to Jacquie in relation to the tax consequences of the above transactions for the year ended 30 June 2021 and calculate her taxable income. Assume that she is an eligible small business, but refer to the normal deductibility rules in the first instance and then cite any special rules that might apply. Support your advice with reference to any relevant authorities.

Purchases of trading stock Purchases of beauty products used to provide services Salaries and Wages paid to staff Drawings by Jacquie from the business for her own living expenses Leasing costs of shop premises (to 30 June 2021) $457,000. $230,000. $180,000. $65,000. $25,000.

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The tax consequences of the above transactions for the year ended 30 June 2021 are as follows 1 Purc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started