Question

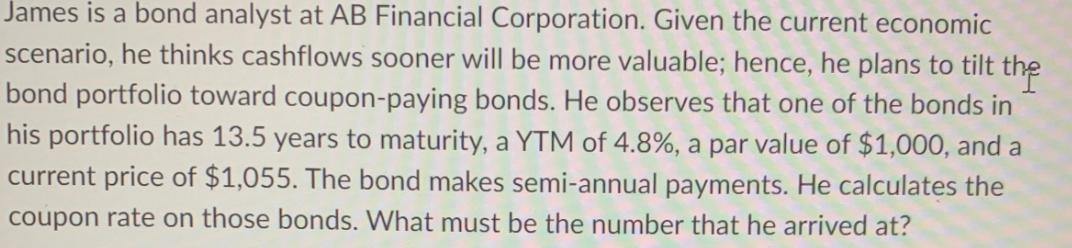

James is a bond analyst at AB Financial Corporation. Given the current economic scenario, he thinks cashflows sooner will be more valuable; hence, he

James is a bond analyst at AB Financial Corporation. Given the current economic scenario, he thinks cashflows sooner will be more valuable; hence, he plans to tilt the bond portfolio toward coupon-paying bonds. He observes that one of the bonds in his portfolio has 13.5 years to maturity, a YTM of 4.8%, a par value of $1,000, and a current price of $1,055. The bond makes semi-annual payments. He calculates the coupon rate on those bonds. What must be the number that he arrived at?

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the bond in Jamess portfolio we have the following information Maturity of the bond 135 y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction to Management Science Quantitative Approach to Decision Making

Authors: David R. Anderson, Dennis J. Sweeney, Thomas A. Williams, Jeffrey D. Camm, James J. Cochran

15th edition

978-1337406529

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App