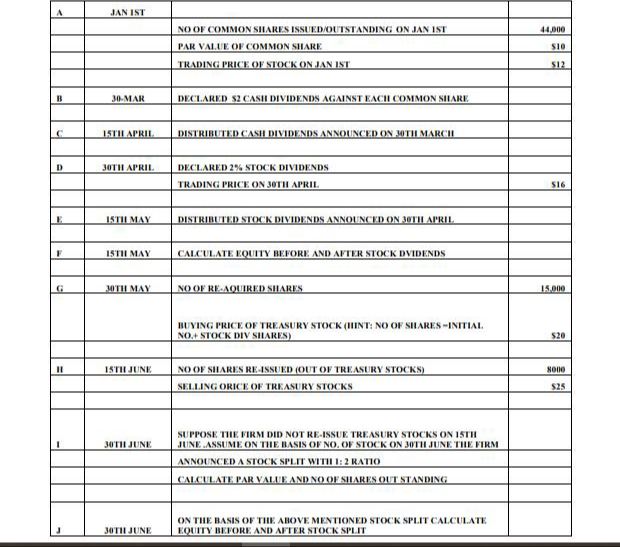

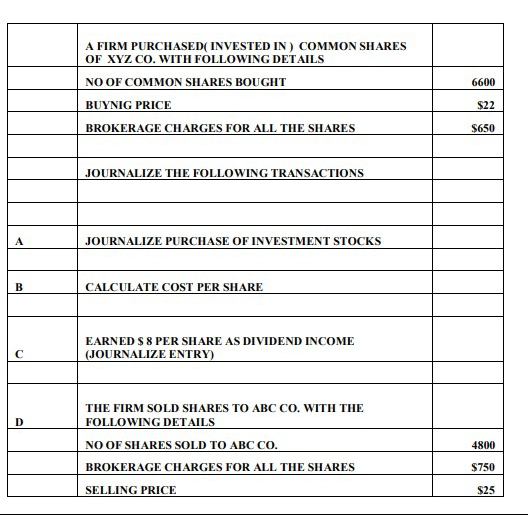

JAN IST 44,000 NO OF COMMON SHARES ISSUED OUTSTANDING ON JAN IST PAR VALUE OF COMMON SHARE TRADING PRICE OF STOCK ON JAN IST SIO 512 B 30-MAR DECLARED $2 CASH DIVIDENDS AGAINST EACH COMMON SHARE ISTILAPRIL DISTRIBUTED CASH DIVIDENDS ANNOUNCED ON 20TH MARCIL D JOTH APRIL DECLARED 2% STOCK DIVIDENDS TRADING PRICE ON 30TH APRIL SIG ISTIL MAY DISTRIBUTED STOCK DIVIDENDS ANNOUNCED ON 30TH APRIL F ISTII MAY CALCULATE EQUITY BEFORE AND AFTER STOCK DVIDENDS MOTII MAY NO OF REQUIRED SHARES 15.000 BUYING PRICE OF TREASURY STOCK (HIINT: NO OF SILARES-INITIAL NO.+ STOCK DIV SILARES) $20 11 ISTIL JUNE soo NO OF SHARES RE-ISSUED (OUT OF TREASURY STOCKS) SELLING ORICE OF TREASURY STOCKS $25 30TH JUNE SUPPOSE THE FIRM DID NOT RE-ISSUE TREASURY STOCKS ON 15TH JUNE ASSUME ON THE BASIS OF NO. OF STOCK ON 30TH JUNE THE FIRM ANNOUNCED A STOCK SPLIT WITH 1:2 RATIO CALCULATE PAR VALUE AND NO OF SILARES OUT STANDING ON THE BASIS OF THE ABOVE MENTIONED STOCK SPLIT CALCULATE EQUITY BEFORE AND AFTER STOCK SPLIT 30TH JUNE 6600 A FIRM PURCHASED( INVESTED IN) COMMON SHARES OF XYZ CO. WITH FOLLOWING DETAILS NO OF COMMON SHARES BOUGHT BUYNIG PRICE BROKERAGE CHARGES FOR ALL THE SHARES S22 $650 JOURNALIZE THE FOLLOWING TRANSACTIONS A JOURNALIZE PURCHASE OF INVESTMENT STOCKS B CALCULATE COST PER SHARE EARNED $ 8 PER SHARE AS DIVIDEND INCOME (JOURNALIZE ENTRY) D THE FIRM SOLD SHARES TO ABC CO. WITH THE FOLLOWING DETAILS NO OF SHARES SOLD TO ABC CO. BROKERAGE CHARGES FOR ALL THE SHARES 4800 $750 SELLING PRICE $25 JAN IST 44,000 NO OF COMMON SHARES ISSUED OUTSTANDING ON JAN IST PAR VALUE OF COMMON SHARE TRADING PRICE OF STOCK ON JAN IST SIO 512 B 30-MAR DECLARED $2 CASH DIVIDENDS AGAINST EACH COMMON SHARE ISTILAPRIL DISTRIBUTED CASH DIVIDENDS ANNOUNCED ON 20TH MARCIL D JOTH APRIL DECLARED 2% STOCK DIVIDENDS TRADING PRICE ON 30TH APRIL SIG ISTIL MAY DISTRIBUTED STOCK DIVIDENDS ANNOUNCED ON 30TH APRIL F ISTII MAY CALCULATE EQUITY BEFORE AND AFTER STOCK DVIDENDS MOTII MAY NO OF REQUIRED SHARES 15.000 BUYING PRICE OF TREASURY STOCK (HIINT: NO OF SILARES-INITIAL NO.+ STOCK DIV SILARES) $20 11 ISTIL JUNE soo NO OF SHARES RE-ISSUED (OUT OF TREASURY STOCKS) SELLING ORICE OF TREASURY STOCKS $25 30TH JUNE SUPPOSE THE FIRM DID NOT RE-ISSUE TREASURY STOCKS ON 15TH JUNE ASSUME ON THE BASIS OF NO. OF STOCK ON 30TH JUNE THE FIRM ANNOUNCED A STOCK SPLIT WITH 1:2 RATIO CALCULATE PAR VALUE AND NO OF SILARES OUT STANDING ON THE BASIS OF THE ABOVE MENTIONED STOCK SPLIT CALCULATE EQUITY BEFORE AND AFTER STOCK SPLIT 30TH JUNE 6600 A FIRM PURCHASED( INVESTED IN) COMMON SHARES OF XYZ CO. WITH FOLLOWING DETAILS NO OF COMMON SHARES BOUGHT BUYNIG PRICE BROKERAGE CHARGES FOR ALL THE SHARES S22 $650 JOURNALIZE THE FOLLOWING TRANSACTIONS A JOURNALIZE PURCHASE OF INVESTMENT STOCKS B CALCULATE COST PER SHARE EARNED $ 8 PER SHARE AS DIVIDEND INCOME (JOURNALIZE ENTRY) D THE FIRM SOLD SHARES TO ABC CO. WITH THE FOLLOWING DETAILS NO OF SHARES SOLD TO ABC CO. BROKERAGE CHARGES FOR ALL THE SHARES 4800 $750 SELLING PRICE $25