Answered step by step

Verified Expert Solution

Question

1 Approved Answer

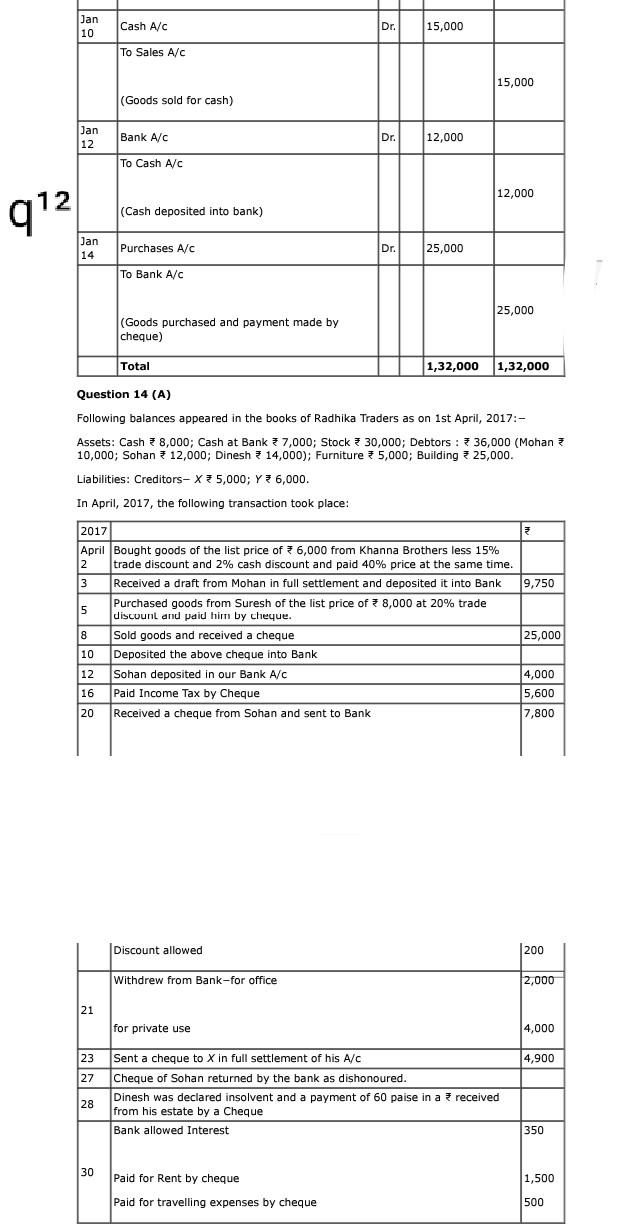

Jan 10 Cash A/C Dr. 15,000 To Sales A/C 15,000 15,000 (Goods sold for cash) Jan 12 Bank A/C Dr. 12,000 To Cash A/C 12,000

Jan 10 Cash A/C Dr. 15,000 To Sales A/C 15,000 15,000 (Goods sold for cash) Jan 12 Bank A/C Dr. 12,000 To Cash A/C 12,000 12 912 (Cash deposited into bank) Jan 14 Purchases A/C Dr. 25,000 To Bank A/C 25,000 (Goods purchased and payment made by cheque) Total 1,32,000 1,32,000 Question 14 (A) Following balances appeared in the books of Radhika Traders as on 1st April, 2017:- Assets: Cash 8,000; Cash at Bank 37,000; Stock 3 30,000; Debtors : 736,000 (Mohan 10,000; Sohan 7 12,000; Dinesh * 14,000); Furniture > 5,000; Building 3 25,000. Liabilities: Creditors-X 5,000; Y 6,000. In April, 2017, the following transaction took place: 2017 April Bought goods of the list price of 6,000 from Khanna Brothers less 15% 2 trade discount and 2% cash discount and paid 40% price at the same time. 3 Received a draft from Mohan in full settlement and deposited it into Bank 9,750 Purchased goods from Suresh of the list price of 8,000 at 20% trade 5 discount and paid him by cheque. 8 Sold goods and received a cheque 25,000 10 Deposited the above cheque into Bank 12 Sohan deposited in our Bank A/C 4,000 16 Paid Income Tax by Cheque 5,600 20 Received a cheque from Sohan and sent to Bank 7,800 Discount allowed 200 Withdrew from Bank-for office - 2,000 21 for private use 4,000 23 4,900 27 Sent a cheque to X in full settlement of his A/C Cheque of Sohan returned by the bank as dishonoured. Dinesh was declared insolvent and a payment of 60 paise in a received from his estate by a Cheque Bank allowed Interest 28 350 30 Paid for Rent by cheque 1,500 Paid for travelling expenses by cheque 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started