Question

Jade and John have been married for 3 years. Jade is employed by Lawley Ltd, she earned an annual salary of 48,000 in 2019/20. She

Jade and John have been married for 3 years. Jade is employed by Lawley Ltd, she earned an annual salary of £48,000 in 2019/20. She also received a payment of £4,000 from her employer to cover expenses in connection with her employment, of which she spent £1,500 on business travel and £1,200 taking clients out for business lunches.

Lawley Ltd provided Jade with a loan of £45,000 in December 2018, she pays the company 1% interest on this loan. Jade repaid £10,000 of the loan on 31st December 2019.

John has been offered two new jobs with different companies. In both positions, John will start work on 6 April 2020. The remuneration packages are as follows:

Job 1

- Basic salary £100,000.

- An unfurnished home, which the employer bought many years ago for £60,000. It was extensively improved in 2010 at a total cost of £150,000. The market value in April 2020 is estimated at £450,000. The annual value of the property is £12,000.

- Membership of the company's occupational pension scheme. John will be required to make a contribution of 5% of his basic salary per annum. His employer will match this contribution.

- Private medical insurance at a cost to his employer of £1,500 per annum.

Job 2

- Basic salary £80,000 and an annual bonus of £25,000 per annum.

- During the week John will stay at a hotel to avoid commuting, his employer will pay £24,000 a year of hotel costs in respect of John.

- John will purchase his own private medical insurance at an annual cost of £2,500.

John owns a number of investment properties which generate annual assessable rental income in excess of £175,000.

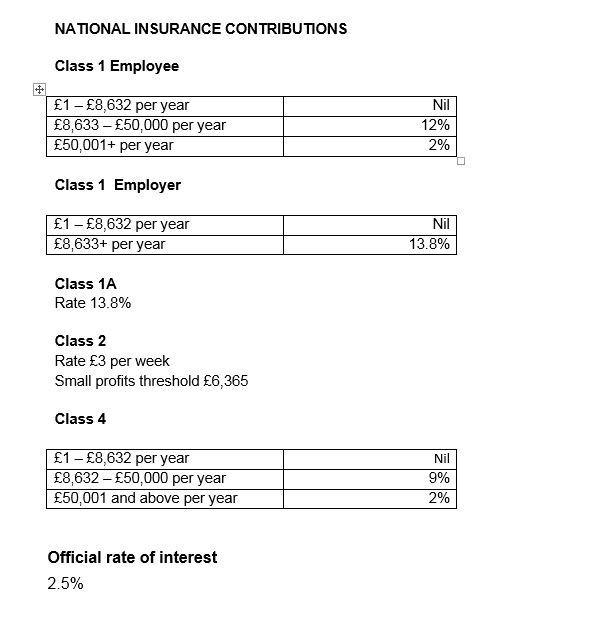

- Calculate the national insurance payable by Jade and Lawley Ltd in respect of Jade’s employment for 2019/20.

- Calculate John’s income tax and national insurance contributions under each job.

- Calculate John’s net disposable income under each job, defined as earnings minus taxation and other payments made by John.

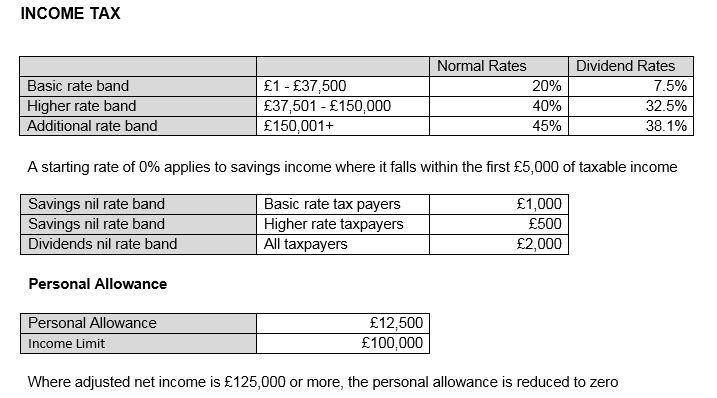

INCOME TAX Basic rate band Higher rate band Additional rate band Personal Allowance 1 - 37,500 37,501 - 150,000 150,001+ Personal Allowance Income Limit Normal Rates A starting rate of 0% applies to savings income where it falls within the first 5,000 of taxable income Savings nil rate band Savings nil rate band Dividends nil rate band Basic rate tax payers Higher rate taxpayers All taxpayers 20% 40% 45% Dividend Rates 7.5% 32.5% 38.1% 1,000 500 2,000 12,500 100,000 Where adjusted net income is 125,000 or more, the personal allowance is reduced to zero

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

National Insurance payable by Jade and Lawley Ltd in respect of Jades employment for 201920 Jades annual salary 48000Employers National Insurance rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started