Answered step by step

Verified Expert Solution

Question

1 Approved Answer

James Bat became a baseball enthusiast at a very early age. All of his baseball experience has provided him valuable knowledge of the sport, and

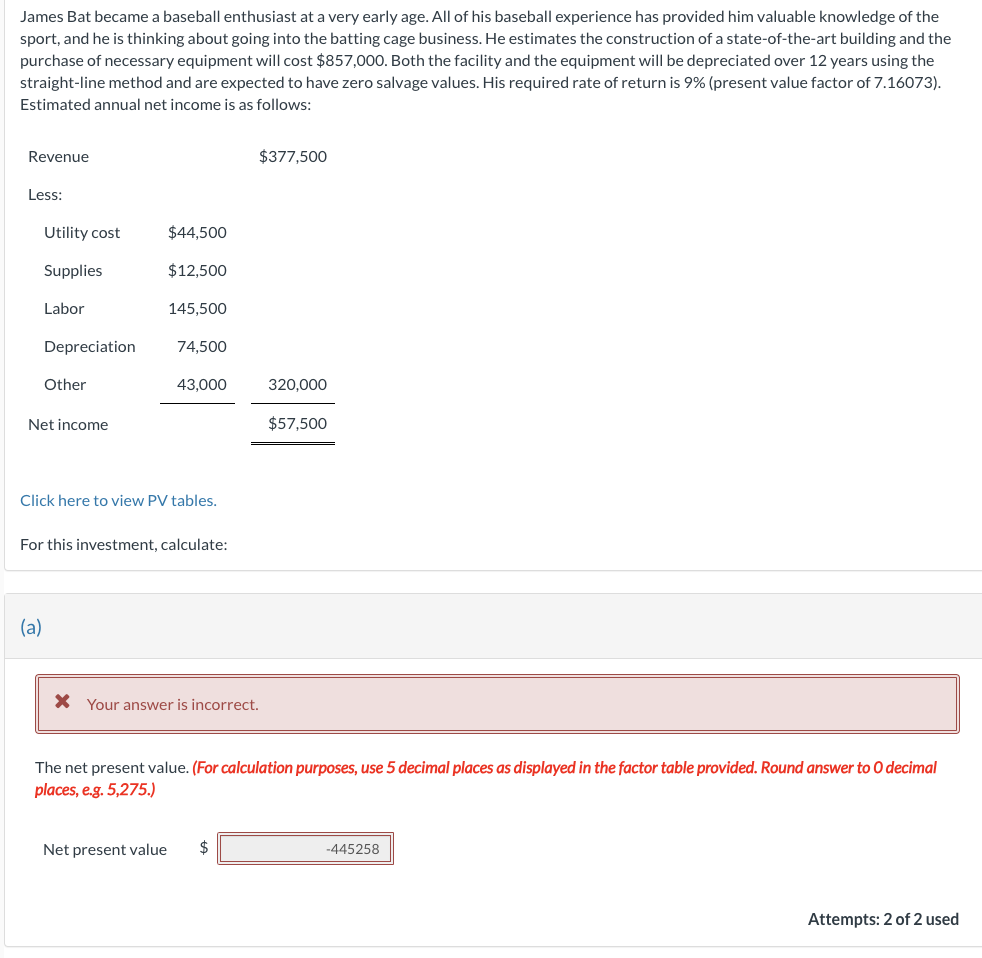

James Bat became a baseball enthusiast at a very early age. All of his baseball experience has provided him valuable knowledge of the sport, and he is thinking about going into the batting cage business. He estimates the construction of a state-of-the-art building and the purchase of necessary equipment will cost $857,000. Both the facility and the equipment will be depreciated over 12 years using the straight-line method and are expected to have zero salvage values. His required rate of return is 9% (present value factor of 7.16073 ). Estimated annual net income is as follows: Click here to view PV tables. For this investment, calculate: (a) Your answer is incorrect. The net present value. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 0 decimal places, e.g. 5,275.) Net present value The internal rate of return. (use the above table.) (Round answer to 0 decimal places, e.g. 15%.) Internal rate of return %

James Bat became a baseball enthusiast at a very early age. All of his baseball experience has provided him valuable knowledge of the sport, and he is thinking about going into the batting cage business. He estimates the construction of a state-of-the-art building and the purchase of necessary equipment will cost $857,000. Both the facility and the equipment will be depreciated over 12 years using the straight-line method and are expected to have zero salvage values. His required rate of return is 9% (present value factor of 7.16073 ). Estimated annual net income is as follows: Click here to view PV tables. For this investment, calculate: (a) Your answer is incorrect. The net present value. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 0 decimal places, e.g. 5,275.) Net present value The internal rate of return. (use the above table.) (Round answer to 0 decimal places, e.g. 15%.) Internal rate of return % Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started