Question

Jamie Lee and Ross are in their late fifties and enjoying planning for their next phase in life: retirement! The triplets are finishing their college

Jamie Lee and Ross are in their late fifties and enjoying planning for their next phase in life: retirement! The triplets are finishing their college educations and will be starting careers of their own in no time at all. As they prepare their children for the next chapter in their lives, Jamie Lee and Ross emphasize the importance of preparing for the future and drawing on their own experiences when offering advice to the three. They have always been candid with their children and have included them in most of their financial decisions over the years, hoping that their focus on saving for the future will also become a way of life for their children.

Jamie Lee and Ross have also included their children in their estate planning, realizing that they are an important part of the entire asset management process. Preparation is key, they all understand, as you never can predict what lies in the future.

Lately, Jamie Lee and Ross have been hearing many stories about acquaintances who have passed away without leaving a will or a plan for their estate, which made Jamie Lee and Ross anxious to review their own estate plan with an attorney. They do not want to think about eventually passing on, but they know it is an essential, as well as an inevitable, part to careful financial planning.

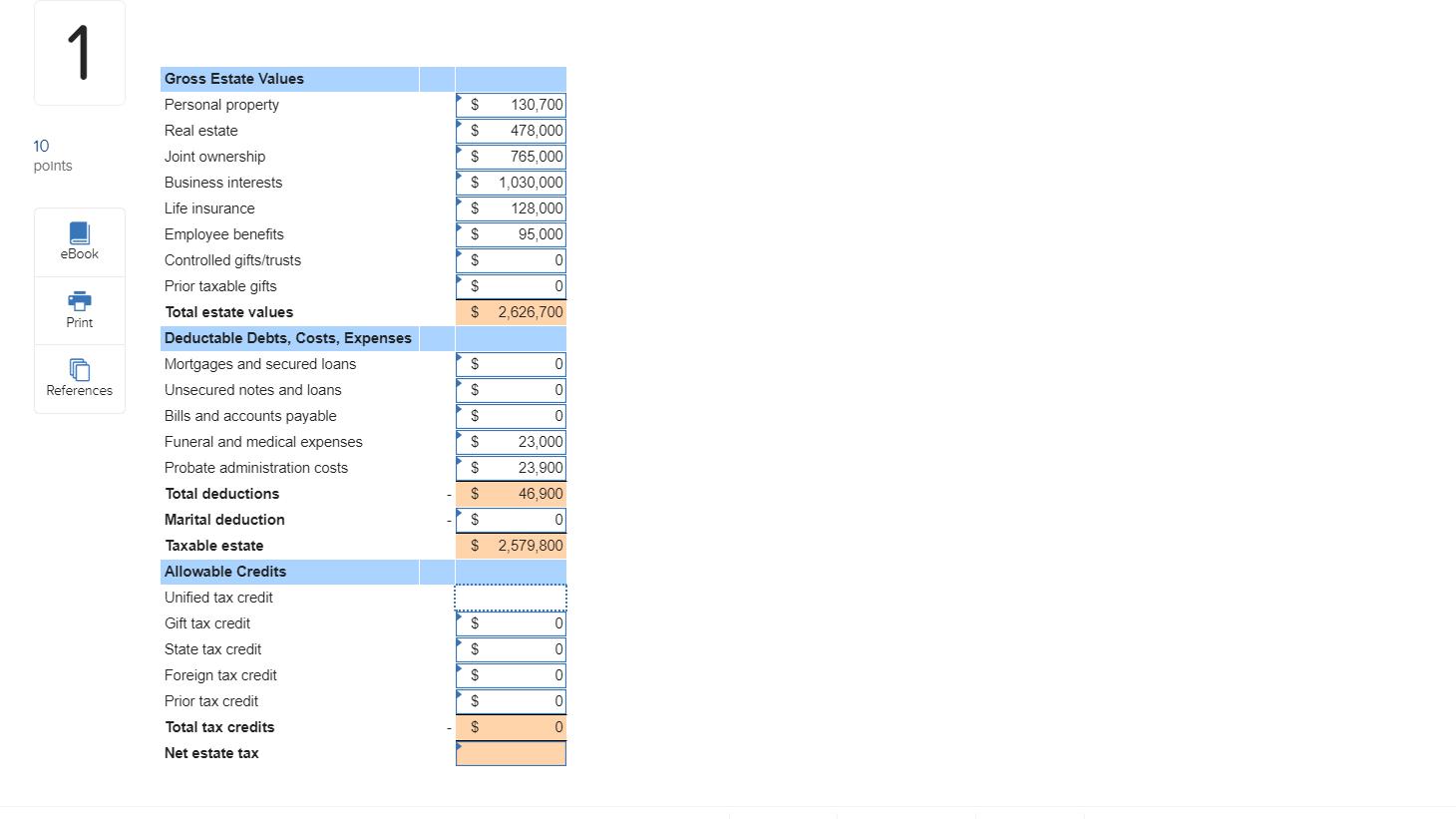

As part of their estate planning, Jamie Lee and Ross need to calculate a scenario to determine the amount of tax, if any, that will be imposed on the estate when it is passed to their three children. In the scenario, they assume their mortgage is paid in full and one spouse has died with the surviving spouse receiving all of the assets under the unlimited marital deduction. They estimate that funeral and medical expenses for the surviving spouse will be $23,000. The real estate they own will have to be re-titled to the children and will need to go through probate at a cost of 5% of its value. Jamie Lee and Ross have not made any taxable gifts in their lifetimes.

Assume the estate can utilize the unified tax credit for both spouses using 2017 amount ($5.49 million per individual). Use the information below to calculate their net estate tax. Each answer must have a value for the assignment to be complete. Enter "0" for any unused categories.

Current Financial Situation

| Assets: | |

| Checking account | $5,200 |

| Savings account | $52,000 |

| Emergency fund savings account | $42,000 |

| Cupcake Cafe | $1,030,000 |

| House | $478,000 |

| IRA balance | $95,000 |

| Life insurance cash value | $128,000 |

| Investments (stocks, bonds - joint ownership) | $765,000 |

| Car (Jamie Lee) | $14,000 |

| Car (Ross) | $17,500 |

| Liabilities: | |

| Mortgage balance | $0 |

| Credit card balance | $0 |

| Car loans | $0 |

I just need the answer to the unified tax credit and the net estate tax. All other boxes are correct. Please leave how you did it.

1 10 points eBook Print References Gross Estate Values Personal property Real estate Joint ownership Business interests Life insurance Employee benefits Controlled gifts/trusts Prior taxable gifts Total estate values Deductable Debts, Costs, Expenses Mortgages and secured loans Unsecured notes and loans Bills and accounts payable Funeral and medical expenses Probate administration costs Total deductions Marital deduction Taxable estate Allowable Credits Unified tax credit Gift tax credit State tax credit Foreign tax credit Prior tax credit Total tax credits Net estate tax $ $ S $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ 130,700 478,000 765,000 1,030,000 128,000 95,000 $ $ 0 0 2,626,700 0 0 0 $ 2,579,800 23,000 23,900 46,900 0 0 0 0 0 0

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net estate tax and the unified tax credit we need to determine the total value of J...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started