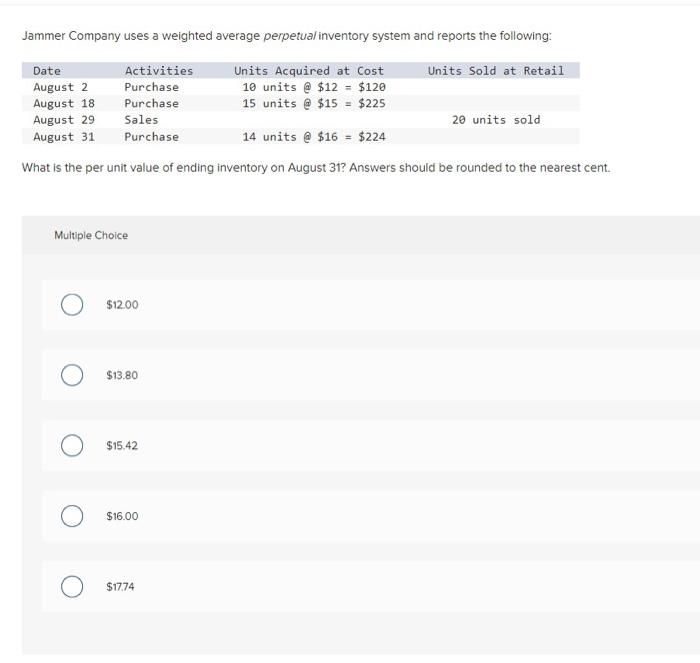

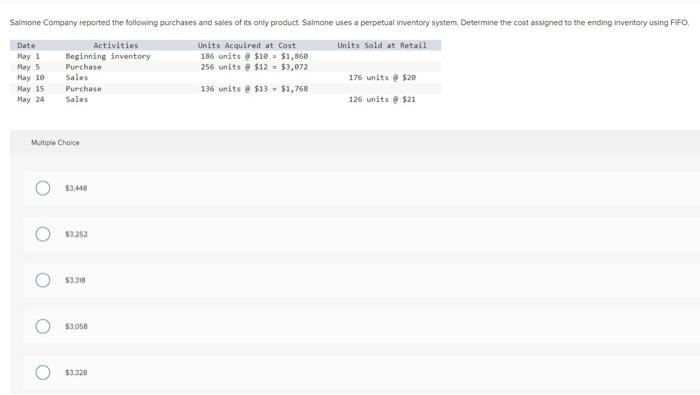

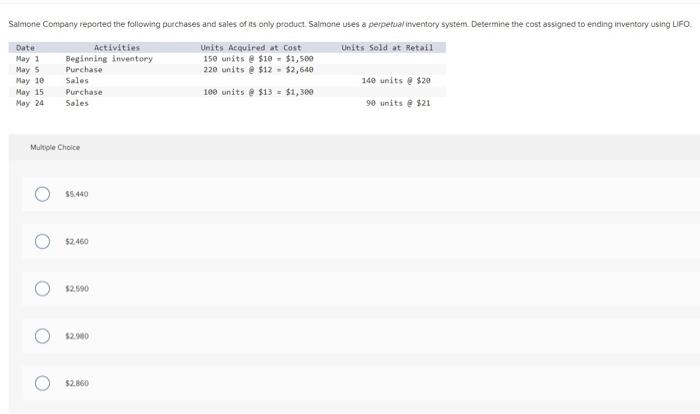

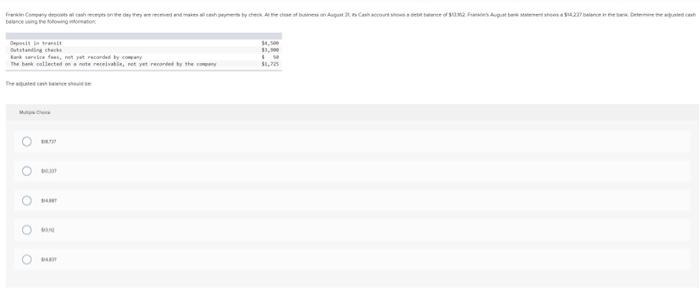

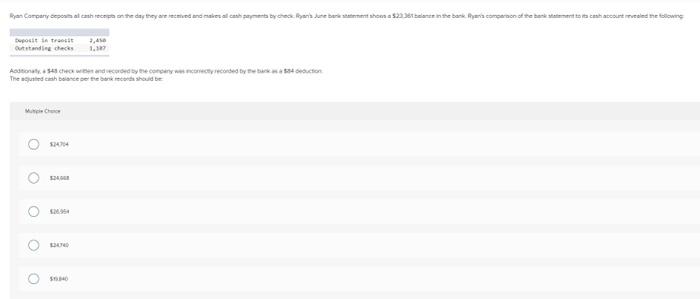

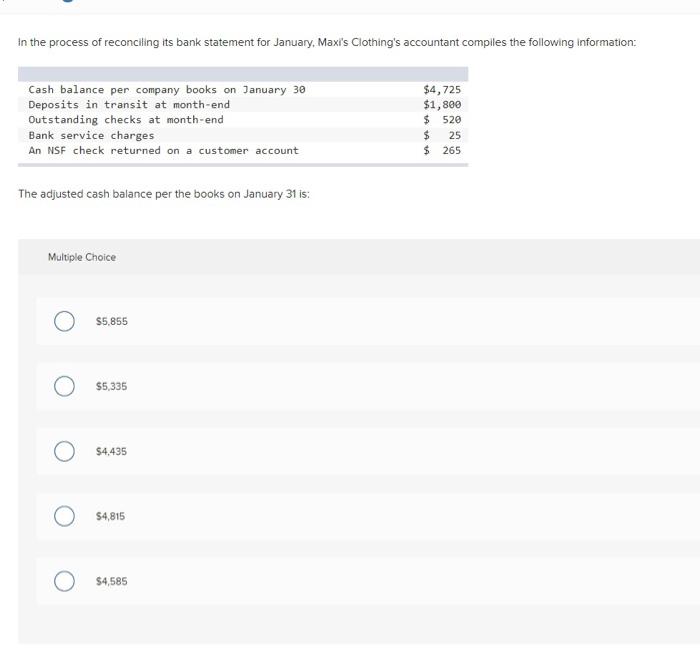

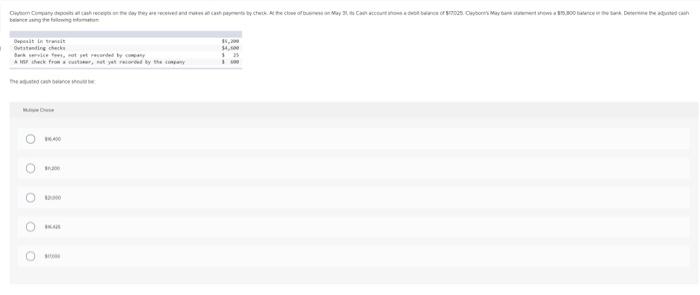

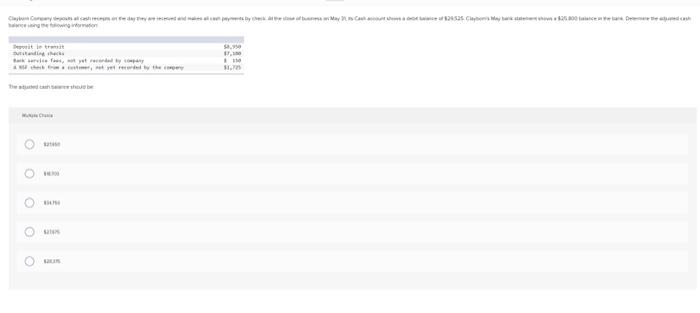

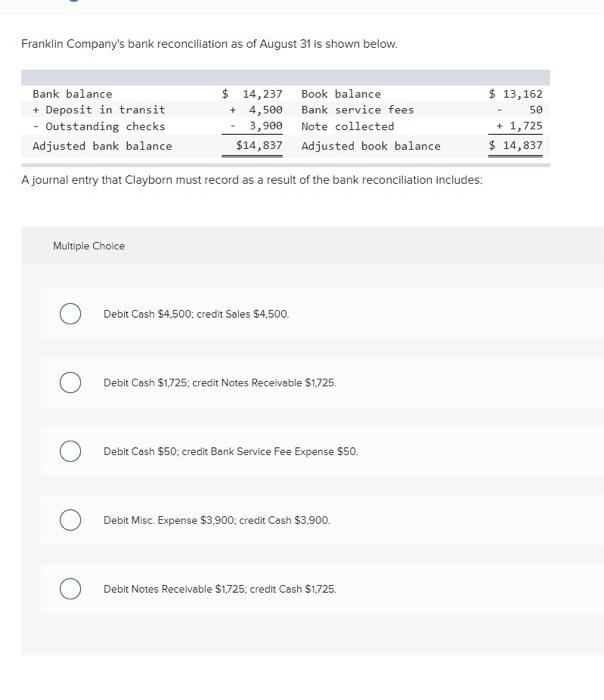

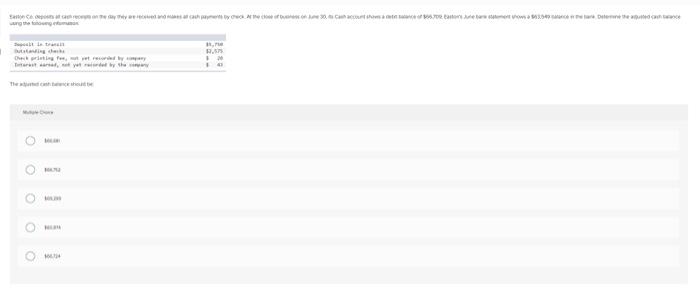

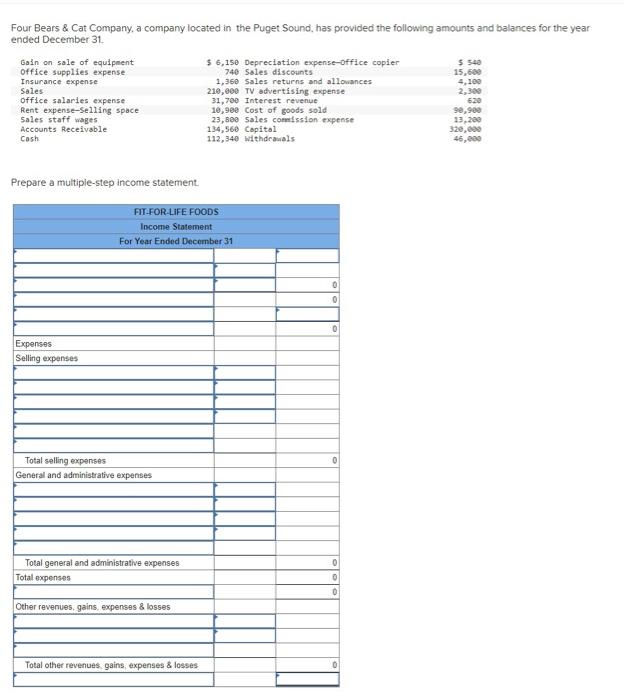

Jammer Company uses a weighted average perpetual inventory system and reports the following: Date Activities Units Acquired at Cost Units Sold at Retail August 2 Purchase 10 units @ $12 = $120 August 18 Purchase 15 units @ $15 = $225 August 29 Sales 20 units sold August 31 Purchase 14 units @ $16 = $224 What is the per unit value of ending inventory on August 31? Answers should be rounded to the nearest cent. Multiple Choice $12.00 $13.80 $15.42 $16.00 $17.74 Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to the ending inventory using FIFO Date Activities Units Acquired at Cost Units sold at Retail May 1 Beginning inventory 186 units @ $10 = $1,860 May 5 Purchase 256 units @ $12 = 53,072 May te 176 units @ $20 May 15 Purchase 136 units @ $13 - 51,768 May 24 Sales 126 units $21 Sales Multiple Choice O $3.448 O $3.252 O $3.30 0 $3,058 $3.328 Date Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to ending inventory using LIFO Activities Units Acquired at Cost Units Sold at Retail May 1 Beginning inventory 150 units @ $10 - $1,500 May 5 Purchase 220 units $12 - $2,640 May 10 Sales 140 units $20 May 15 Purchase 100 units @ $13. $1,300 May 24 Sales 90 units $21 Multiple Choice O O 55.440 O $2.460 52.590 52.900 $2.860 3. , bar allested on , renorith the rey 7 0 0 0 0 0 Ryan Company Seal cathetedytheremedand machache. Je bent 522:30ean he bank ya como basket cash account ne song Dopocit te troost 7,410 Outstanding checks. Asation 548 CHOW andere comes to be con The used cash bace detect should be he O 0 In the process of reconciling its bank statement for January, Maxi's Clothing's accountant compiles the following information: Cash balance per company books on January 30 Deposits in transit at month-end Outstanding checks at month-end Bank service charges An NSF check returned on a customer account $4,725 $1,880 $ 520 $ 25 $ 265 The adjusted cash balance per the books on January 31 is: Multiple Choice S5.855 $5,335 $4,435 $4,815 $4,585 Bukkede 15.00 14.00 0 Dit in trit But yet been . A the be WE Franklin Company's bank reconciliation as of August 31 is shown below. + Bank balance + Deposit in transit - Outstanding checks Adjusted bank balance $ 14,237 Book balance 4,500 Bank service fees 3,900 Note collected $14,837 Adjusted book balance $ 13,162 50 + 1,725 $ 14,837 A journal entry that Clayborn must record as a result of the bank reconciliation includes: Multiple Choice Debit Cash $4.500; credit Sales $4,500 Debit Cash $1,725; credit Notes Receivable $1,725 Debit Cash $50;credit Bank Service Fee Expense $50. Debit Misc. Expense $3,900, credit Cash $3,900 Debit Notes Receivable $1725: credit Cash $1,725. , Ceriti Trouwe Four Bears & Cat Company, a company located in the Puget Sound, has provided the following amounts and balances for the year ended December 31 Gain on sale of equipment $ 6,150 Depreciation expense-office copier 5 540 Office supplies expense 740 Soles discounts 15,600 Insurance expense 1,360 Sales returns and allowances 4,100 Sales 210,000 TV advertising expense 2,300 Office salaries expense 31,700 Interest revenue 620 Rent expense-Selling space 10,900 Cost of goods sold 99,900 Sales staff wages 23,800 Sales comission expense 13,200 Accounts Receivable 134,560 Capital 320,000 Cash 112,340 withdrawals 46,000 Prepare a multiple-step income statement FIT-FOR-LIFE FOODS Income Statement For Year Ended December 31 0 Expenses Selling expenses Total selling expenses General and administrative expenses Total general and administrative expenses Total expenses 0 0 Other revenues, gains, expenses &losses Total other revenues gains expenses & losses