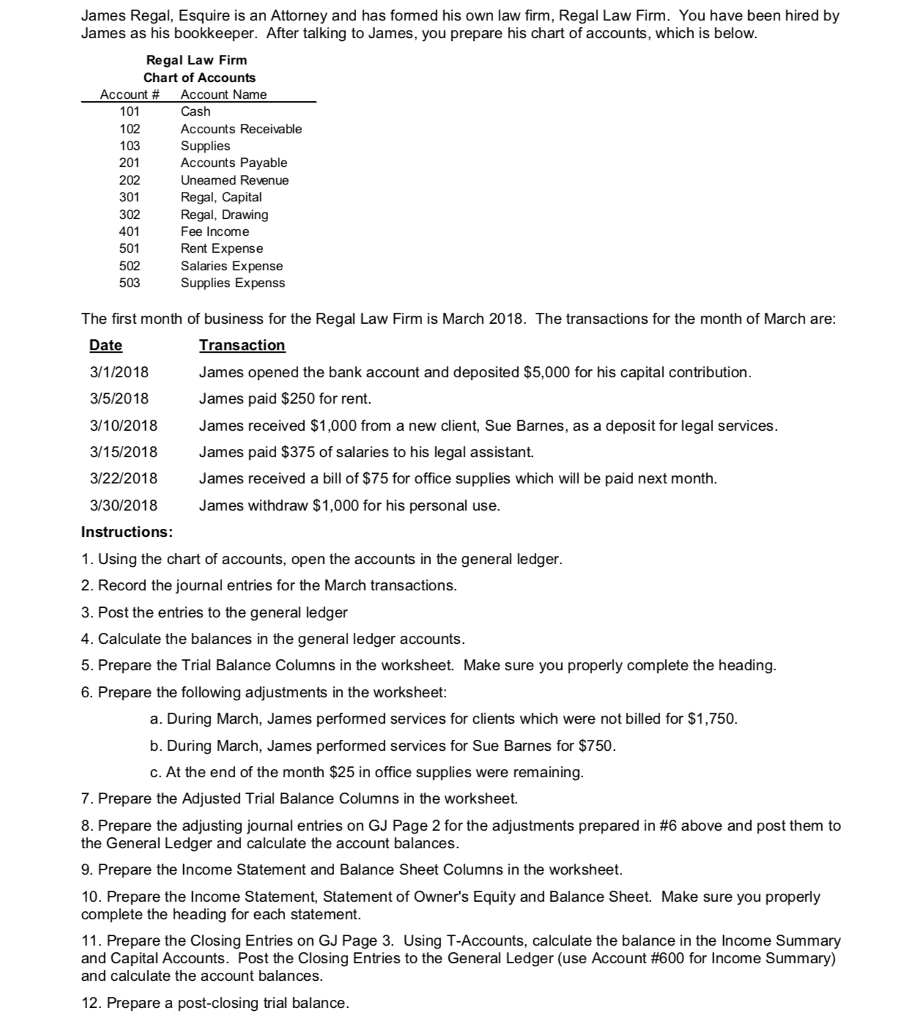

James Regal, Esquire is an Attorney and has fomed his own law firm, Regal Law Firm. You have been hired by James as his bookkeeper. After talking to James, you prepare his chart of accounts, which is below Regal Law Firm Chart of Accounts Account # 101 102 103 201 202 301 302 401 501 502 503 Account Name Cash Accounts Receivable Supplies Accounts Payable Uneamed Revenue Regal, Capital Regal, Drawing Fee Income Rent Expense Salaries Expense Supplies Expenss The first month of business for the Regal Law Firm is March 2018. The transactions for the month of March are Date 3/1/2018 3/5/2018 3/10/2018 3/15/2018 3/22/2018 3/30/2018 ransaction James opened the bank account and deposited $5,000 for his capital contribution James paid $250 for rent. James received $1,000 from a new client, Sue Barnes, as a deposit for legal services James paid $375 of salaries to his legal assistant. James received a bill of $75 for office supplies which will be paid next month James withdraw $1,000 for his personal use Instructions: 1. Using the chart of accounts, open the accounts in the general ledger 2. Record the journal entries for the March transactions 3. Post the entries to the general ledger 4. Calculate the balances in the general ledger accounts 5. Prepare the Trial Balance Columns in the worksheet. Make sure you properly complete the heading 6. Prepare the following adjustments in the worksheet a. During March, James performed services for clients which were not billed for $1,750 b. During March, James performed services for Sue Barnes for $750 c. At the end of the month $25 in office supplies were remaining 7. Prepare the Adjusted Trial Balance Columns in the worksheet. 8. Prepare the adjusting journal entries on GJ Page 2 for the adjustments prepared in #6 above and post them to the General Ledger and calculate the account balances 9. Prepare the Income Statement and Balance Sheet Columns in the worksheet 10. Prepare the Income Statement, Statement of Owner's Equity and Balance Sheet. Make sure you properly complete the heading for each statement. 11. Prepare the Closing Entries on GJ Page 3. Using T-Accounts, calculate the balance in the Income Summary and Capital Accounts. Post the Closing Entries to the General Ledger (use Account #600 for Income Summary) and calculate the account balances Prepare a post-closing trial balance