Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jamming Limited has two production departments: Forming and Assembly. The company also has two service departments: Maintenance and Stores. It manufactures Part YDN12 that

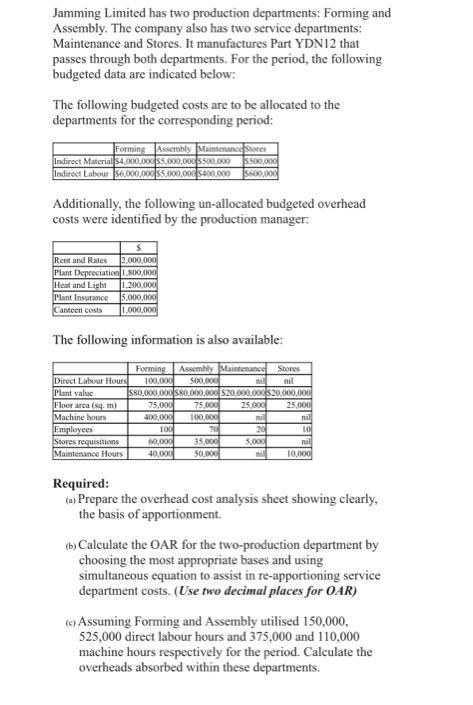

Jamming Limited has two production departments: Forming and Assembly. The company also has two service departments: Maintenance and Stores. It manufactures Part YDN12 that passes through both departments. For the period, the following budgeted data are indicated below: The following budgeted costs are to be allocated to the departments for the corresponding period: Forming Assembly Maintenance Stores Indirect Material $4,000,000 $5,000,000 5500.000 $500,000 Indirect Labour $6,000,000 $5,000,000 $400,000 $600,000 Additionally, the following un-allocated budgeted overhead costs were identified by the production manager: Rent and Rates 2,000,000 Plant Depreciation 1.800,000 Heat and Light Plant Insurance Canteen costs The following information is also available: 1,200,000 5,000,000 1,000,000 Direct Labour Hours Plant value. Floor area (sq. m) Machine hours Employees Stores requisitions Maintenance Hours Forming Assembly Maintenance Stores 100,000 500,000 nil $80,000,000 $80,000,000 $20,000,000 $20,000,000 25,000 nil 75,000 400,000 100 60,000 35,000 40,000 50,000 75,000 100,000 70 ni 25,000 nil 20 5,000 10 nil 10,000 Required: (a) Prepare the overhead cost analysis sheet showing clearly, the basis of apportionment. (b) Calculate the OAR for the two-production department by choosing the most appropriate bases and using simultaneous equation to assist in re-apportioning service department costs. (Use two decimal places for OAR) (c) Assuming Forming and Assembly utilised 150,000, 525,000 direct labour hours and 375,000 and 110,000 machine hours respectively for the period. Calculate the overheads absorbed within these departments.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started