Answered step by step

Verified Expert Solution

Question

1 Approved Answer

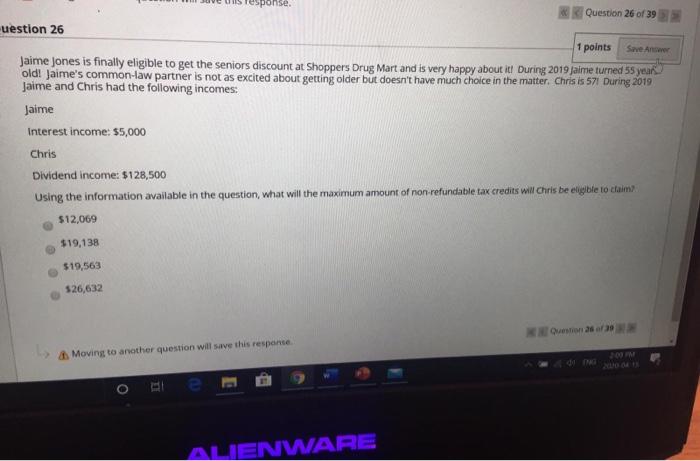

uestion 26 esponse. 1 points Save Answer Jaime Jones is finally eligible to get the seniors discount at Shoppers Drug Mart and is very

uestion 26 esponse. 1 points Save Answer Jaime Jones is finally eligible to get the seniors discount at Shoppers Drug Mart and is very happy about it! During 2019 Jaime turned 55 year old! Jaime's common-law partner is not as excited about getting older but doesn't have much choice in the matter. Chris is 571 During 2019 Jaime and Chris had the following incomes: Jaime Interest income: $5,000 Chris Dividend income: $128,500 Using the information available in the question, what will the maximum amount of non-refundable tax credits will Chris be eligible to claim? $12,069 $19,138 $19,563 $26,632 & Moving to another question will save this response. O Question 26 of 39 ALIENWARE Question 26 of 39 di ING 2:00 PM

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The maximum amount of nonrefundable tax credits Chris will be eligible to claim is 19563 Ch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started