Answered step by step

Verified Expert Solution

Question

1 Approved Answer

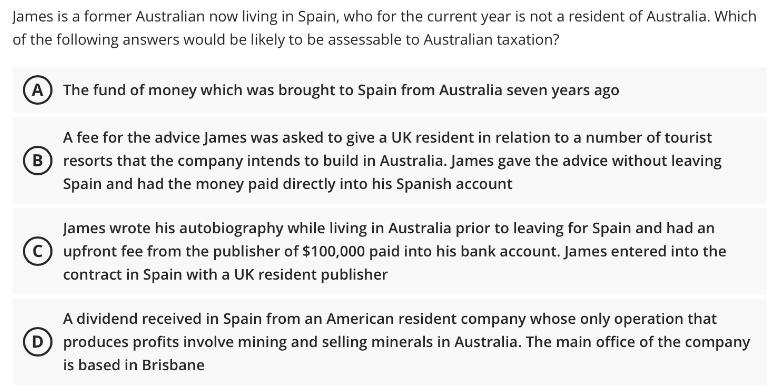

James is a former Australian now living in Spain, who for the current year is not a resident of Australia. Which of the following

James is a former Australian now living in Spain, who for the current year is not a resident of Australia. Which of the following answers would be likely to be assessable to Australian taxation? A The fund of money which was brought to Spain from Australia seven years ago A fee for the advice James was asked to give a UK resident in relation to a number of tourist B resorts that the company intends to build in Australia. James gave the advice without leaving Spain and had the money paid directly into his Spanish account James wrote his autobiography while living in Australia prior to leaving for Spain and had an upfront fee from the publisher of $100,000 paid into his bank account. James entered into the contract in Spain with a UK resident publisher A dividend received in Spain from an American resident company whose only operation that produces profits involve mining and selling minerals in Australia. The main office of the company is based in Brisbane

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started