Question

Jan 22: Blazing Sales Consultants performed services for customers on account, $10000. Jan 30: Blazing Sale Consultants received cash on account from customers, $7,000. Jan

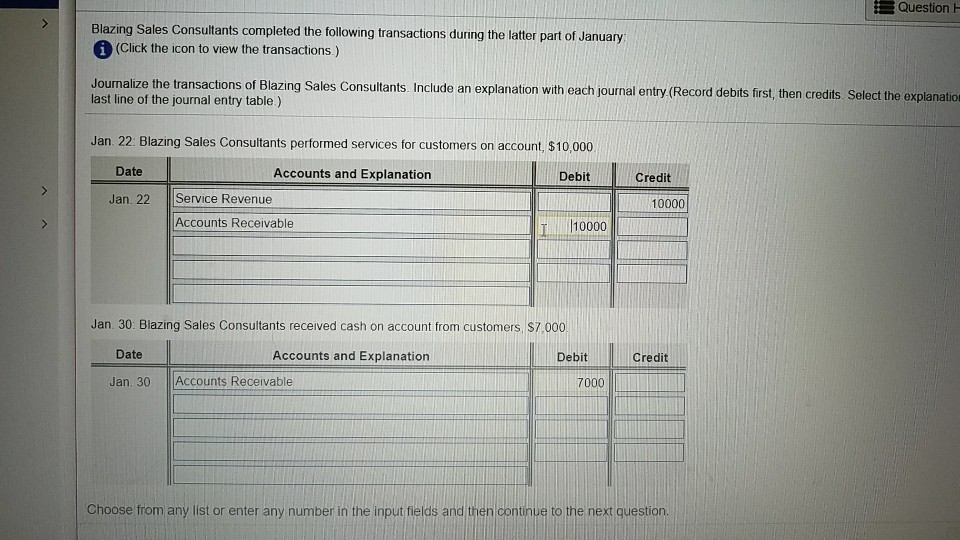

Jan 22: Blazing Sales Consultants performed services for customers on account, $10000.

Jan 30: Blazing Sale Consultants received cash on account from customers, $7,000.

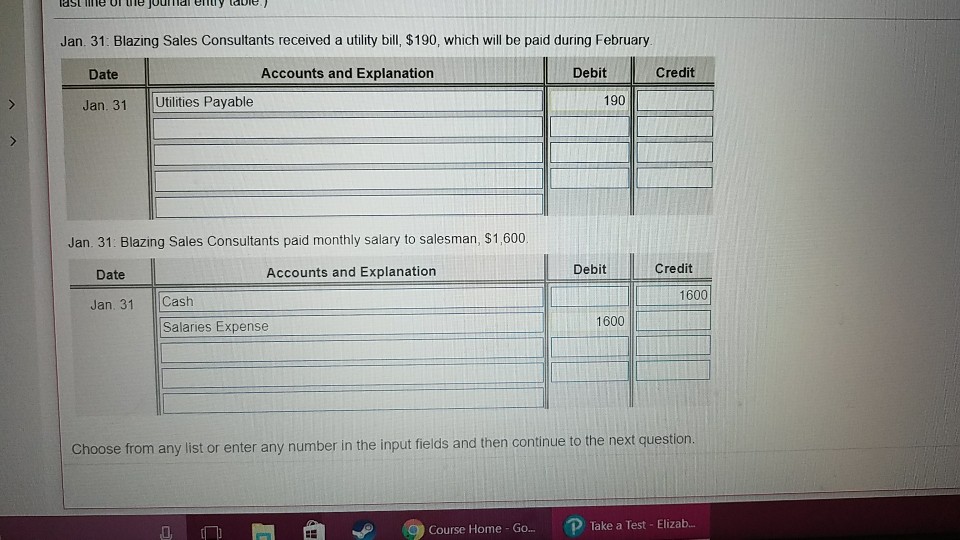

Jan 31: Blazing Sales Consultants received utility bill, $190, which will be paid during February.

Jan 31: Blazing Sales Consultants laid monthly salary to salesman, $1600.

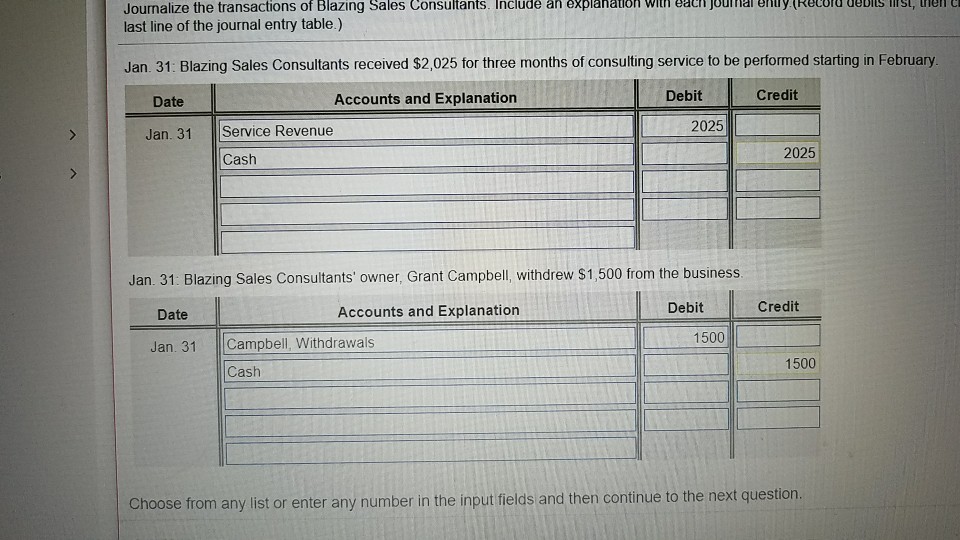

Jan 31: Blazing Sales Consultants received $2,025 for three months of consulting service to be performed starting in February.

Jan 31: Blazing Sales Consultants' owner, Grant Campbell, withdrew $1500 from the business.

Question Blazing Sales Consultants completed the following transactions during the latter part of January (Click the icon to view the transactions) Journalize the transactions of Blazing Sales Consultants. Include an explanation with each journal entry (Record debits frst, then credits Select the explanatior last line of the journal entry table) Jan 22: Blazing Sales Consultants performed services for customers on account, $10,000 Date Accounts and Explanation Debit Credit 10000 Jan. 22Service Revenue Accounts Receivable 10000 Jan. 30: Blazing Sales Consultants received cash on account from customers S7,000 Debit Credit Date Accounts and Explanation 7000 Jan. 30 Accounts Receivable Choose from any list or enter any number in the input fields and then continue to the nextStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started