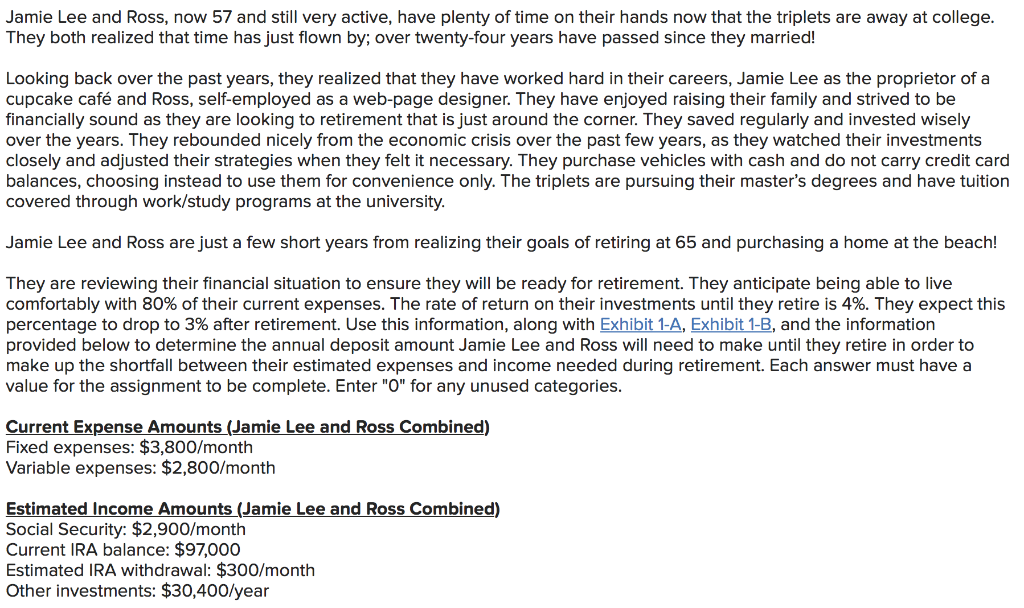

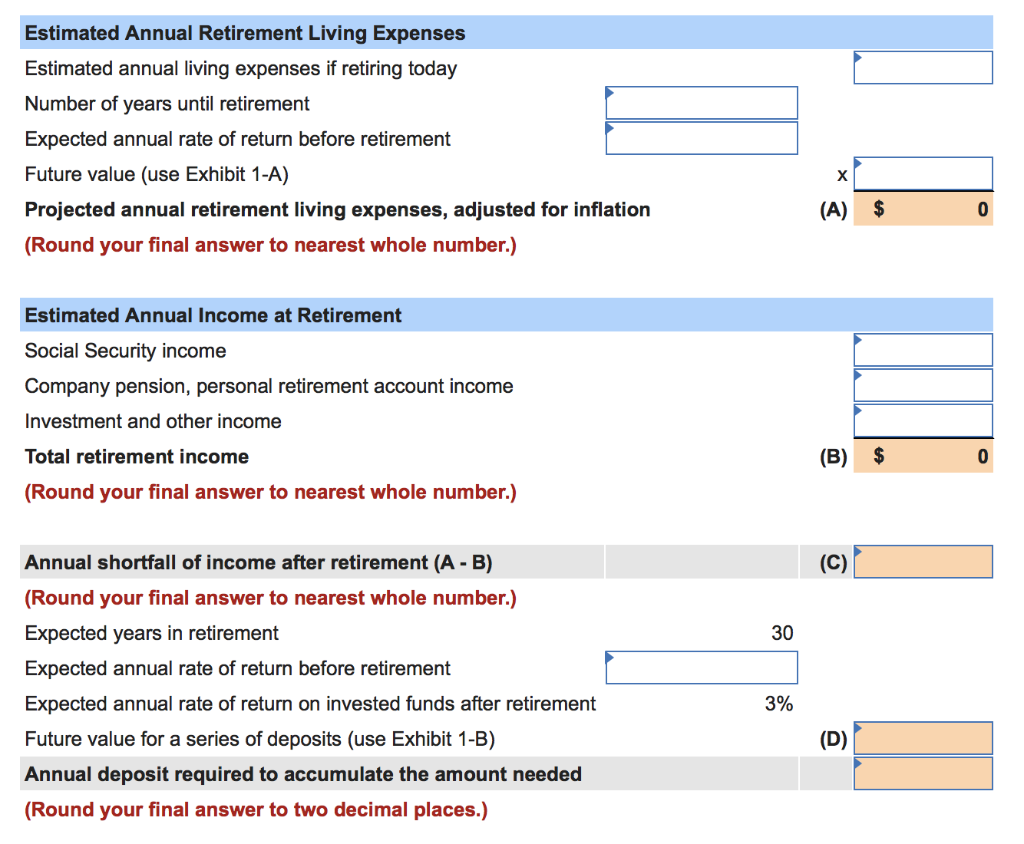

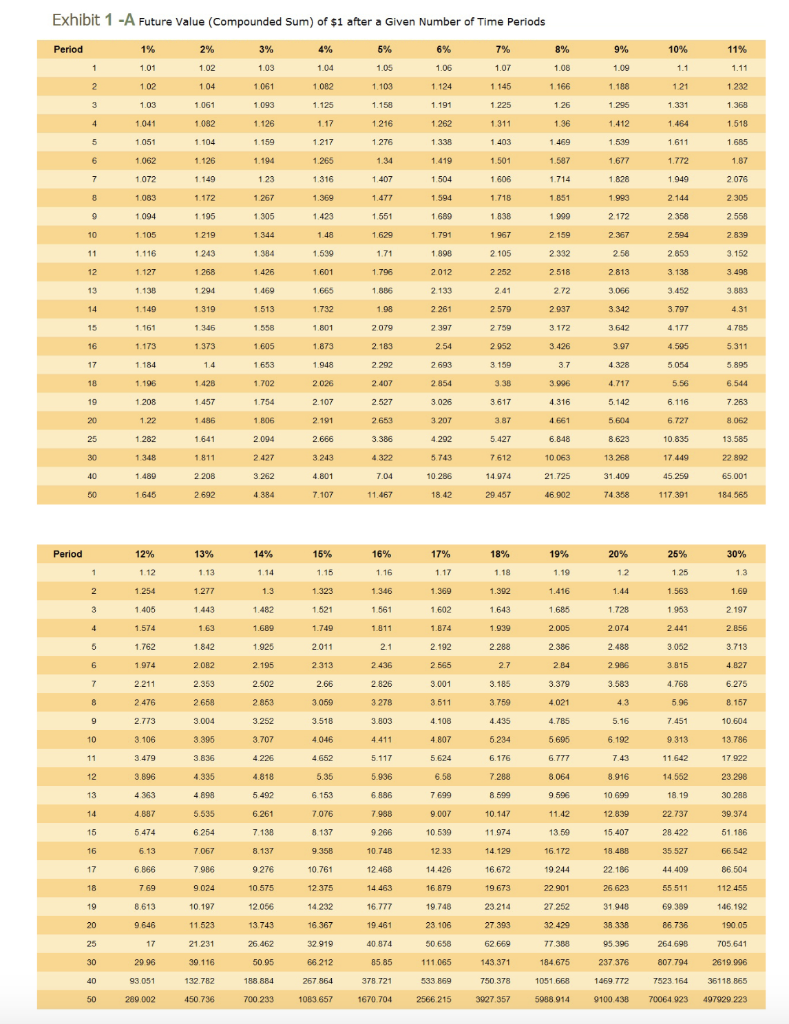

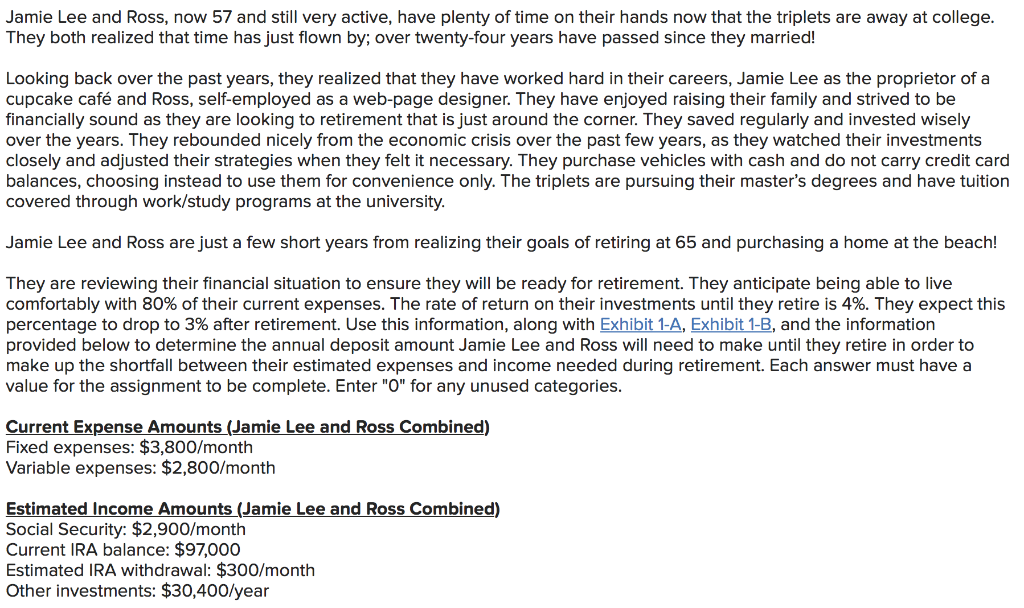

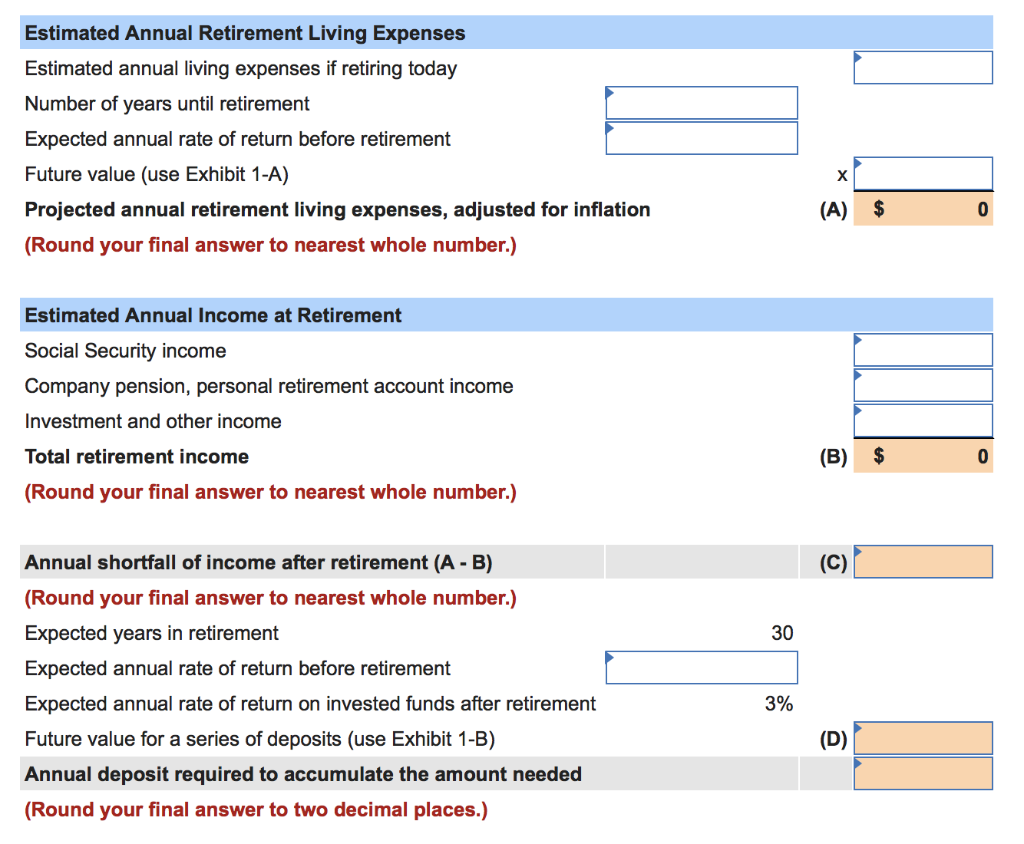

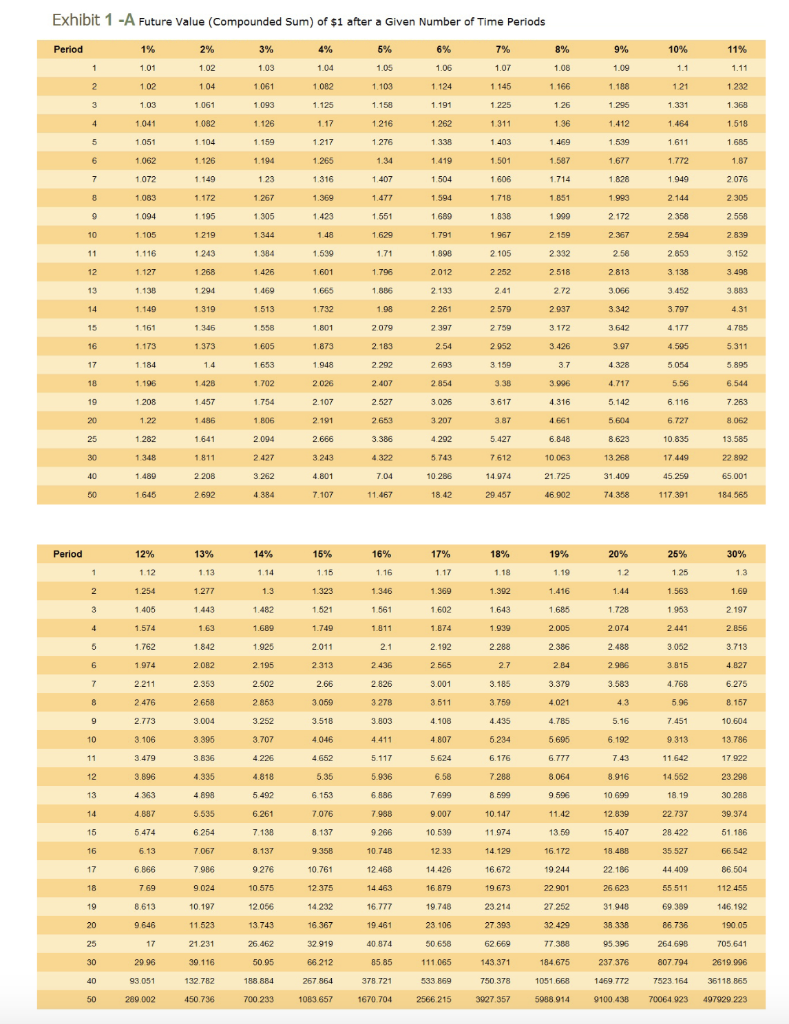

Jamie Lee and Ross, now 57 and still very active, have plenty of time on their hands now that the triplets are away at college. They both realized that time has just flown by; over twenty-four years have passed since they married! Looking back over the past years, they realized that they have worked hard in their careers, Jamie Lee as the proprietor of a cupcake caf and Ross, self-employed as a web-page designer. They have enjoyed raising their family and strived to be financially sound as they are looking to retirement that is just around the corner. They saved regularly and invested wisely over the years. They rebounded nicely from the economic crisis over the past few years, as they watched their investments closely and adjusted their strategies when they felt it necessary. They purchase vehicles with cash and do not carry credit card balances, choosing instead to use them for convenience only. The triplets are pursuing their master's degrees and have tuition covered through work/study programs at the university. Jamie Lee and Ross are just a few short years from realizing their goals of retiring at 65 and purchasing a home at the beach! They are reviewing their financial situation to ensure they will be ready for retirement. They anticipate being able to live comfortably with 80% of their current expenses. The rate of return on their investments until they retire is 4%. They expect this percentage to drop to 3% after retirement. Use this information, along with Exhibit 1-A, Exhibit 1-B, and the information provided below to determine the annual deposit amount Jamie Lee and Ross will need to make until they retire in order to make up the shortfall between their estimated expenses and income needed during retirement. Each answer must have a value for the assignment to be complete. Enter "O" for any unused categories. Current Expense Amounts (Jamie Lee and Ross Combined) Fixed expenses: $3,800/month Variable expenses: $2,800/month Estimated Income Amounts (Jamie Lee and Ross Combined) Social Security: $2,900/month Current IRA balance: $97,000 Estimated IRA withdrawal: $300/month Other investments: $30,400/year Estimated Annual Retirement Living Expenses Estimated annual living expenses if retiring today Number of years until retirement Expected annual rate of return before retirement Future value (use Exhibit 1-A) Projected annual retirement living expenses, adjusted for inflation (Round your final answer to nearest whole number.) (A) $ 0 Estimated Annual Income at Retirement Social Security income Company pension, personal retirement account income Investment and other income Total retirement income (Round your final answer to nearest whole number.) (B) $ 0 Annual shortfall of income after retirement (A - B) (Round your final answer to nearest whole number.) Expected years in retirement Expected annual rate of return before retirement Expected annual rate of return on invested funds after retirement Future value for a series of deposits (use Exhibit 1-B) Annual deposit required to accumulate the amount needed (Round your final answer to two decimal places.) 3% Exhibit 1 -A Future Value (Compounded Sum) of $1 after a Given Number of Time Periods 1% 5% 6% 7% 9% 10% 11% Period 1 8% 1.08 1 1.04 1 .06 1.07 1.09 1 1. 1 .11 .01 102 2% 102 104 1.061 3% 103 1061 1.093 1. 05 1.103 2 1082 1124 1 145 1.166 1211232 1.331 1.368 1.03 1.158 1.191 1.26 1.188 1295 1.412 1.125 1.17 1.126 1.518 1,082 1.104 1.126 1.225 1 311 1.403 1.501 1.216 1 276 1.34 1 262 1.338 1.419 1.159 1.194 1.217 1.265 1539 1.36 1 469 1.587 1 685 1.464 1611 1.772 1.677 1.87 1 149 123 1 316 1.407 1 504 1.606 1714 1949 2 076 1.041 5 1.051 6 1.062 7 1072 8 1.083 1.094 10 1.105 11 1.116 121.127 1.172 1369 1.477 1.594 1.718 1 851 1.828 1.993 2.172 1.267 1 305 2.305 2.144 2.358 1.195 1.423 1551 1838 1999 2.558 1.689 1.791 1219 1.629 2.594 2.839 1.48 1.539 2.367 258 1898 3.152 1 243 1 268 1.344 1384 1426 1.469 1.71 1.796 1.967 2.105 2 252 2.41 1 601 2.159 2 332 2518 2.72 2937 2.813 2012 2.133 2853 3.138 3.452 3 498 131 .138 1 294 1.665 1.886 3,066 3.883 1.149 1.513 2579 3.342 4 31 1 319 1345 1.732 1801 1.98 2.079 2 261 2397 2.759 3.642 4.785 1.161 1.173 1184 1.196 1.208 1558 1.605 1.653 3.97 1.373 14 5.311 3.172 3426 3.7 2.54 2.693 2 952 3159 3.38 3.797 4.177 4.595 5054 5.56 1.873 1948 2.026 2.107 4.328 2.183 2 292 2.407 2.527 5.895 4.717 6.544 1.428 1.457 1.702 1.754 2.854 3.026 3.996 4.316 3.617 5.142 6.116 7 263 1.22 1 486 1.806 2.191 2653 3.87 4661 6.727 8.062 3207 4292 5.604 8.623 6.848 1.282 1348 1.489 1.645 1.641 1 811 2 208 2 692 2.094 2427 3.262 4.384 2.666 3243 4.801 7.107 3.386 4322 .04 11.467 5.427 7612 14.974 29.457 5743 10.285 18.42 10.063 21.725 46.902 7 10.836 17.449 45.259 117.391 13 268 3 1.409 7 4.368 13.585 22.892 65.001 184.565 50 Period 20% 30% 12% 112 1.254 13% 113 1277 14% 114 1 2 17% 117 1.369 12 18% 118 1.392 13 15% 1.15 1323 1.521 1.749 19% 119 1.416 1.685 1.3 1.69 1.44 1.728 25% 125 1.563 1.963 2441 3.052 3 1.405 1.443 1482 1.602 1.643 2.197 1.63 1.689 1.874 1.939 2.005 2.074 2.856 16% 116 1.346 1.561 1811 2.1 2 436 2.826 3 278 3.803 1.925 2011 2.192 2.288 2.386 2.488 4 5 6 7 8 3.713 2.195 2565 2.7 2 34 2.986 1.574 1.762 1.974 2.211 2.476 .773 4.827 1.842 2002 2.353 2658 3.004 3.379 3.583 2.502 2863 3.252 6.275 2 313 2.66 3069 3.518 3.001 3.511 4.108 3.815 4.768 5.96 3.185 3.759 4.435 4021 8.157 9 2 4.785 5.16 7.451 10.604 103 .106 3.395 3.707 4.046 4.411 5.234 6.1929 13.786 5.695 6.777 .313 11 642 3.836 4.807 5624 6.58 4.226 6.176 5.117 5.936 7.43 17 922 3 298 4.335 4.818 7.288 8.064 8.916 14.562 2 113.479 123.896 13 4363 144.887 4898 5.535 6 254 5.492 6.261 7.138 4.652 5.35 6153 7.076 8137 6 886 7.988 7699 9.007 10 539 8599 10.147 11.974 9.596 11.42 1350 10.699 12.839 15.407 18.19 2 2.737 2 8 422 3 0 288 39.374 51 186 15 5.474 9266 16 6.13 7.067 8.137 9358 12 33 14.129 18.488 35 527 66 542 10.748 12.468 1 17 6.866 7986 9.276 10.761 14.426 14426 16 672 44.409 6 6.504 7.69 9.024 12375 14.463 16.879 19.673 55 511 112.455 16.172 19.244 22.901 27.252 32 429 77.388 8.613 14.232 16367 32 919 10.575 12.056 13.743 26.462 5095 188.884 7 00 233 16.777 19.461 40.874 19.748 23.106 5 0.658 23 214 27393 62 669 22.186 25.623 31.948 38 338 95.396 69.389 86.736 264.698 146.192 190.05 705.641 25 30 40 50 9.646 17 2996 93.051 289.002 10.197 11.523 2 1231 39.116 1 32.782 450.736 66 212 267 864 1083 657 85.85 378.721 1670 704 1 11065 5 33.869 2566 215 143.371 750 378 3927.357 184.675 1051.668 5088 914 237376 1469.772 9100 438 807 794 2619 996 7523.164 36118.865 70064 923497929 223 Exhibit 1-B Future Value (Compounded Sum) of $1 Paid In at the End of Each Period for a Given Number of Time Periods (an Annuity) Period 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 1% 1 1 1 2.02 3.06 2.05 2.08 2.09 S 2.1 2.01 3.03 2.11 2.03 3.091 204 3.122 2.06 3.184 2.07 3215 3.163 3.246 3.278 3.31 3.342 4.31 4.573 4.71 4.05 5.101 4.122 5 204 6.306 4.184 5309 6.468 4.246 5.416 6.633 5 526 4.375 5.637 6.975 5751 4.506 5867 7.336 5985 6228 4.641 6.105 7.716 9.487 6.152 6.802 7.153 7.913 7.523 92 7.214 7.434 7 662 7 898 8.142 8394 8 654 8.923 9.783 8.286 8.892 9.214 9.549 9.397 1026 10.637 11.436 11.859 8.583 9.756 9.369 10.159 11.027 11.491 11978 12.488 13.579 14.164 10.583 12.006 10462 10.95 11 464 12 578 13 181 13 816 14 497 15.937 16.722 11 12.169 14207 11,567 12.683 13.412 11.029 13.021 15 193 17.56 20.141 22953 26.019 29.361 15 917 13 13.486 15 026 16.627 18.292 20.024 13.809 19.561 22 713 26 212 30 095 14.68 17.713 18.531 21.384 24.523 27.975 31.772 14947 15.974 19.599 16.645 18.977 21.495 24 215 27.152 30 324 33.75 17.293 21.579 34.405 15 16 12.808 14. 192 15.618 17.086 18.500 20.157 21.762 23.414 25.117 26.87 14.972 1687 18.882 21.016 23.276 25 673 28.213 30.906 33.76 36.786 15.784 17.888 20.141 22.55 25.129 27.888 30.84 33 999 37 379 40.995 39. 19 44.501 16.007 17 258 16.43 19.615 20.811 22.019 28.243 34.785 48.885 64.463 18.639 20.012 21.412 22.841 24.297 21.825 23.696 25 645 27.671 29.778 23 657 25.84 28.132 30.539 3745 41.446 33 003 36.974 41 301 46.018 51.16 50.396 35 95 40.545 45599 51.159 57.275 56 039 33.066 45.762 6 4.203 32.03 36.459 41.646 47.727 54.355 63 249 73.106 84 701 98.347 114 413 20 25 30 40 50 40.568 6 0.402 84.579 47.575 75.401 112.797 5 6.085 95.026 152.667 66.439 1208 209.348 7 9.056 154.762 290.336 94.461 1 99 635 406.529 113.283 259.057 5 73.77 136 308 337882 815.084 164.494 442.593 1163.909 199 021 581.825 1668.771 Period 12% 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 2 2 .12 2.18 2. 19 2 2 225 2.3 2.13 3.407 2.14 3.44 2.15 3.473 3.374 3.506 3.539 3.64 3.813 399 4.779 4.85 4.921 4.993 5.066 5.141 5368 5.766 6.187 6.363 6 877 7442 9 043 8.207 11.259 6.48 8.323 10.405 12.757 15.416 6.61 8.536 10.73 13 233 16.085 8.977 11.414 8.115 10.089 123 1 4.776 7,014 9.207 11.772 14.773 18.285 9.93 12 916 15.073 12.756 17 583 23 858 14.24 3.572 3.606 5.215 5.291 7.154 7 297 9.442 9.683 12142 12.523 15327 15.902 19.086 19.923 23.521 24.709 28.755 30.404 34.931 37.18 42 219 45.244 16.490 20.799 19.842 25.802 9 17.519 32 015 10 18.42 21.321 25 959 33.253 42.619 19.337 23.045 6.742 8.754 11.067 13.727 16.786 20.304 24 349 29.002 34 352 40 505 47.58 55.717 22.398 272 25.733 32.15 42.566 66.405 12 27 271 30.85 32.824 39.581 54.208 17.549 20.665 24.133 28.029 32 393 37.28 42 753 74.327 21.814 25.65 29.985 34883 40.417 36.786 68.78 32.089 37581 43.842 43 672 54 841 39,404 47.103 56.11 66.649 66 649 48 497 59 196 0 105 72.035 8 6.949 109.687 97 625 127 913 167.286 60.965 66.261 51.66 60 925 C 925 16 46.672 50 98 7 2939 79 35 87.442 138.109 218 472 17 48.884 53.739 65.075 71.673 78.979 8 7.068 96.022 105.931 173.636 285.014 59.118 68394 55.75 61.725 75.836 84 141 103.74 115.266 218.045 273.556 371.518 483 973 19 70.749 08.603 80 947 342 945 630 165 25 30 40 50 6 3.44 72.052 133.334 241 333 767.091 2400.018 155.62 293 199 1013.704 3459.507 78.969 91.025 181.871 356 787 1342.025 4994 521 88 212 102.444 212.793 434.746 1779.09 7217.716 115.38 249.214 530 312 2 360.757 10435 649 93.406 110.285 130 033 292.105 647.439 3 134.522 15089.502 123 414 146 628 342.603 7 90 948 4 163213 2 1813.094 138.166 165.418 4 02.042 966 712 5 529.629 31515,336 128 117 154.74 186688 471.981 1181 882 7343.858 45497191 1054.791 3227 174 30088.655 280255 693 2 348.003 8729 985 120392 883 1659760 743 Jamie Lee and Ross, now 57 and still very active, have plenty of time on their hands now that the triplets are away at college. They both realized that time has just flown by; over twenty-four years have passed since they married! Looking back over the past years, they realized that they have worked hard in their careers, Jamie Lee as the proprietor of a cupcake caf and Ross, self-employed as a web-page designer. They have enjoyed raising their family and strived to be financially sound as they are looking to retirement that is just around the corner. They saved regularly and invested wisely over the years. They rebounded nicely from the economic crisis over the past few years, as they watched their investments closely and adjusted their strategies when they felt it necessary. They purchase vehicles with cash and do not carry credit card balances, choosing instead to use them for convenience only. The triplets are pursuing their master's degrees and have tuition covered through work/study programs at the university. Jamie Lee and Ross are just a few short years from realizing their goals of retiring at 65 and purchasing a home at the beach! They are reviewing their financial situation to ensure they will be ready for retirement. They anticipate being able to live comfortably with 80% of their current expenses. The rate of return on their investments until they retire is 4%. They expect this percentage to drop to 3% after retirement. Use this information, along with Exhibit 1-A, Exhibit 1-B, and the information provided below to determine the annual deposit amount Jamie Lee and Ross will need to make until they retire in order to make up the shortfall between their estimated expenses and income needed during retirement. Each answer must have a value for the assignment to be complete. Enter "O" for any unused categories. Current Expense Amounts (Jamie Lee and Ross Combined) Fixed expenses: $3,800/month Variable expenses: $2,800/month Estimated Income Amounts (Jamie Lee and Ross Combined) Social Security: $2,900/month Current IRA balance: $97,000 Estimated IRA withdrawal: $300/month Other investments: $30,400/year Estimated Annual Retirement Living Expenses Estimated annual living expenses if retiring today Number of years until retirement Expected annual rate of return before retirement Future value (use Exhibit 1-A) Projected annual retirement living expenses, adjusted for inflation (Round your final answer to nearest whole number.) (A) $ 0 Estimated Annual Income at Retirement Social Security income Company pension, personal retirement account income Investment and other income Total retirement income (Round your final answer to nearest whole number.) (B) $ 0 Annual shortfall of income after retirement (A - B) (Round your final answer to nearest whole number.) Expected years in retirement Expected annual rate of return before retirement Expected annual rate of return on invested funds after retirement Future value for a series of deposits (use Exhibit 1-B) Annual deposit required to accumulate the amount needed (Round your final answer to two decimal places.) 3% Exhibit 1 -A Future Value (Compounded Sum) of $1 after a Given Number of Time Periods 1% 5% 6% 7% 9% 10% 11% Period 1 8% 1.08 1 1.04 1 .06 1.07 1.09 1 1. 1 .11 .01 102 2% 102 104 1.061 3% 103 1061 1.093 1. 05 1.103 2 1082 1124 1 145 1.166 1211232 1.331 1.368 1.03 1.158 1.191 1.26 1.188 1295 1.412 1.125 1.17 1.126 1.518 1,082 1.104 1.126 1.225 1 311 1.403 1.501 1.216 1 276 1.34 1 262 1.338 1.419 1.159 1.194 1.217 1.265 1539 1.36 1 469 1.587 1 685 1.464 1611 1.772 1.677 1.87 1 149 123 1 316 1.407 1 504 1.606 1714 1949 2 076 1.041 5 1.051 6 1.062 7 1072 8 1.083 1.094 10 1.105 11 1.116 121.127 1.172 1369 1.477 1.594 1.718 1 851 1.828 1.993 2.172 1.267 1 305 2.305 2.144 2.358 1.195 1.423 1551 1838 1999 2.558 1.689 1.791 1219 1.629 2.594 2.839 1.48 1.539 2.367 258 1898 3.152 1 243 1 268 1.344 1384 1426 1.469 1.71 1.796 1.967 2.105 2 252 2.41 1 601 2.159 2 332 2518 2.72 2937 2.813 2012 2.133 2853 3.138 3.452 3 498 131 .138 1 294 1.665 1.886 3,066 3.883 1.149 1.513 2579 3.342 4 31 1 319 1345 1.732 1801 1.98 2.079 2 261 2397 2.759 3.642 4.785 1.161 1.173 1184 1.196 1.208 1558 1.605 1.653 3.97 1.373 14 5.311 3.172 3426 3.7 2.54 2.693 2 952 3159 3.38 3.797 4.177 4.595 5054 5.56 1.873 1948 2.026 2.107 4.328 2.183 2 292 2.407 2.527 5.895 4.717 6.544 1.428 1.457 1.702 1.754 2.854 3.026 3.996 4.316 3.617 5.142 6.116 7 263 1.22 1 486 1.806 2.191 2653 3.87 4661 6.727 8.062 3207 4292 5.604 8.623 6.848 1.282 1348 1.489 1.645 1.641 1 811 2 208 2 692 2.094 2427 3.262 4.384 2.666 3243 4.801 7.107 3.386 4322 .04 11.467 5.427 7612 14.974 29.457 5743 10.285 18.42 10.063 21.725 46.902 7 10.836 17.449 45.259 117.391 13 268 3 1.409 7 4.368 13.585 22.892 65.001 184.565 50 Period 20% 30% 12% 112 1.254 13% 113 1277 14% 114 1 2 17% 117 1.369 12 18% 118 1.392 13 15% 1.15 1323 1.521 1.749 19% 119 1.416 1.685 1.3 1.69 1.44 1.728 25% 125 1.563 1.963 2441 3.052 3 1.405 1.443 1482 1.602 1.643 2.197 1.63 1.689 1.874 1.939 2.005 2.074 2.856 16% 116 1.346 1.561 1811 2.1 2 436 2.826 3 278 3.803 1.925 2011 2.192 2.288 2.386 2.488 4 5 6 7 8 3.713 2.195 2565 2.7 2 34 2.986 1.574 1.762 1.974 2.211 2.476 .773 4.827 1.842 2002 2.353 2658 3.004 3.379 3.583 2.502 2863 3.252 6.275 2 313 2.66 3069 3.518 3.001 3.511 4.108 3.815 4.768 5.96 3.185 3.759 4.435 4021 8.157 9 2 4.785 5.16 7.451 10.604 103 .106 3.395 3.707 4.046 4.411 5.234 6.1929 13.786 5.695 6.777 .313 11 642 3.836 4.807 5624 6.58 4.226 6.176 5.117 5.936 7.43 17 922 3 298 4.335 4.818 7.288 8.064 8.916 14.562 2 113.479 123.896 13 4363 144.887 4898 5.535 6 254 5.492 6.261 7.138 4.652 5.35 6153 7.076 8137 6 886 7.988 7699 9.007 10 539 8599 10.147 11.974 9.596 11.42 1350 10.699 12.839 15.407 18.19 2 2.737 2 8 422 3 0 288 39.374 51 186 15 5.474 9266 16 6.13 7.067 8.137 9358 12 33 14.129 18.488 35 527 66 542 10.748 12.468 1 17 6.866 7986 9.276 10.761 14.426 14426 16 672 44.409 6 6.504 7.69 9.024 12375 14.463 16.879 19.673 55 511 112.455 16.172 19.244 22.901 27.252 32 429 77.388 8.613 14.232 16367 32 919 10.575 12.056 13.743 26.462 5095 188.884 7 00 233 16.777 19.461 40.874 19.748 23.106 5 0.658 23 214 27393 62 669 22.186 25.623 31.948 38 338 95.396 69.389 86.736 264.698 146.192 190.05 705.641 25 30 40 50 9.646 17 2996 93.051 289.002 10.197 11.523 2 1231 39.116 1 32.782 450.736 66 212 267 864 1083 657 85.85 378.721 1670 704 1 11065 5 33.869 2566 215 143.371 750 378 3927.357 184.675 1051.668 5088 914 237376 1469.772 9100 438 807 794 2619 996 7523.164 36118.865 70064 923497929 223 Exhibit 1-B Future Value (Compounded Sum) of $1 Paid In at the End of Each Period for a Given Number of Time Periods (an Annuity) Period 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 1% 1 1 1 2.02 3.06 2.05 2.08 2.09 S 2.1 2.01 3.03 2.11 2.03 3.091 204 3.122 2.06 3.184 2.07 3215 3.163 3.246 3.278 3.31 3.342 4.31 4.573 4.71 4.05 5.101 4.122 5 204 6.306 4.184 5309 6.468 4.246 5.416 6.633 5 526 4.375 5.637 6.975 5751 4.506 5867 7.336 5985 6228 4.641 6.105 7.716 9.487 6.152 6.802 7.153 7.913 7.523 92 7.214 7.434 7 662 7 898 8.142 8394 8 654 8.923 9.783 8.286 8.892 9.214 9.549 9.397 1026 10.637 11.436 11.859 8.583 9.756 9.369 10.159 11.027 11.491 11978 12.488 13.579 14.164 10.583 12.006 10462 10.95 11 464 12 578 13 181 13 816 14 497 15.937 16.722 11 12.169 14207 11,567 12.683 13.412 11.029 13.021 15 193 17.56 20.141 22953 26.019 29.361 15 917 13 13.486 15 026 16.627 18.292 20.024 13.809 19.561 22 713 26 212 30 095 14.68 17.713 18.531 21.384 24.523 27.975 31.772 14947 15.974 19.599 16.645 18.977 21.495 24 215 27.152 30 324 33.75 17.293 21.579 34.405 15 16 12.808 14. 192 15.618 17.086 18.500 20.157 21.762 23.414 25.117 26.87 14.972 1687 18.882 21.016 23.276 25 673 28.213 30.906 33.76 36.786 15.784 17.888 20.141 22.55 25.129 27.888 30.84 33 999 37 379 40.995 39. 19 44.501 16.007 17 258 16.43 19.615 20.811 22.019 28.243 34.785 48.885 64.463 18.639 20.012 21.412 22.841 24.297 21.825 23.696 25 645 27.671 29.778 23 657 25.84 28.132 30.539 3745 41.446 33 003 36.974 41 301 46.018 51.16 50.396 35 95 40.545 45599 51.159 57.275 56 039 33.066 45.762 6 4.203 32.03 36.459 41.646 47.727 54.355 63 249 73.106 84 701 98.347 114 413 20 25 30 40 50 40.568 6 0.402 84.579 47.575 75.401 112.797 5 6.085 95.026 152.667 66.439 1208 209.348 7 9.056 154.762 290.336 94.461 1 99 635 406.529 113.283 259.057 5 73.77 136 308 337882 815.084 164.494 442.593 1163.909 199 021 581.825 1668.771 Period 12% 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 2 2 .12 2.18 2. 19 2 2 225 2.3 2.13 3.407 2.14 3.44 2.15 3.473 3.374 3.506 3.539 3.64 3.813 399 4.779 4.85 4.921 4.993 5.066 5.141 5368 5.766 6.187 6.363 6 877 7442 9 043 8.207 11.259 6.48 8.323 10.405 12.757 15.416 6.61 8.536 10.73 13 233 16.085 8.977 11.414 8.115 10.089 123 1 4.776 7,014 9.207 11.772 14.773 18.285 9.93 12 916 15.073 12.756 17 583 23 858 14.24 3.572 3.606 5.215 5.291 7.154 7 297 9.442 9.683 12142 12.523 15327 15.902 19.086 19.923 23.521 24.709 28.755 30.404 34.931 37.18 42 219 45.244 16.490 20.799 19.842 25.802 9 17.519 32 015 10 18.42 21.321 25 959 33.253 42.619 19.337 23.045 6.742 8.754 11.067 13.727 16.786 20.304 24 349 29.002 34 352 40 505 47.58 55.717 22.398 272 25.733 32.15 42.566 66.405 12 27 271 30.85 32.824 39.581 54.208 17.549 20.665 24.133 28.029 32 393 37.28 42 753 74.327 21.814 25.65 29.985 34883 40.417 36.786 68.78 32.089 37581 43.842 43 672 54 841 39,404 47.103 56.11 66.649 66 649 48 497 59 196 0 105 72.035 8 6.949 109.687 97 625 127 913 167.286 60.965 66.261 51.66 60 925 C 925 16 46.672 50 98 7 2939 79 35 87.442 138.109 218 472 17 48.884 53.739 65.075 71.673 78.979 8 7.068 96.022 105.931 173.636 285.014 59.118 68394 55.75 61.725 75.836 84 141 103.74 115.266 218.045 273.556 371.518 483 973 19 70.749 08.603 80 947 342 945 630 165 25 30 40 50 6 3.44 72.052 133.334 241 333 767.091 2400.018 155.62 293 199 1013.704 3459.507 78.969 91.025 181.871 356 787 1342.025 4994 521 88 212 102.444 212.793 434.746 1779.09 7217.716 115.38 249.214 530 312 2 360.757 10435 649 93.406 110.285 130 033 292.105 647.439 3 134.522 15089.502 123 414 146 628 342.603 7 90 948 4 163213 2 1813.094 138.166 165.418 4 02.042 966 712 5 529.629 31515,336 128 117 154.74 186688 471.981 1181 882 7343.858 45497191 1054.791 3227 174 30088.655 280255 693 2 348.003 8729 985 120392 883 1659760 743