Answered step by step

Verified Expert Solution

Question

1 Approved Answer

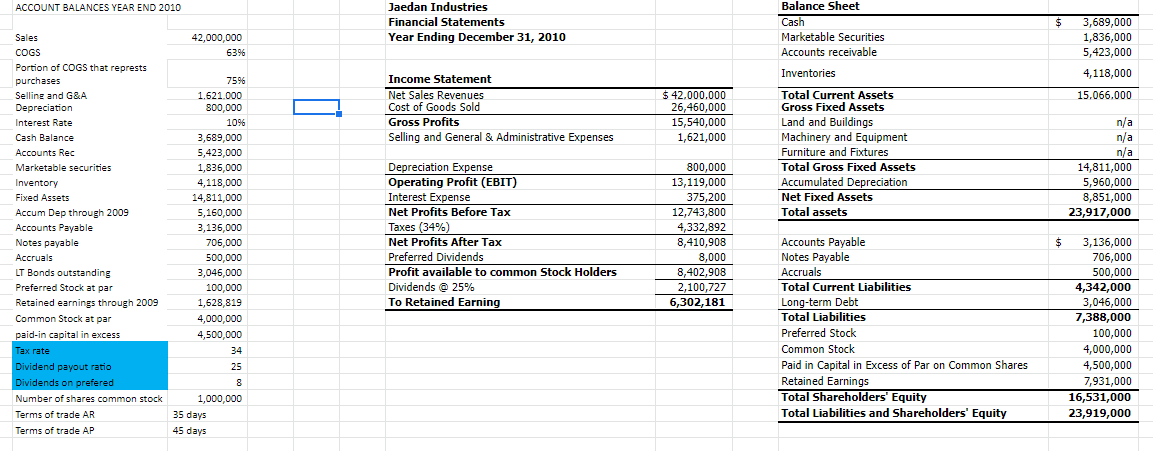

Jaedan Industires has the following account balances as of December 31, 2010 (provided in spreadsheet). The Firm's dividend payout ratio is 25% and the tax

Jaedan Industires has the following account balances as of December 31, 2010 (provided in spreadsheet). The Firm's dividend payout ratio is 25% and the tax rate is 34%. The firm's stock price on December 31, 2009 was 42.89 and on Dec 31, 2010 was 56.82.

Why is my balance sheet is 2000 off?

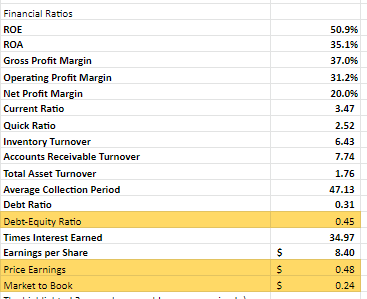

Please verify the accuracy of the financial ratios, i have already solved them just looking for a verification and state why if any issues please.

What is the "Portion of COGS that represents purchases" mean in this case?

ACCOUNT BALANCES YEAR END 2010 Jaedan Industries Financial Statements Year Ending December 31, 2010 $ 42,000,000 6396 3,689,000 1,836,000 5,423,000 4,118,000 15.066.000 Income Statement Net Sales Revenues Cost of Goods Sold Gross Profits Selling and General & Administrative Expenses $ 42.000.000 26,460,000 15,540,000 1,621,000 Balance Sheet Cash Marketable Securities Accounts receivable Inventories Total Current Assets Gross Fixed Assets Land and Buildings Machinery and Equipment Furniture and Fixtures Total Gross Fixed Assets Accumulated Depreciation Net Fixed Assets Total assets n/a n/a n/a 14,811,000 5,960,000 8,851,000 23,917,000 Sales COGS Portion of COGS that represts purchases Selline and G&A Depreciation Interest Rate Cash Balance Accounts Rec Marketable securities Inventory Fixed Assets Accum Dep through 2009 Accounts Payable Notes payable Accruals LT Bonds outstanding Preferred Stock at par Retained earnings through 2009 Common Stock at par paid-in capital in excess - Tax rate Dividend payout ratio Dividends on prefered Number of shares common stock Terms of trade AR Terms of trade AP 7596 1.621.000 800.000 1096 3,689,000 5,423,000 1,836,000 4,118,000 14,811,000 5,160,000 3,136,000 706,000 500,000 3,045,000 100,000 1,628,819 4,000,000 4,500,000 34 25 8 1,000,000 Depreciation Expense Operating Profit (EBIT) Interest Expense Net Profits Before Tax Taxes (34%) Net Profits After Tax Preferred Dividends Profit available to common Stock Holders Dividends @ 25% To Retained Earning 800,000 13,119,000 375,200 12.743,800 4,332,892 8,410,908 8,000 8,402,908 2,100,727 6,302,181 $ Accounts Payable Notes Payable Accruals Total Current Liabilities Long-term Debt Total Liabilities Preferred Stock Common Stock Paid in Capital in Excess of Par on Common Shares Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 3,136,000 706,000 500,000 4,342,000 3,046,000 7,388,000 100,000 4,000,000 4,500,000 7,931,000 16,531,000 23,919,000 35 days 45 days Financial Ratios ROE ROA Gross Profit Margin Operating Profit Margin Net Profit Margin Current Ratio Quick Ratio Inventory Turnover Accounts Receivable Turnover Total Asset Turnover Average Collection Period Debt Ratio Debt-Equity Ratio Times Interest Earned Earnings per Share Price Earnings Market to Book 50.996 35.196 37.096 31.296 20.096 3.47 2.52 6.43 7.74 1.76 47.13 0.31 0.45 34.97 8.40 $ $ $ $ $ 0.48 0.24

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started