Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jaguar Plastics Company has been operating for three years. At December 31 of last year, the accounting records reflected the following: Cash $27,000 Accounts

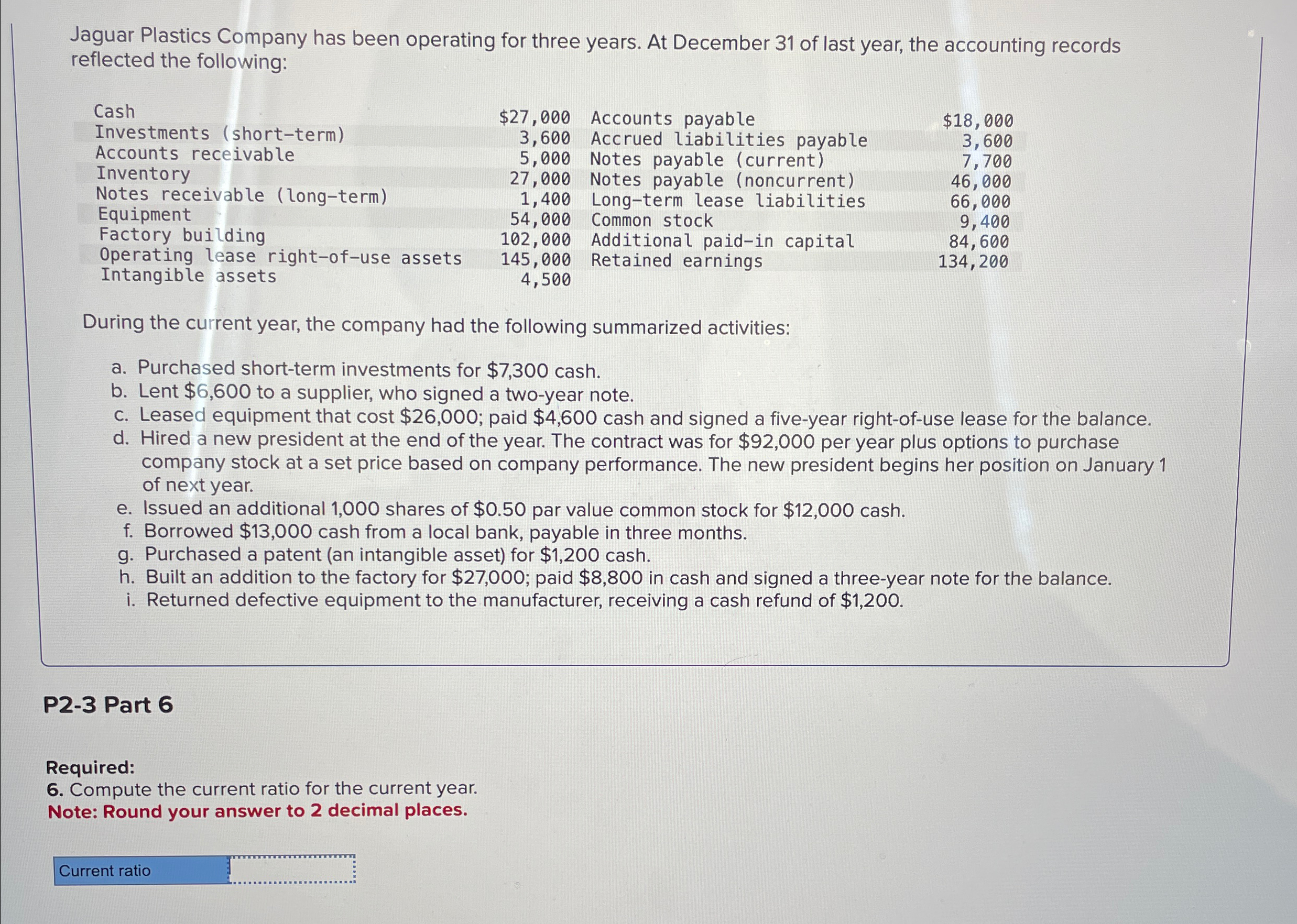

Jaguar Plastics Company has been operating for three years. At December 31 of last year, the accounting records reflected the following: Cash $27,000 Accounts payable $18,000 Investments (short-term) Accounts receivable Inventory Notes receivable (long-term) Equipment 1,400 54,000 3,600 Accrued liabilities payable 5,000 Notes payable (current) 27,000 Notes payable (noncurrent) Long-term lease liabilities Common stock 3,600 7,700 46,000 66,000 9,400 Factory building 102,000 Additional paid-in capital 84,600 Operating lease right-of-use assets Intangible assets 145,000 4,500 Retained earnings 134,200 During the current year, the company had the following summarized activities: a. Purchased short-term investments for $7,300 cash. b. Lent $6,600 to a supplier, who signed a two-year note. c. Leased equipment that cost $26,000; paid $4,600 cash and signed a five-year right-of-use lease for the balance. d. Hired a new president at the end of the year. The contract was for $92,000 per year plus options to purchase company stock at a set price based on company performance. The new president begins her position on January 1 of next year. e. Issued an additional 1,000 shares of $0.50 par value common stock for $12,000 cash. f. Borrowed $13,000 cash from a local bank, payable in three months. g. Purchased a patent (an intangible asset) for $1,200 cash. h. Built an addition to the factory for $27,000; paid $8,800 in cash and signed a three-year note for the balance. i. Returned defective equipment to the manufacturer, receiving a cash refund of $1,200. P2-3 Part 6 Required: 6. Compute the current ratio for the current year. Note: Round your answer to 2 decimal places. Current ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer The current ratio is a financial metric that measures a companys ability to pay its shortterm ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d5138d87a9_968094.pdf

180 KBs PDF File

663d5138d87a9_968094.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started