Question

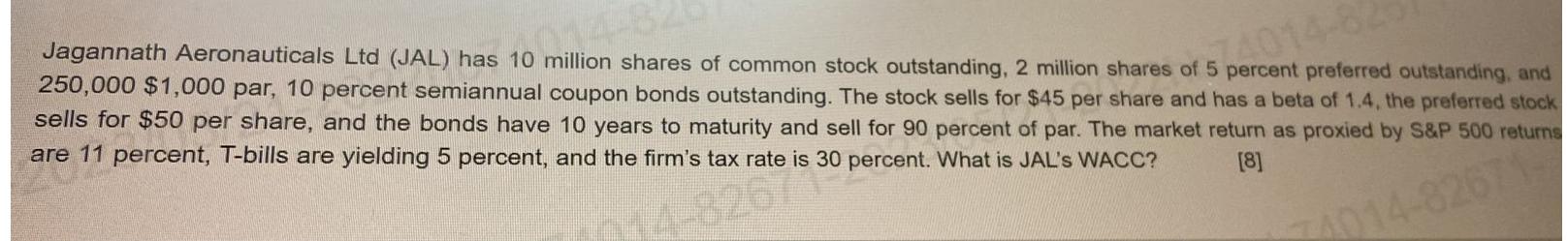

Jagannath Aeronauticals Ltd (JAL) has 10 million shares of common stock outstanding, 2 million shares of 5 percent preferred outstanding, and 250,000 $1,000 par,

Jagannath Aeronauticals Ltd (JAL) has 10 million shares of common stock outstanding, 2 million shares of 5 percent preferred outstanding, and 250,000 $1,000 par, 10 percent semiannual coupon bonds outstanding. The stock sells for $45 per share and has a beta of 1.4, the preferred stock sells for $50 per share, and the bonds have 10 years to maturity and sell for 90 percent of par. The market return as proxied by S&P 500 returns are 11 percent, T-bills are yielding 5 percent, and the firm's tax rate is 30 74014-82 percent. What is JAL's WACC? 14-826 30 [8] 74014-82671-

Step by Step Solution

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To work out JALs weighted normal expense of capital WACC we want to decide the weightings of every part of its capital design and the relating cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

13th Edition

1265553602, 978-1265553609

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App