Answered step by step

Verified Expert Solution

Question

1 Approved Answer

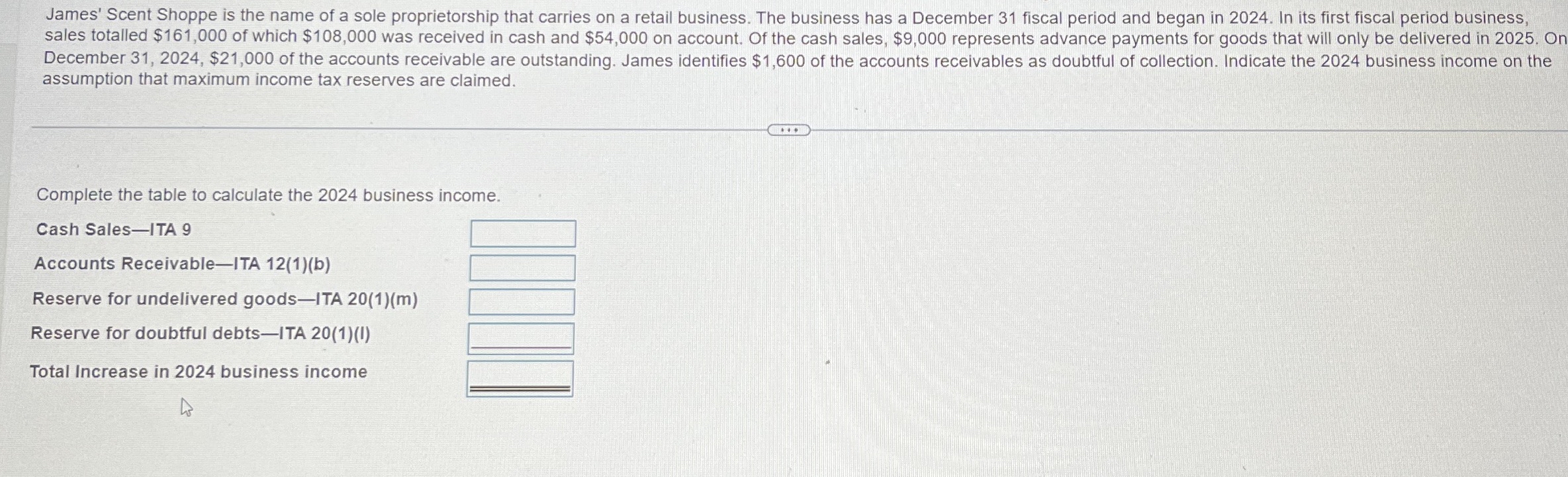

James' Scent Shoppe is the name of a sole proprietorship that carries on a retail business. The business has a December 3 1 fiscal period

James' Scent Shoppe is the name of a sole proprietorship that carries on a retail business. The business has a December fiscal period and began in In its first fiscal period business, sales totalled $ of which $ was received in cash and $ on account. Of the cash sales, $ represents advance payments for goods that will only be delivered in On December $ of the accounts receivable are outstanding. James identifies $ of the accounts receivables as doubtful of collection. Indicate the business income on the assumption that maximum income tax reserves are claimed.

Complete the table to calculate the business income.

Cash SalesITA

Accounts ReceivableITA b

Reserve for undelivered goodsITA m

Reserve for doubtful debtsITA I

Total Increase in business income

James' Scent Shoppe is the name of a sole proprietorship that carries on a retail business. The business has a December fiscal period and began in In its first fiscal period business, sales totalled $ of which $ was received in cash and $ on account. Of the cash sales, $ represents advance payments for goods that will only be delivered in On December $ of the accounts receivable are outstanding. James identifies $ of the accounts receivables as doubtful of collection. Indicate the business income on the assumption that maximum income tax reserves are claimed.

Complete the table to calculate the business income.

Cash SalesITA

Accounts ReceivableITA b

Reserve for undelivered goodsITA m

Reserve for doubtful debtsITA I

Total Increase in business income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started