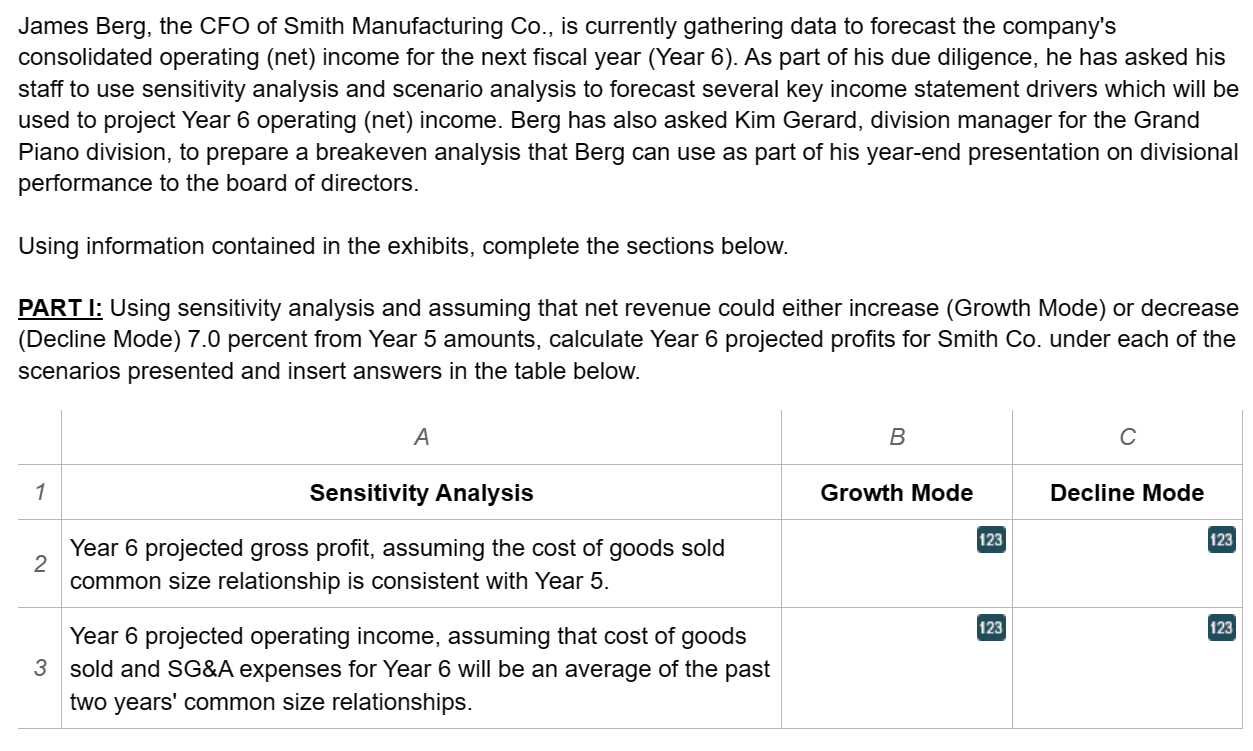

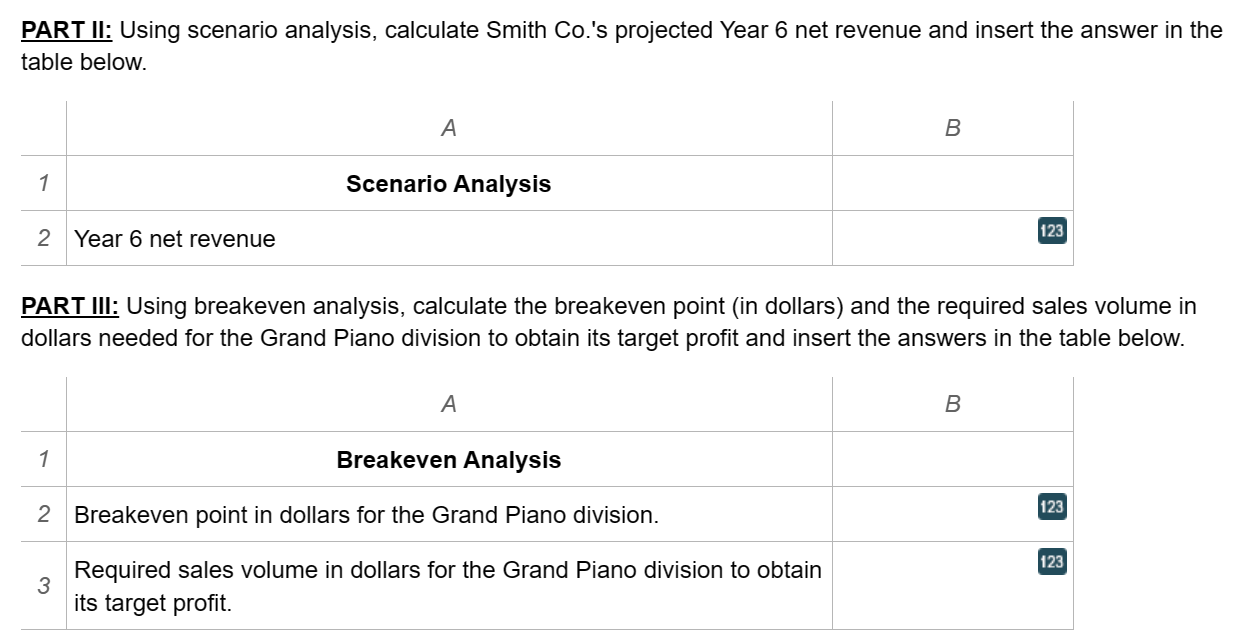

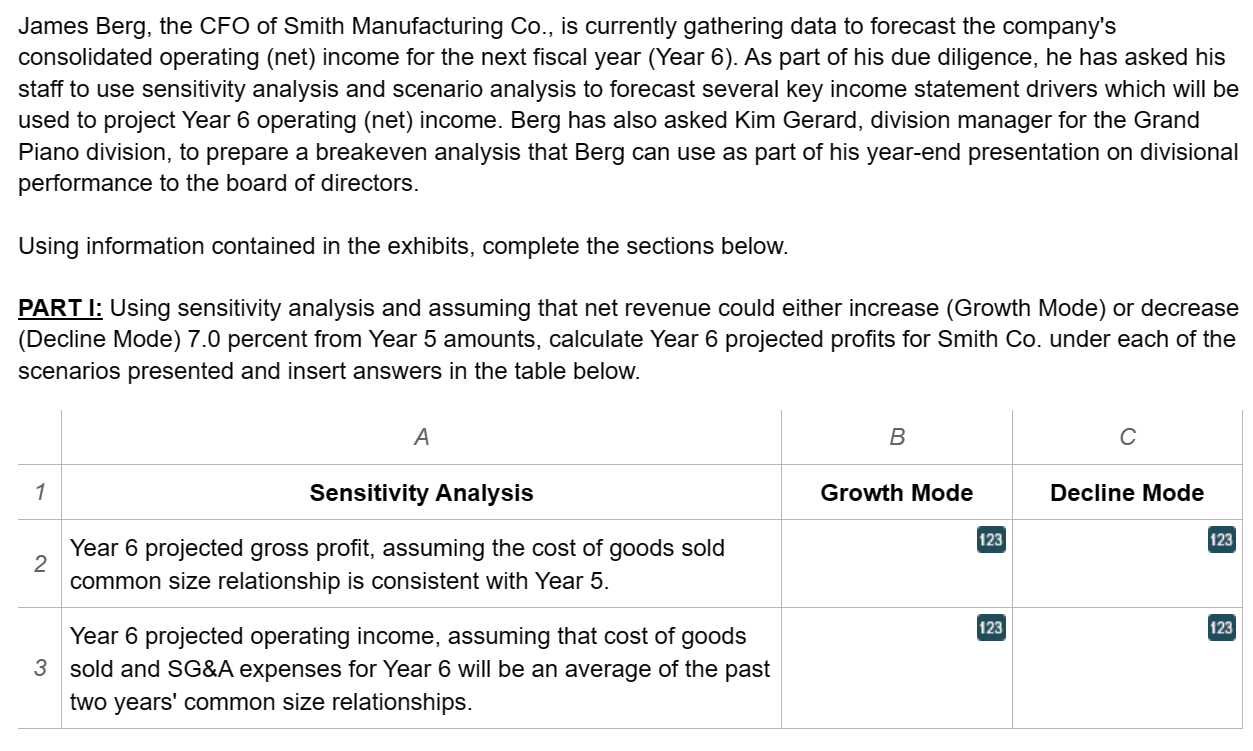

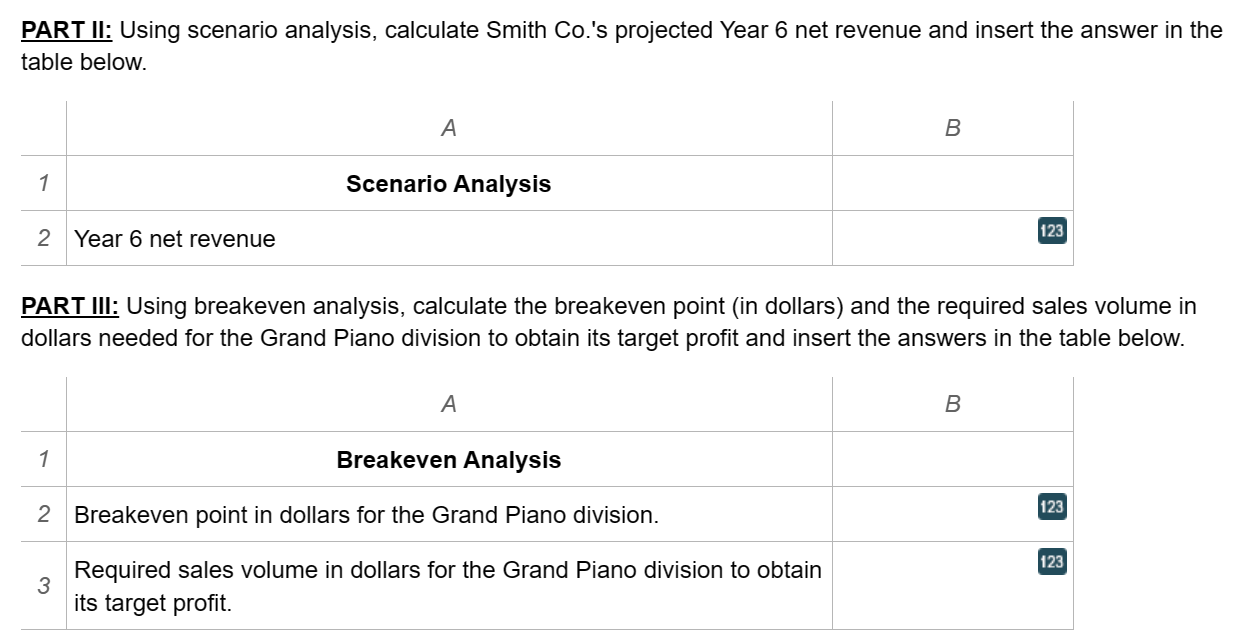

James Berg, the CFO of Smith Manufacturing Co., is currently gathering data to forecast the company's consolidated operating (net) income for the next fiscal year (Year 6). As part of his due diligence, he has asked his staff to use sensitivity analysis and scenario analysis to forecast several key income statement drivers which will be used to project Year 6 operating (net) income. Berg has also asked Kim Gerard, division manager for the Grand Piano division, to prepare a breakeven analysis that Berg can use as part of his year-end presentation on divisional performance to the board of directors. Using information contained in the exhibits, complete the sections below. PART I: Using sensitivity analysis and assuming that net revenue could either increase (Growth Mode) or decrease (Decline Mode) 7.0 percent from Year 5 amounts, calculate Year 6 projected profits for Smith Co. under each of the scenarios presented and insert answers in the table below. PART II: Using scenario analysis, calculate Smith Co.'s projected Year 6 net revenue and insert the answer in the table below. PART III: Using breakeven analysis, calculate the breakeven point (in dollars) and the required sales volume in dollars needed for the Grand Piano division to obtain its target profit and insert the answers in the table below. James Berg, the CFO of Smith Manufacturing Co., is currently gathering data to forecast the company's consolidated operating (net) income for the next fiscal year (Year 6). As part of his due diligence, he has asked his staff to use sensitivity analysis and scenario analysis to forecast several key income statement drivers which will be used to project Year 6 operating (net) income. Berg has also asked Kim Gerard, division manager for the Grand Piano division, to prepare a breakeven analysis that Berg can use as part of his year-end presentation on divisional performance to the board of directors. Using information contained in the exhibits, complete the sections below. PART I: Using sensitivity analysis and assuming that net revenue could either increase (Growth Mode) or decrease (Decline Mode) 7.0 percent from Year 5 amounts, calculate Year 6 projected profits for Smith Co. under each of the scenarios presented and insert answers in the table below. PART II: Using scenario analysis, calculate Smith Co.'s projected Year 6 net revenue and insert the answer in the table below. PART III: Using breakeven analysis, calculate the breakeven point (in dollars) and the required sales volume in dollars needed for the Grand Piano division to obtain its target profit and insert the answers in the table below