Answered step by step

Verified Expert Solution

Question

1 Approved Answer

James has made the following disposals during 2020-21. 1) James bought a house in Exeter on 1 July 2002 for 121,000. This house was

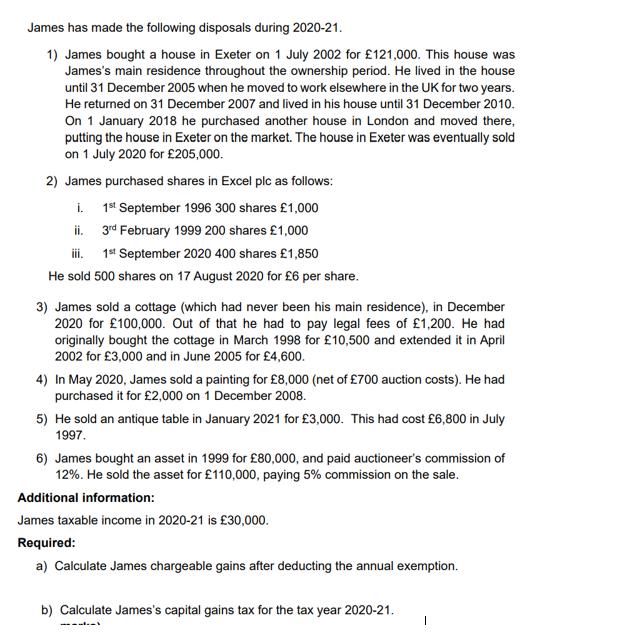

James has made the following disposals during 2020-21. 1) James bought a house in Exeter on 1 July 2002 for 121,000. This house was James's main residence throughout the ownership period. He lived in the house until 31 December 2005 when he moved to work elsewhere in the UK for two years. He returned on 31 December 2007 and lived in his house until 31 December 2010. On 1 January 2018 he purchased another house in London and moved there, putting the house in Exeter on the market. The house in Exeter was eventually sold on 1 July 2020 for 205,000. 2) James purchased shares in Excel plc as follows: i. 1st September 1996 300 shares 1,000 ii. 3rd February 1999 200 shares 1,000 iii. 1st September 2020 400 shares 1,850 He sold 500 shares on 17 August 2020 for 6 per share. 3) James sold a cottage (which had never been his main residence), in December 2020 for 100,000. Out of that he had to pay legal fees of 1,200. He had originally bought the cottage in March 1998 for 10,500 and extended it in April 2002 for 3,000 and in June 2005 for 4,600. 4) In May 2020, James sold a painting for 8,000 (net of 700 auction costs). He had purchased it for 2,000 on 1 December 2008. 5) He sold an antique table in January 2021 for 3,000. This had cost 6,800 in July 1997. 6) James bought an asset in 1999 for 80,000, and paid auctioneer's commission of 12%. He sold the asset for 110,000, paying 5% commission on the sale. Additional information: James taxable income in 2020-21 is 30,000. Required: a) Calculate James chargeable gains after deducting the annual exemption. b) Calculate James's capital gains tax for the tax year 2020-21. |

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Jamess chargeable gains and capital gains tax for the tax year 202021 lets go through each disposal and calculate the gains separately 1 House in Exeter James bought the house in Exeter o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started