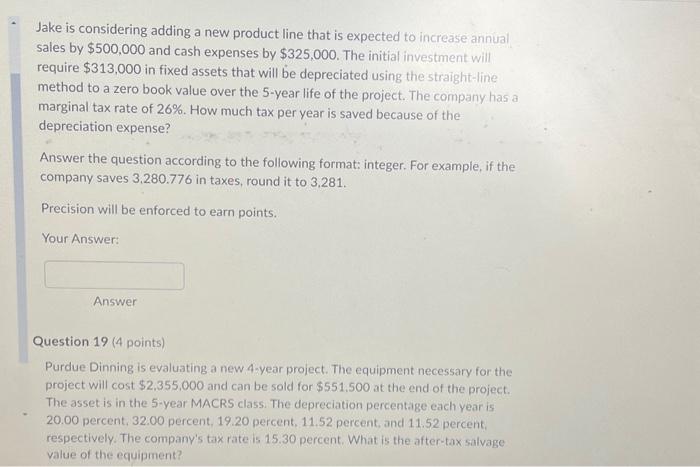

Jake is considering adding a new product line that is expected to increase annual sales by $500,000 and cash expenses by $325,000. The initial investment will require $313,000 in fixed assets that will be depreciated using the straight-line method to a zero book value over the 5 -year life of the project. The company has a marginal tax rate of 26%. How much tax per year is saved because of the depreciation expense? Answer the question according to the following format: integer. For example, if the company saves 3,280.776 in taxes, round it to 3,281 . Precision will be enforced to earn points. Your Answer: Answer Question 19 (4 points) Purdue Dinning is evaluating a new 4 -year project. The equipment necessary for the project will cost $2,355,000 and can be sold for $551.500 at the end of the project. The asset is in the 5-year MACRS class. The depreciation percentage each year is 20.00 percent, 32.00 percent, 19.20 percent, 11.52 percent, and 11.52 percent. respectively. The company's tax rate is 15.30 percent. What is the after-tax salvage value of the equipment? Jake is considering adding a new product line that is expected to increase annual sales by $500,000 and cash expenses by $325,000. The initial investment will require $313,000 in fixed assets that will be depreciated using the straight-line method to a zero book value over the 5 -year life of the project. The company has a marginal tax rate of 26%. How much tax per year is saved because of the depreciation expense? Answer the question according to the following format: integer. For example, if the company saves 3,280.776 in taxes, round it to 3,281 . Precision will be enforced to earn points. Your Answer: Answer Question 19 (4 points) Purdue Dinning is evaluating a new 4 -year project. The equipment necessary for the project will cost $2,355,000 and can be sold for $551.500 at the end of the project. The asset is in the 5-year MACRS class. The depreciation percentage each year is 20.00 percent, 32.00 percent, 19.20 percent, 11.52 percent, and 11.52 percent. respectively. The company's tax rate is 15.30 percent. What is the after-tax salvage value of the equipment