Answered step by step

Verified Expert Solution

Question

1 Approved Answer

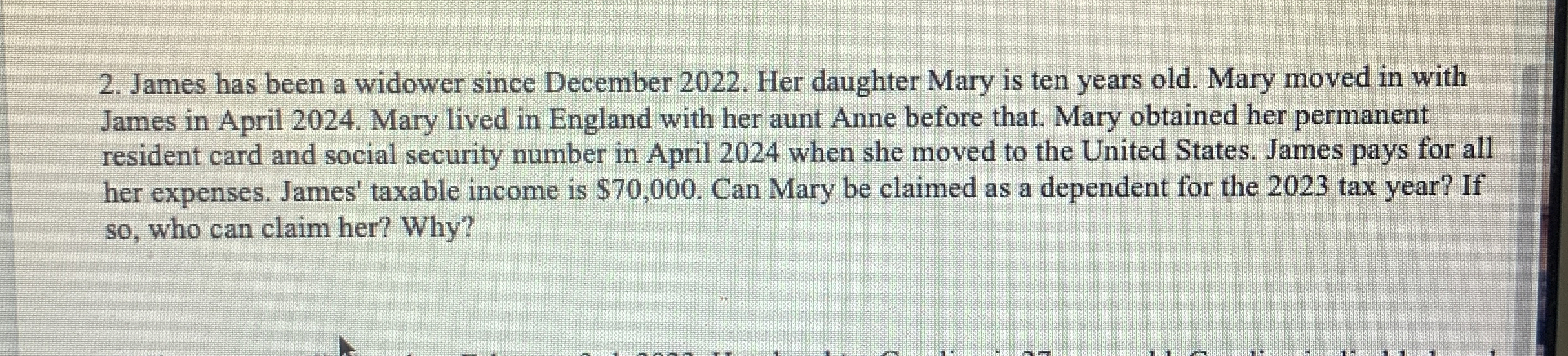

James has been a widower since December 2 0 2 2 . Her daughter Mary is ten years old. Mary moved in with James in

James has been a widower since December Her daughter Mary is ten years old. Mary moved in with

James in April Mary lived in England with her aunt Anne before that. Mary obtained her permanent

resident card and social security number in April when she moved to the United States. James pays for all

her expenses. James' taxable income is $ Can Mary be claimed as a dependent for the tax year? If

so who can claim her? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started