Jamie Lee Jackson, age 25, a busy full-time student and part-time bakery clerk, has been trying to organize her priorities, including her budget. She

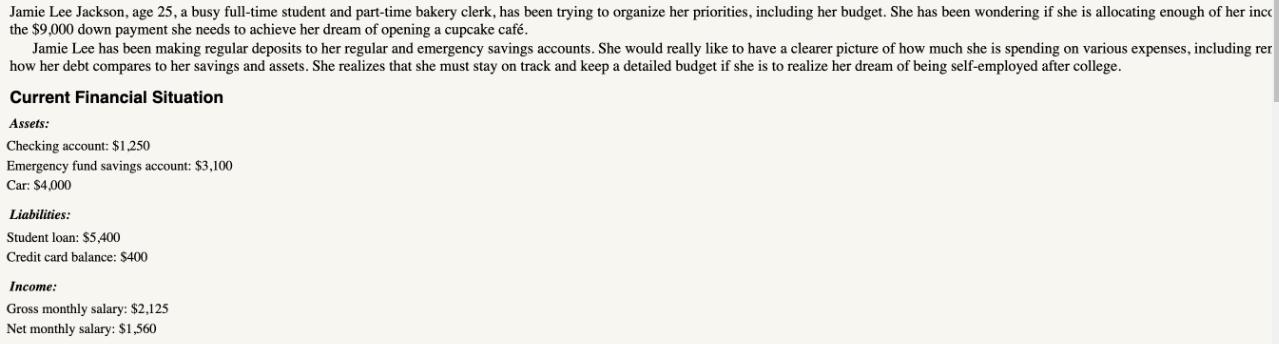

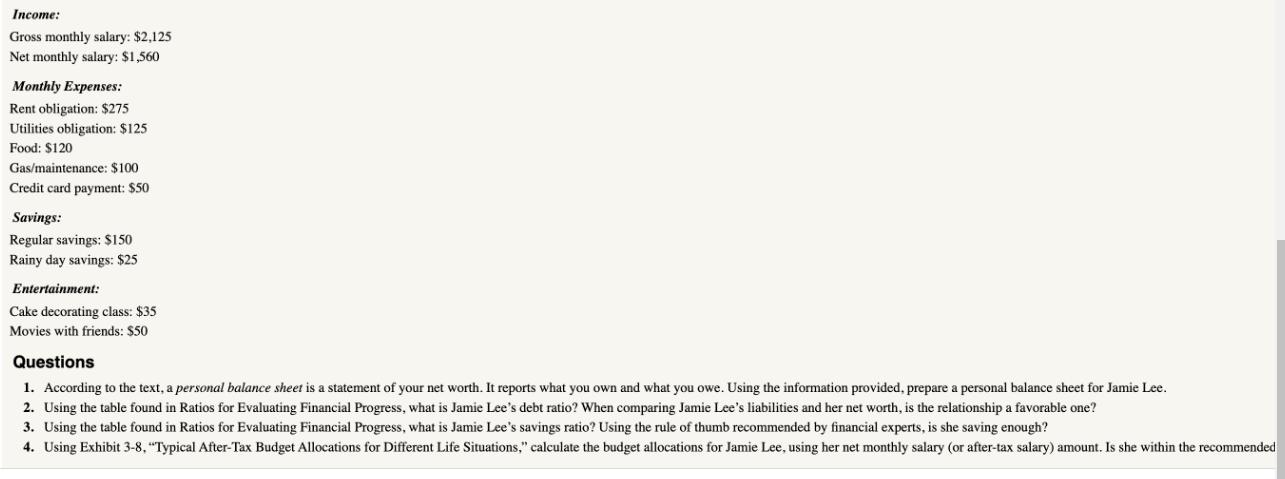

Jamie Lee Jackson, age 25, a busy full-time student and part-time bakery clerk, has been trying to organize her priorities, including her budget. She has been wondering if she is allocating enough of her inco the $9,000 down payment she needs to achieve her dream of opening a cupcake caf. Jamie Lee has been making regular deposits to her regular and emergency savings accounts. She would really like to have a clearer picture of how much she is spending on various expenses, including rer how her debt compares to her savings and assets. She realizes that she must stay on track and keep a detailed budget if she is to realize her dream of being self-employed after college. Current Financial Situation Assets: Checking account: $1,250 Emergency fund savings account: $3,100 Car: $4,000 Liabilities: Student loan: $5,400 Credit card balance: $400 Income: Gross monthly salary: $2,125 Net monthly salary: $1,560 Income: Gross monthly salary: $2,125 Net monthly salary: $1,560 Monthly Expenses: Rent obligation: $275 Utilities obligation: $125 Food: $120 Gas/maintenance: $100 Credit card payment: $50 Savings: Regular savings: $150 Rainy day savings: $25 Entertainment: Cake decorating class: $35 Movies with friends: $50 Questions 1. According to the text, a personal balance sheet is a statement of your net worth. It reports what you own and what you owe. Using the information provided, prepare a personal balance sheet for Jamie Lee. 2. Using the table found in Ratios for Evaluating Financial Progress, what is Jamie Lee's debt ratio? When comparing Jamie Lee's liabilities and her net worth, is the relationship a favorable one? 3. Using the table found in Ratios for Evaluating Financial Progress, what is Jamie Lee's savings ratio? Using the rule of thumb recommended by financial experts, is she saving enough? 4. Using Exhibit 3-8, "Typical After-Tax Budget Allocations for Different Life Situations," calculate the budget allocations for Jamie Lee, using her net monthly salary (or after-tax salary) amount. Is she within the recommended

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the feedback and make the initial answer clearer well break it down into concise wellorganized sections and use straightforward language We... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards