Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jane and Bill are married and file a joint Year 1 tax return on September 1, Year 2, without seeking an extension of time

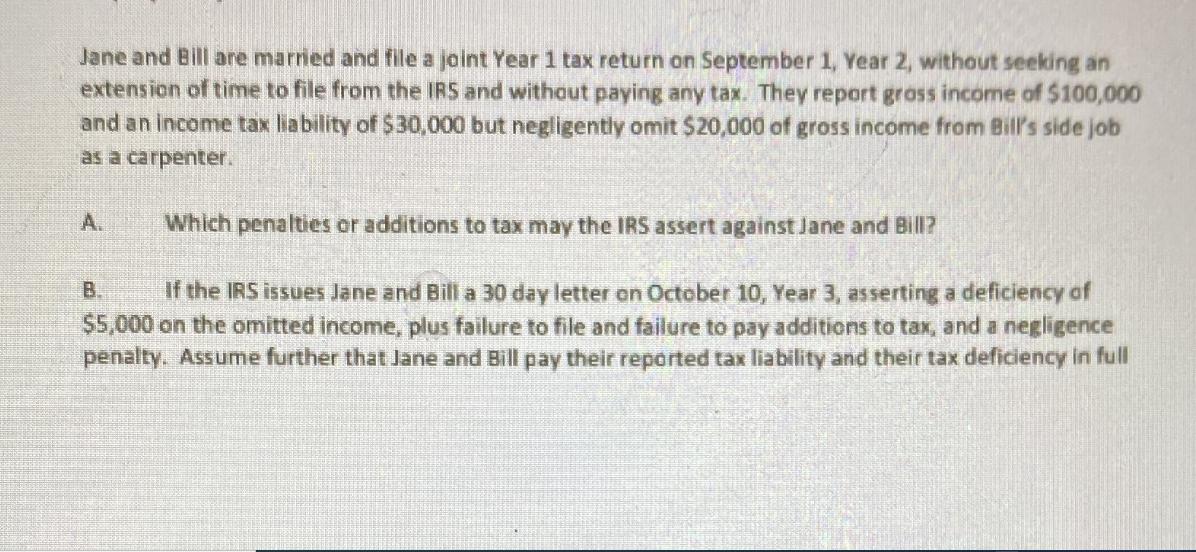

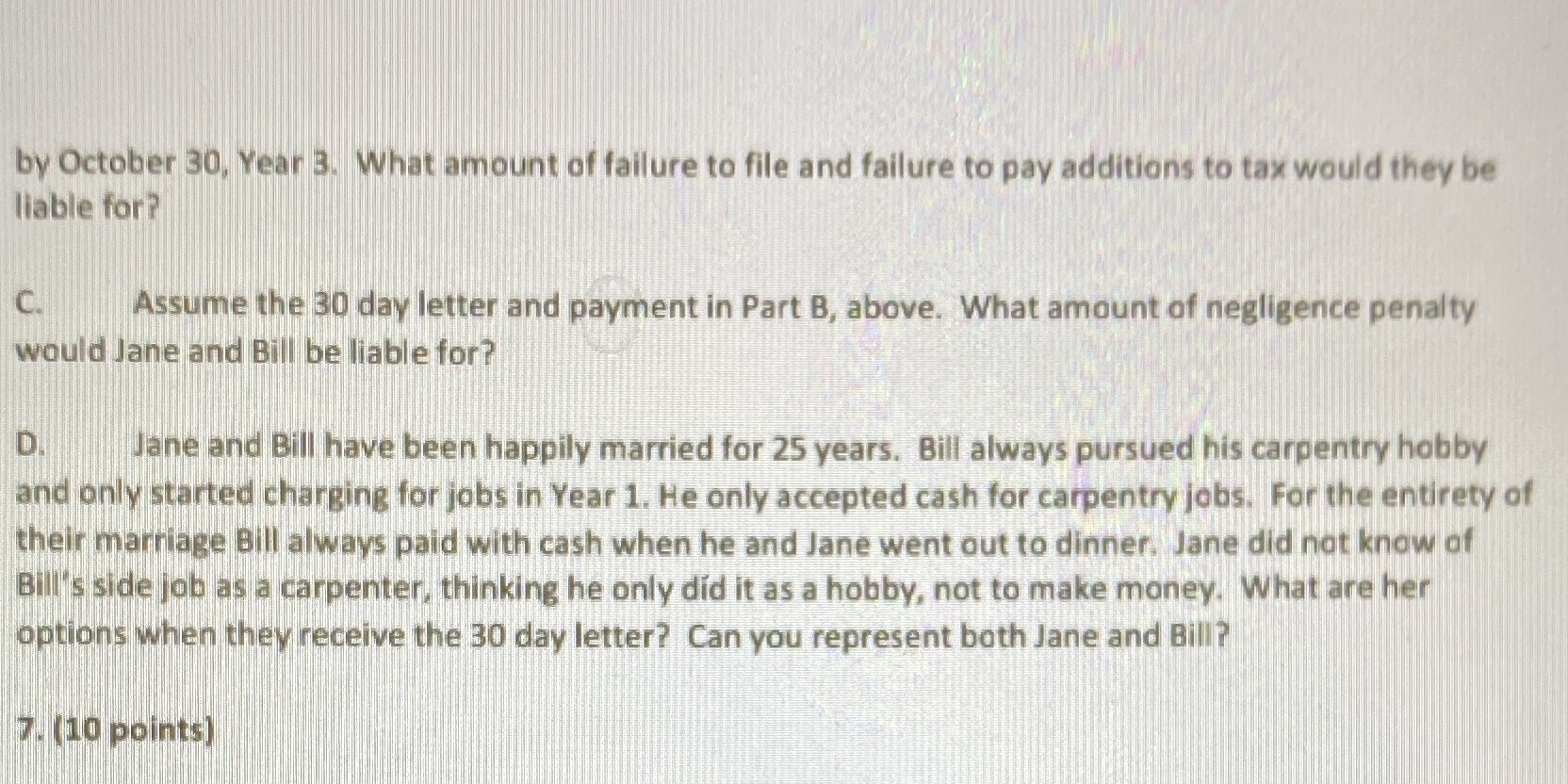

Jane and Bill are married and file a joint Year 1 tax return on September 1, Year 2, without seeking an extension of time to file from the IRS and without paying any tax. They report gross income of $100,000 and an income tax liability of $30,000 but negligently omit $20,000 of gross income from Bill's side job as a carpenter. A. Which penalties or additions to tax may the IRS assert against Jane and Bill? B. If the IRS issues Jane and Bill a 30 day letter on October 10, Year 3, asserting a deficiency of $5,000 on the omitted income, plus failure to file and failure to pay additions to tax, and a negligence penalty. Assume further that Jane and Bill pay their reported tax liability and their tax deficiency in full by October 30, Year 3. What amount of failure to file and failure to pay additions to tax would they be liable for? C. Assume the 30 day letter and payment in Part B, above. What amount of negligence penalty would Jane and Bill be liable for? Jane and Bill have been happily married for 25 years. Bill always pursued his carpentry hobby and only started charging for jobs in Year 1. He only accepted cash for carpentry jobs. For the entirety of their marriage Bill always paid with cash when he and Jane went out to dinner. Jane did not know of Bill's side job as a carpenter, thinking he only did it as a hobby, not to make money. What are her options when they receive the 30 day letter? Can you represent both Jane and Bill? 7. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Penalties and Additions to Tax Here are the potential penalties and additions to tax the IRS might assess against Jane and Bill Failure to File 5 pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started