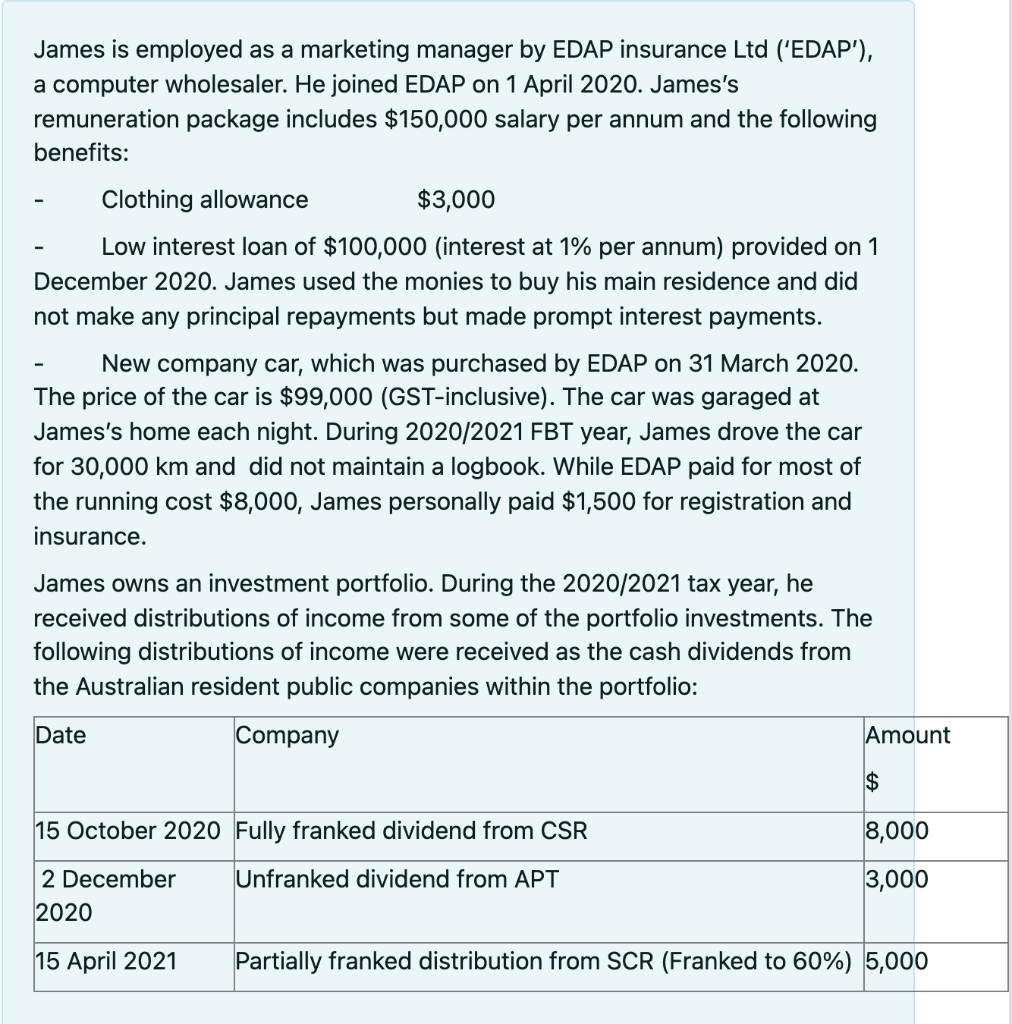

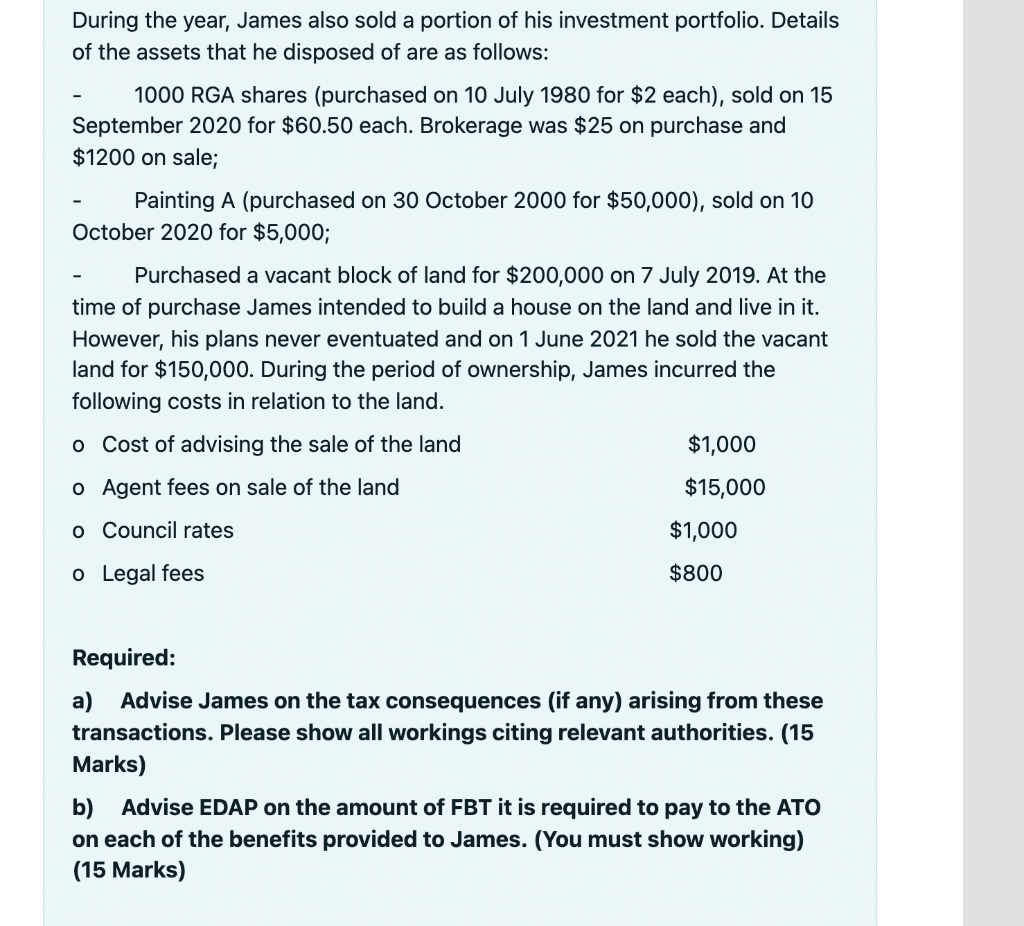

James is employed as a marketing manager by EDAP insurance Ltd ('EDAP'), a computer wholesaler. He joined EDAP on 1 April 2020. James's remuneration package includes $150,000 salary per annum and the following benefits: Clothing allowance $3,000 Low interest loan of $100,000 (interest at 1% per annum) provided on 1 December 2020. James used the monies to buy his main residence and did not make any principal repayments but made prompt interest payments. New company car, which was purchased by EDAP on 31 March 2020. The price of the car is $99,000 (GST-inclusive). The car was garaged at James's home each night. During 2020/2021 FBT year, James drove the car for 30,000 km and did not maintain a logbook. While EDAP paid for most of the running cost $8,000, James personally paid $1,500 for registration and insurance. James owns an investment portfolio. During the 2020/2021 tax year, he received distributions of income from some of the portfolio investments. The following distributions of income were received as the cash dividends from the Australian resident public companies within the portfolio: Date Company Amount $ 15 October 2020 Fully franked dividend from CSR 8,000 Unfranked dividend from APT 3,000 2 December 2020 15 April 2021 Partially franked distribution from SCR (Franked to 60%) 5,000 During the year, James also sold a portion of his investment portfolio. Details of the assets that he disposed of are as follows: 1000 RGA shares (purchased on 10 July 1980 for $2 each), sold on 15 September 2020 for $60.50 each. Brokerage was $25 on purchase and $1200 on sale; Painting A (purchased on 30 October 2000 for $50,000), sold on 10 October 2020 for $5,000; Purchased a vacant block of land for $200,000 on 7 July 2019. At the time of purchase James intended to build a house on the land and live in it. However, his plans never eventuated and on 1 June 2021 he sold the vacant land for $150,000. During the period of ownership, James incurred the following costs in relation to the land. o Cost of advising the sale of the land $1,000 O Agent fees on sale of the land $15,000 o Council rates $1,000 $800 o Legal fees Required: a) Advise James on the tax consequences (if any) arising from these transactions. Please show all workings citing relevant authorities. (15 Marks) b) Advise EDAP on the amount of FBT it is required to pay to the ATO on each of the benefits provided to James. (You must show working) (15 Marks) James is employed as a marketing manager by EDAP insurance Ltd ('EDAP'), a computer wholesaler. He joined EDAP on 1 April 2020. James's remuneration package includes $150,000 salary per annum and the following benefits: Clothing allowance $3,000 Low interest loan of $100,000 (interest at 1% per annum) provided on 1 December 2020. James used the monies to buy his main residence and did not make any principal repayments but made prompt interest payments. New company car, which was purchased by EDAP on 31 March 2020. The price of the car is $99,000 (GST-inclusive). The car was garaged at James's home each night. During 2020/2021 FBT year, James drove the car for 30,000 km and did not maintain a logbook. While EDAP paid for most of the running cost $8,000, James personally paid $1,500 for registration and insurance. James owns an investment portfolio. During the 2020/2021 tax year, he received distributions of income from some of the portfolio investments. The following distributions of income were received as the cash dividends from the Australian resident public companies within the portfolio: Date Company Amount $ 15 October 2020 Fully franked dividend from CSR 8,000 Unfranked dividend from APT 3,000 2 December 2020 15 April 2021 Partially franked distribution from SCR (Franked to 60%) 5,000 During the year, James also sold a portion of his investment portfolio. Details of the assets that he disposed of are as follows: 1000 RGA shares (purchased on 10 July 1980 for $2 each), sold on 15 September 2020 for $60.50 each. Brokerage was $25 on purchase and $1200 on sale; Painting A (purchased on 30 October 2000 for $50,000), sold on 10 October 2020 for $5,000; Purchased a vacant block of land for $200,000 on 7 July 2019. At the time of purchase James intended to build a house on the land and live in it. However, his plans never eventuated and on 1 June 2021 he sold the vacant land for $150,000. During the period of ownership, James incurred the following costs in relation to the land. o Cost of advising the sale of the land $1,000 O Agent fees on sale of the land $15,000 o Council rates $1,000 $800 o Legal fees Required: a) Advise James on the tax consequences (if any) arising from these transactions. Please show all workings citing relevant authorities. (15 Marks) b) Advise EDAP on the amount of FBT it is required to pay to the ATO on each of the benefits provided to James. (You must show working) (15 Marks)