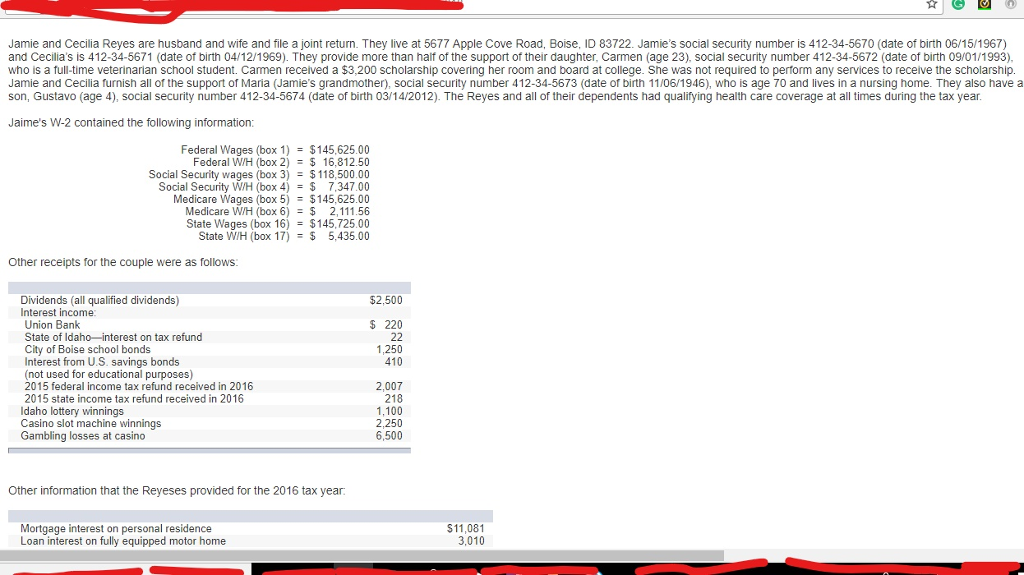

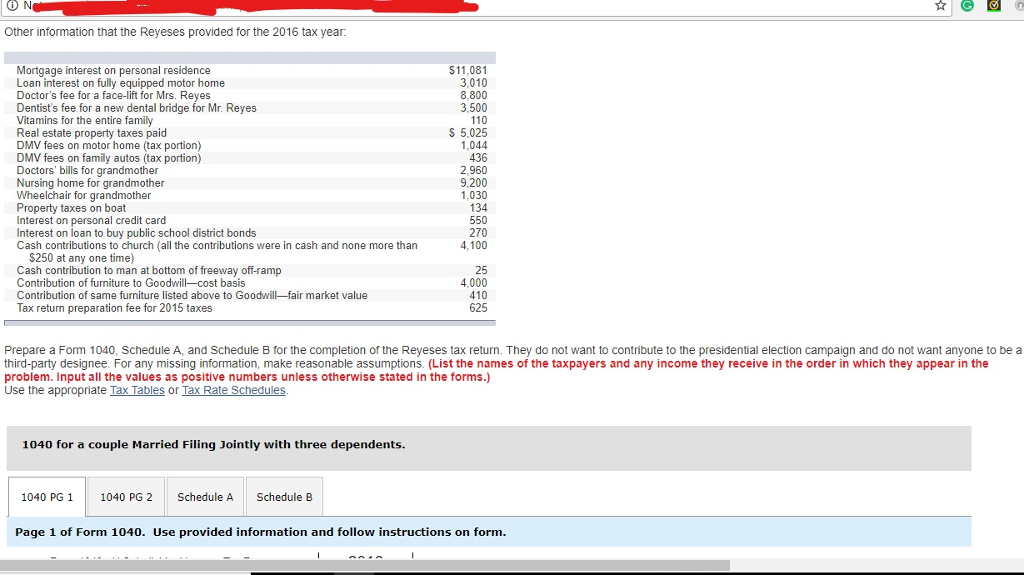

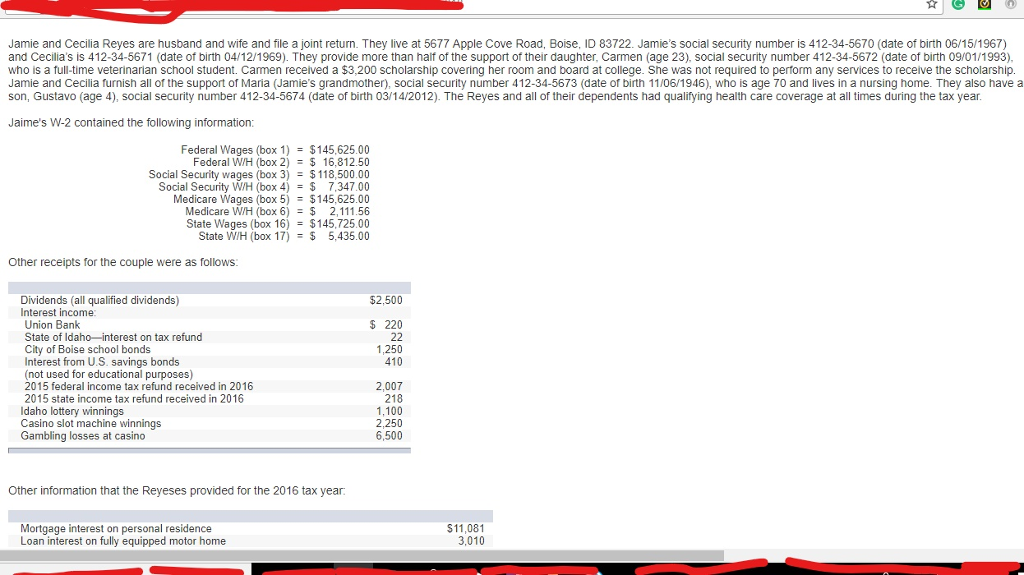

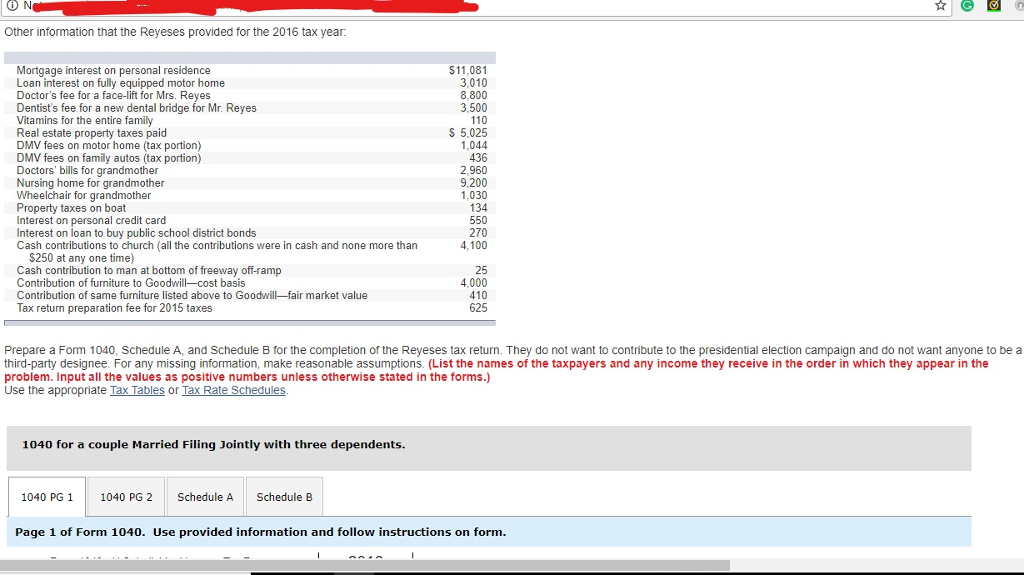

Jamie and Cecilia Reyes are husband and wife and file a joint return. They live at 5677 Apple Cove Road, Boise, ID 83722. Jamie's social security number is 412-34-5670 (date of birth 06/15/1967) and Cecilia's is 412-34-5671 (date of birth 04/12/1969). They provide more than half of the support of their daughter, Carmen (age 23), social security number 412-34-5672 (date of birth 09/01/1993), who is a full-time veterinarian school student. Carmen received a $3,200 scholarship covering her room and board at college. She was not required to perform any services to receive the scholarship Jamie and Cecilia furnish all of the support of Maria (Jamie's grandmother), social security number 412-34-5673 (date of birth 11/06/1946), who is age 70 and lives in a nursing home. They also have a son, Gustavo (age 4), social security number 412-34-5674 (date of birth 03/14/2012). The Reyes and all of their dependents had qualifying health care coverage at all times during the tax year. Jaime's W-2 contained the following information Federal Wages (box 1) = $145,625.00 Federal W/H (box 2)16,812.50 Social Security wages (box 3)$118,500.00 Social Security W/H (box 4) $ 7,347.00 Medicare Wages (box 5)$145,625.00 Medicare W/H (box 6)= $ 2,111.56 State Wages (box 16) $145,725.00 State WH (box 17) 5,435.00 Other receipts for the couple were as follows Dividends (all qualified dividends) Interest income: Union Bank State of Idaho-interest on tax refund City of Boise school bonds Interest from U.S. savings bonds (not used for educational purposes) 2015 federal income tax refund received in 2016 2015 state income tax refund received in 2016 Idaho lottery winnings Casino slot machine winnings Gambling losses at casino $2,500 $ 220 1,250 410 2,007 218 1,100 2,250 6,500 Other information that the Reyeses provided for the 2016 tax year Mortgage interest on personal residence Loan interest on fully equipped motor home $11,081 3,010 Jamie and Cecilia Reyes are husband and wife and file a joint return. They live at 5677 Apple Cove Road, Boise, ID 83722. Jamie's social security number is 412-34-5670 (date of birth 06/15/1967) and Cecilia's is 412-34-5671 (date of birth 04/12/1969). They provide more than half of the support of their daughter, Carmen (age 23), social security number 412-34-5672 (date of birth 09/01/1993), who is a full-time veterinarian school student. Carmen received a $3,200 scholarship covering her room and board at college. She was not required to perform any services to receive the scholarship Jamie and Cecilia furnish all of the support of Maria (Jamie's grandmother), social security number 412-34-5673 (date of birth 11/06/1946), who is age 70 and lives in a nursing home. They also have a son, Gustavo (age 4), social security number 412-34-5674 (date of birth 03/14/2012). The Reyes and all of their dependents had qualifying health care coverage at all times during the tax year. Jaime's W-2 contained the following information Federal Wages (box 1) = $145,625.00 Federal W/H (box 2)16,812.50 Social Security wages (box 3)$118,500.00 Social Security W/H (box 4) $ 7,347.00 Medicare Wages (box 5)$145,625.00 Medicare W/H (box 6)= $ 2,111.56 State Wages (box 16) $145,725.00 State WH (box 17) 5,435.00 Other receipts for the couple were as follows Dividends (all qualified dividends) Interest income: Union Bank State of Idaho-interest on tax refund City of Boise school bonds Interest from U.S. savings bonds (not used for educational purposes) 2015 federal income tax refund received in 2016 2015 state income tax refund received in 2016 Idaho lottery winnings Casino slot machine winnings Gambling losses at casino $2,500 $ 220 1,250 410 2,007 218 1,100 2,250 6,500 Other information that the Reyeses provided for the 2016 tax year Mortgage interest on personal residence Loan interest on fully equipped motor home $11,081 3,010