Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jake, Sacha, and Brianne own a tour company called Adventure Sports. The partners share profit and losses in a 2:3:5 ratio. After lengthy disagreements

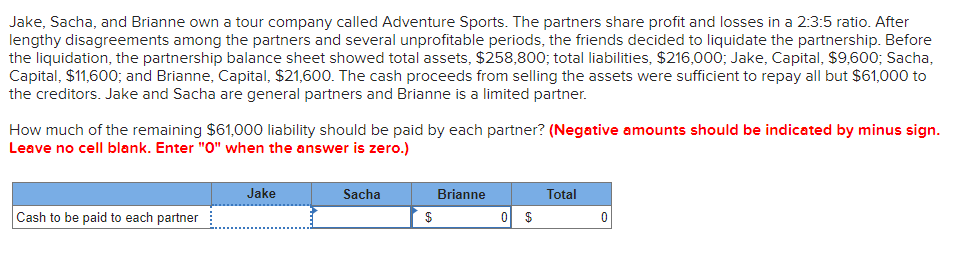

Jake, Sacha, and Brianne own a tour company called Adventure Sports. The partners share profit and losses in a 2:3:5 ratio. After lengthy disagreements among the partners and several unprofitable periods, the friends decided to liquidate the partnership. Before the liquidation, the partnership balance sheet showed total assets, $258,800; total liabilities, $216,000; Jake, Capital, $9,600; Sacha, Capital, $11,600; and Brianne, Capital, $21,600. The cash proceeds from selling the assets were sufficient to repay all but $61,000 to the creditors. Jake and Sacha are general partners and Brianne is a limited partner. How much of the remaining $61,000 liability should be paid by each partner? (Negative amounts should be indicated by minus sign. Leave no cell blank. Enter "O" when the answer is zero.) Jake Cash to be paid to each partner Sacha Brianne Total $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To determine how much each partner should contribute towards the remaining liabili...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started