Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jake and Tina, the couple have one child, Tony, who is eight years old. Tony's Social Security number is 233-11-2122. Jake is an engineer

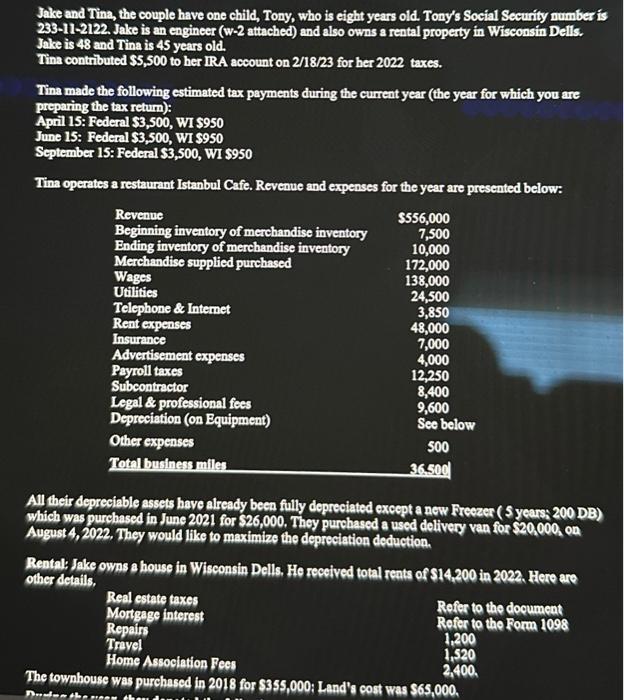

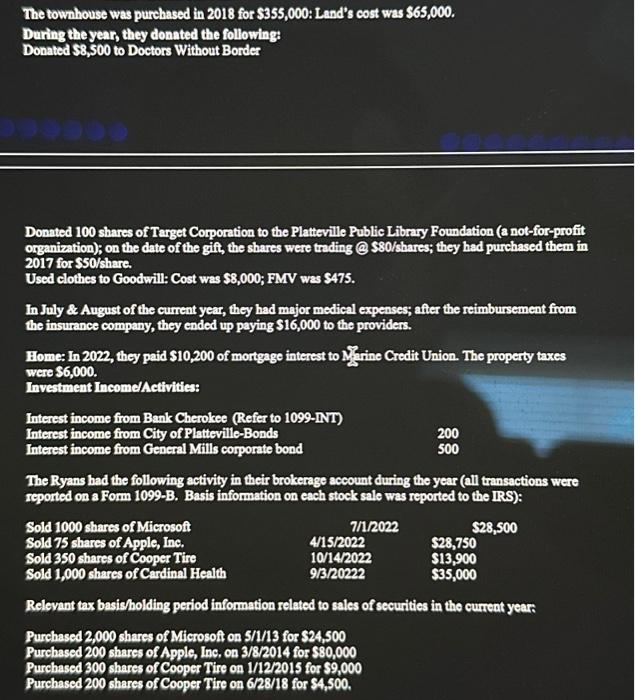

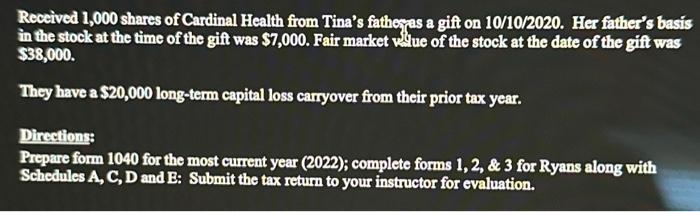

Jake and Tina, the couple have one child, Tony, who is eight years old. Tony's Social Security number is 233-11-2122. Jake is an engineer (w-2 attached) and also owns a rental property in Wisconsin Dells. Jake is 48 and Tina is 45 years old. Tina contributed $5,500 to her IRA account on 2/18/23 for her 2022 taxes. Tina made the following estimated tax payments during the current year (the year for which you are preparing the tax return): April 15: Federal $3,500, WI $950 June 15: Federal $3,500, WI $950 September 15: Federal $3,500, WI $950 Tina operates a restaurant Istanbul Cafe. Revenue and expenses for the year are presented below: Revenue $556,000 Beginning inventory of merchandise inventory 7,500 Ending inventory of merchandise inventory Merchandise supplied purchased Wages Utilities 10,000 172,000 138,000 24,500 Telephone & Internet 3,850 Insurance Rent expenses Advertisement expenses 48,000 7,000 4,000 Payroll taxes 12,250 Subcontractor 8,400 Legal & professional fees 9,600 Depreciation (on Equipment) See below Other expenses 500 Total business miles 36.500 All their depreciable assets have already been fully depreciated except a new Freezer (5 years; 200 DB) which was purchased in June 2021 for $26,000. They purchased a used delivery van for $20,000, on August 4, 2022. They would like to maximize the depreciation deduction. Rental: Jake owns a house in Wisconsin Dells. He received total rents of $14,200 in 2022. Here are other details. Real estate taxes Mortgage interest Refer to the document Refer to the Form 1098 Repairs 1,200 Travel 1,520 Home Association Fees 2,400 The townhouse was purchased in 2018 for $355,000: Land's cost was $65,000. The townhouse was purchased in 2018 for $355,000: Land's cost was $65,000. During the year, they donated the following: Donated $8,500 to Doctors Without Border Donated 100 shares of Target Corporation to the Platteville Public Library Foundation (a not-for-profit organization); on the date of the gift, the shares were trading @ $80/shares; they had purchased them in 2017 for $50/share. Used clothes to Goodwill: Cost was $8,000; FMV was $475. In July & August of the current year, they had major medical expenses; after the reimbursement from the insurance company, they ended up paying $16,000 to the providers. Home: In 2022, they paid $10,200 of mortgage interest to Marine Credit Union. The property taxes were $6,000. Investment Income/Activities: Interest income from Bank Cherokee (Refer to 1099-INT) Interest income from City of Platteville-Bonds Interest income from General Mills corporate bond 200 500 The Ryans had the following activity in their brokerage account during the year (all transactions were reported on a Form 1099-B. Basis information on each stock sale was reported to the IRS): Sold 1000 shares of Microsoft Sold 75 shares of Apple, Inc. Sold 350 shares of Cooper Tire Sold 1,000 shares of Cardinal Health 7/1/2022 $28,500 4/15/2022 $28,750 10/14/2022 $13,900 9/3/20222 $35,000 Relevant tax basis/holding period information related to sales of securities in the current year: Purchased 2,000 shares of Microsoft on 5/1/13 for $24,500 Purchased 200 shares of Apple, Inc. on 3/8/2014 for $80,000 Purchased 300 shares of Cooper Tire on 1/12/2015 for $9,000 Purchased 200 shares of Cooper Tire on 6/28/18 for $4,500. Received 1,000 shares of Cardinal Health from Tina's father as a gift on 10/10/2020. Her father's basis in the stock at the time of the gift was $7,000. Fair market value of the stock at the date of the gift was $38,000. They have a $20,000 long-term capital loss carryover from their prior tax year. Directions: Prepare form 1040 for the most current year (2022); complete forms 1, 2, & 3 for Ryans along with Schedules A, C, D and E: Submit the tax return to your instructor for evaluation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started