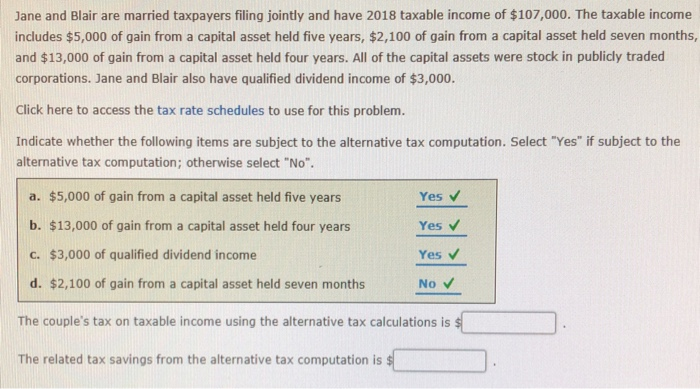

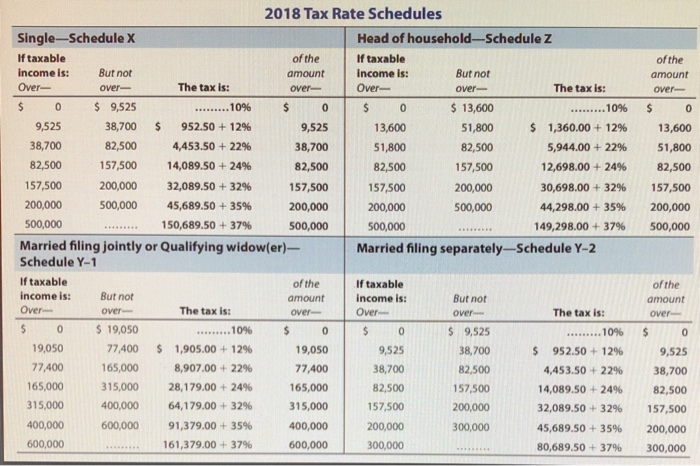

Jane and Blair are married taxpayers filing jointly and have 2018 taxable income of $107,000. The taxable income includes $5,000 of gain from a capital asset held five years, $2,100 of gain from a capital asset held seven months, and $13,000 of gain from a capital asset held four years. All of the capital assets were stock in publicly traded corporations. Jane and Blair also have qualified dividend income of $3,000. Click here to access the tax rate schedules to use for this problem. Indicate whether the following items are subject to the alternative tax computation. Select "Yes" if subject to the alternative tax computation; otherwise select "No". a. $5,000 of gain from a capital asset held five years b. $13,000 of gain from a capital asset held four years c. $3,000 of qualified dividend income d. $2,100 of gain from a capital asset held seven months Yes v Yes Yes The couple's tax on taxable income using the alternative tax calculations is s The related tax savings from the alternative tax computation is 2018 Tax Rate Schedules Single-Schedule X Iftaxable income is: Over- Head of household-Schedule Z If taxable of the amountincome is: of the amount But not over_ But not The tax is: The tax is: s O 9,525 38,700 82,500 157,500 200,000 500,000 13,600 51,800 82,500 157,500 200,000 500,000 0 $ 1,360.00 + 12% 13,600 5,944.00 +22% 51,800 12,698.00+24% 82,500 30,698.00+32% 157,500 44,298.00+35% 200,000 149,298.00+37% 500,000 10% 9,525 38,700 82,500 157,500 200,000 500,000 Married filing jointly or Qualifying widow(er)-Married filing separately-Schedule Y-2 9,525 38,700 82,500 157,500 200,000 500,000 $ 952.50 + 12% 4,453.50 + 22% 14,089.50+24% 32,089.50+32% 45,689.50 + 35% 150,689.50 + 37% 13,600 51,800 82,500 157,500 200,000 00,000 Schedule Y-1 If taxable income is: But not of the amountincome is: If taxable of the amount But not The tax is: The tax is: over $ 0 19,050 77,400 165,000 315,000 400,000 600,000 10% $ 1,905.00 + 12% 8,907.00 + 22% 28,179.00 + 24% 64,179.00+32% 91,379.00 + 35% 161,379.00 + 37% $ 9,525 38,700 82,500 157,500 200,000 300,000 10% $ 19,050 77,400 165,000 315,000 400,000 600,000 19,050 77,400 165,000 315,000 400,000 600,000 9,525 38,700 82,500 157,500 200,000 300,000 952.50+12% 9,525 4,453.50 + 22% 38,700 14,089.50 + 24% 82,500 32,089.50+3296 157,500 45,689.50+35% 200,000 80,689.50 + 37% 300,000