Question

Jamie Lee Jackson, age 26, is in her last semester of college and is anxiously waiting for graduation day that is just around the corner!

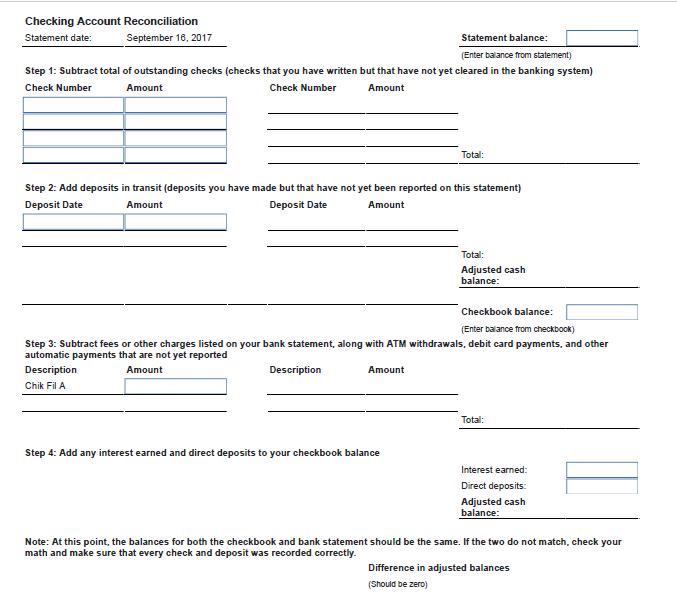

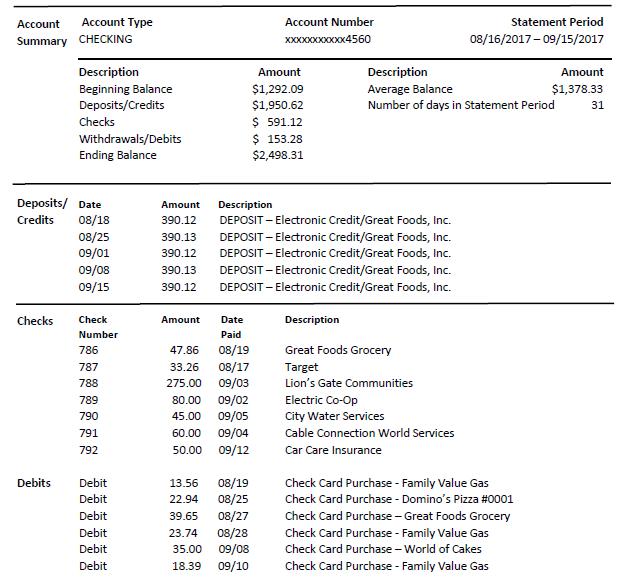

Jamie Lee Jackson, age 26, is in her last semester of college and is anxiously waiting for graduation day that is just around the corner! She still works part-time as a bakery clerk, has been sticking to her budget the past two years, and is on track to accumulate enough money for the $13,500 down payment she needs to open her cupcake café within the next two years. Jamie Lee is still single, shares a small apartment with a friend, and continues to split all of the associated living expenses, such as rent and utilities, but unfortunately, through a turn of events, has had to seriously consider a place of her own. One evening, after returning to the apartment after a long shift at the bakery, Jamie learned that her roommate had a couple of friends over earlier in the evening. As Jamie went to her room, she noticed that her top desk drawer had been left open and her Debit/ATM card, as well as her checkbook and Social Security card, were missing. She immediately contacted the authorities, and the police instructed her to notify her financial institution immediately. But it was late Saturday night, and Jamie thought she had to now wait until Monday morning. Unfortunately, within no time, Jamie found that her checking account had been emptied! Jamie Lee’s luck worsened, as she had paid many of her monthly bills late last week. Her automobile insurance, two utility bills, and a layaway payment had all been paid for by check. Her bank almost immediately began sending overdraft alerts through her smartphone for the emptied checking account. Determine the balance in Jamie Lee’s checkbook register below. Use this total along with the information from Jamie Lee’s monthly bank statement to reconcile her checkbook register with her bank statement. Each answer must have a value for the assignment to be complete. Enter "0" for any unused categories.

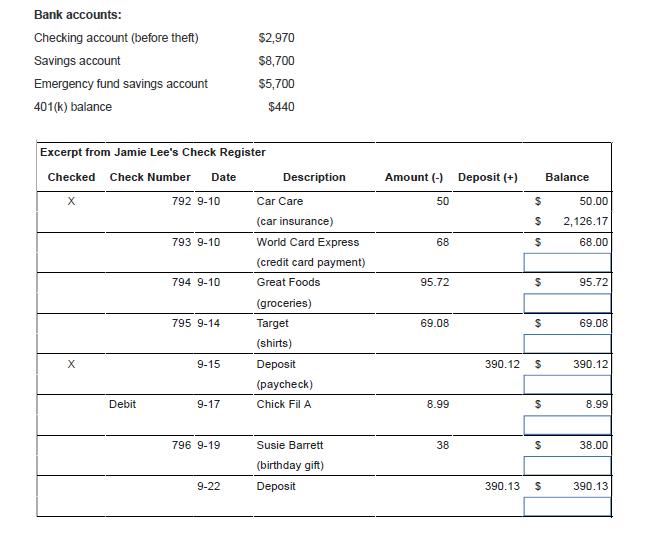

Bank accounts: Checking account (before theft) $2,970 Savings account $8,700 Emergency fund savings account $5,700 401(K) balance $440 Excerpt from Jamie Lee's Check Register Checked Check Number Date Description Amount (-) Deposit (+) Balance 792 9-10 Car Care 50 50.00 (car insurance) 2,126.17 793 9-10 World Card Express 68 68.00 (credit card payment) 794 9-10 Great Foods 95.72 95.72 (groceries) 795 9-14 Target 69.08 69.08 (shirts) X 9-15 Deposit 390.12 390.12 (paycheck) Debit 9-17 Chick Fil A 8.99 8.99 796 9-19 Susie Barrett 38 38.00 (birthday gift) 9-22 Deposit 390.13 390.13 %24 %24

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started