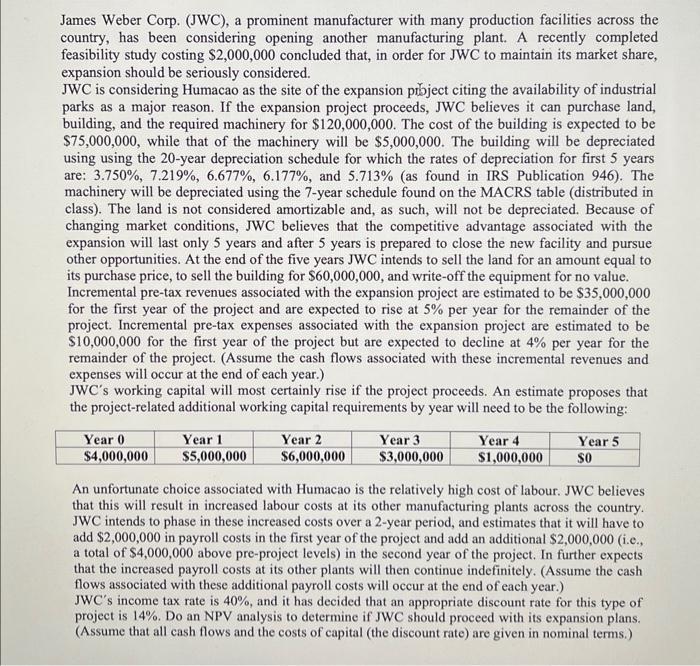

James Weber Corp. (JWC), a prominent manufacturer with many production facilities across the country, has been considering opening another manufacturing plant. A recently completed feasibility study costing $2,000,000 concluded that, in order for JWC to maintain its market share, expansion should be seriously considered. JWC is considering Humacao as the site of the expansion project citing the availability of industrial parks as a major reason. If the expansion project proceeds, JWC believes it can purchase land, building, and the required machinery for $120,000,000. The cost of the building is expected to be $75,000,000, while that of the machinery will be $5,000,000. The building will be depreciated using using the 20 -year depreciation schedule for which the rates of depreciation for first 5 years are: 3.750%,7.219%,6.677%,6.177%, and 5.713% (as found in IRS Publication 946). The machinery will be depreciated using the 7-year schedule found on the MACRS table (distributed in class). The land is not considered amortizable and, as such, will not be depreciated. Because of changing market conditions, JWC believes that the competitive advantage associated with the expansion will last only 5 years and after 5 years is prepared to close the new facility and pursue other opportunities. At the end of the five years JWC intends to sell the land for an amount equal to its purchase price, to sell the building for $60,000,000, and write-off the equipment for no value. Incremental pre-tax revenues associated with the expansion project are estimated to be $35,000,000 for the first year of the project and are expected to rise at 5% per year for the remainder of the project. Incremental pre-tax expenses associated with the expansion project are estimated to be $10,000,000 for the first year of the project but are expected to decline at 4% per year for the remainder of the project. (Assume the cash flows associated with these incremental revenues and expenses will occur at the end of each year.) JWC's working capital will most certainly rise if the project proceeds. An estimate proposes that the project-related additional working capital requirements by year will need to be the following: An unfortunate choice associated with Humacao is the relatively high cost of labour. JWC believes that this will result in increased labour costs at its other manufacturing plants across the country. JWC intends to phase in these increased costs over a 2-year period, and estimates that it will have to add $2,000,000 in payroll costs in the first year of the project and add an additional $2,000,000 (i.e., a total of $4,000,000 above pre-project levels) in the second year of the project. In further expects that the increased payroll costs at its other plants will then continue indefinitely. (Assume the cash flows associated with these additional payroll costs will occur at the end of each year.) JWC's income tax rate is 40%, and it has decided that an appropriate discount rate for this type of project is 14%. Do an NPV analysis to determine if JWC should proceed with its expansion plans. (Assume that all cash flows and the costs of capital (the discount rate) are given in nominal terms.) a) What is the impact on the NPV of the project of the $2,000,000 feasibility study? (1 mark) b) What is the impact on the NPV of the project of the investment in (i) land, (ii) building and (iii) new equipment? (Ignore the effect of any possible tax shields and salvage) (1 mark) c) What is the impact on the NPV of the project of the net working capital requirements associated with the project? ( 2 marks) d) What is the impact on the NPV of the project of the tax shields associated with the use of the assets in the project? ( 2 marks) e) What is the impact on the NPV of the project of the salvgge of the assets at the end of year five? (Ignore the effect of any lost tax shields.) (2 marks) f) What is the impact on the NPV of the project of the incremental revenues associated with the project? ( 2 marks) g) What is the impact on the NPV of the project of the incremental expenses associated with the project (excluding the increased payroll costs at JWC's other plants)? (2 marks) h) What is the impact on the NPV of the project of the increased payroll costs at JWC's other plants? ( 2 marks) i) What is the NPV of the project \& what is your recommendation? (1 mark) James Weber Corp. (JWC), a prominent manufacturer with many production facilities across the country, has been considering opening another manufacturing plant. A recently completed feasibility study costing $2,000,000 concluded that, in order for JWC to maintain its market share, expansion should be seriously considered. JWC is considering Humacao as the site of the expansion project citing the availability of industrial parks as a major reason. If the expansion project proceeds, JWC believes it can purchase land, building, and the required machinery for $120,000,000. The cost of the building is expected to be $75,000,000, while that of the machinery will be $5,000,000. The building will be depreciated using using the 20 -year depreciation schedule for which the rates of depreciation for first 5 years are: 3.750%,7.219%,6.677%,6.177%, and 5.713% (as found in IRS Publication 946). The machinery will be depreciated using the 7-year schedule found on the MACRS table (distributed in class). The land is not considered amortizable and, as such, will not be depreciated. Because of changing market conditions, JWC believes that the competitive advantage associated with the expansion will last only 5 years and after 5 years is prepared to close the new facility and pursue other opportunities. At the end of the five years JWC intends to sell the land for an amount equal to its purchase price, to sell the building for $60,000,000, and write-off the equipment for no value. Incremental pre-tax revenues associated with the expansion project are estimated to be $35,000,000 for the first year of the project and are expected to rise at 5% per year for the remainder of the project. Incremental pre-tax expenses associated with the expansion project are estimated to be $10,000,000 for the first year of the project but are expected to decline at 4% per year for the remainder of the project. (Assume the cash flows associated with these incremental revenues and expenses will occur at the end of each year.) JWC's working capital will most certainly rise if the project proceeds. An estimate proposes that the project-related additional working capital requirements by year will need to be the following: An unfortunate choice associated with Humacao is the relatively high cost of labour. JWC believes that this will result in increased labour costs at its other manufacturing plants across the country. JWC intends to phase in these increased costs over a 2-year period, and estimates that it will have to add $2,000,000 in payroll costs in the first year of the project and add an additional $2,000,000 (i.e., a total of $4,000,000 above pre-project levels) in the second year of the project. In further expects that the increased payroll costs at its other plants will then continue indefinitely. (Assume the cash flows associated with these additional payroll costs will occur at the end of each year.) JWC's income tax rate is 40%, and it has decided that an appropriate discount rate for this type of project is 14%. Do an NPV analysis to determine if JWC should proceed with its expansion plans. (Assume that all cash flows and the costs of capital (the discount rate) are given in nominal terms.) a) What is the impact on the NPV of the project of the $2,000,000 feasibility study? (1 mark) b) What is the impact on the NPV of the project of the investment in (i) land, (ii) building and (iii) new equipment? (Ignore the effect of any possible tax shields and salvage) (1 mark) c) What is the impact on the NPV of the project of the net working capital requirements associated with the project? ( 2 marks) d) What is the impact on the NPV of the project of the tax shields associated with the use of the assets in the project? ( 2 marks) e) What is the impact on the NPV of the project of the salvgge of the assets at the end of year five? (Ignore the effect of any lost tax shields.) (2 marks) f) What is the impact on the NPV of the project of the incremental revenues associated with the project? ( 2 marks) g) What is the impact on the NPV of the project of the incremental expenses associated with the project (excluding the increased payroll costs at JWC's other plants)? (2 marks) h) What is the impact on the NPV of the project of the increased payroll costs at JWC's other plants? ( 2 marks) i) What is the NPV of the project \& what is your recommendation? (1 mark)