Answered step by step

Verified Expert Solution

Question

1 Approved Answer

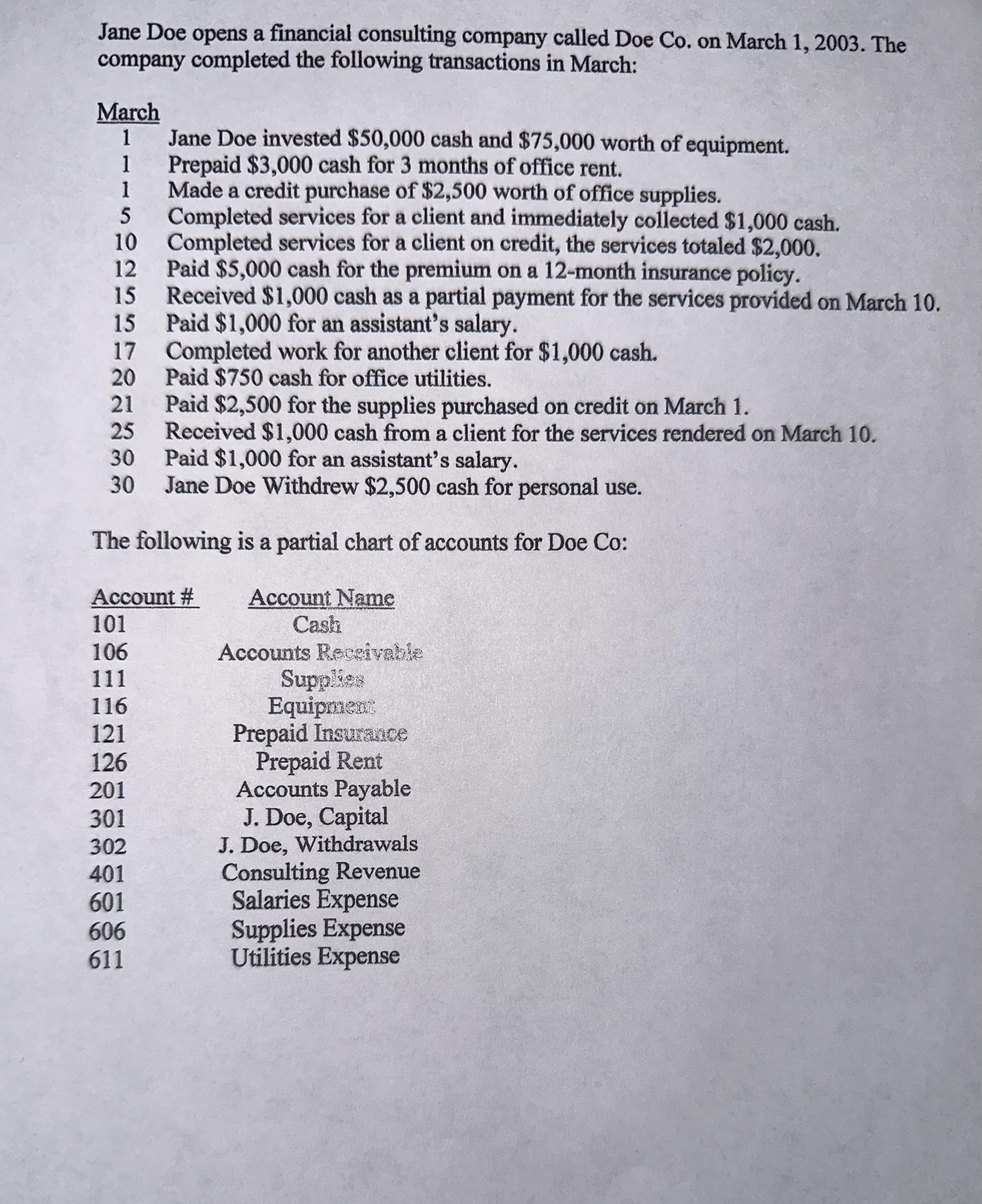

Jane Doe opens a financial consulting company called Doe Co. on March 1, 2003. The company completed the following transactions in March: March 1

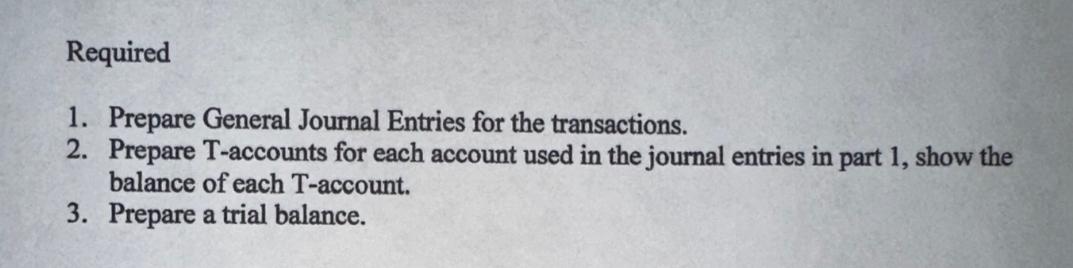

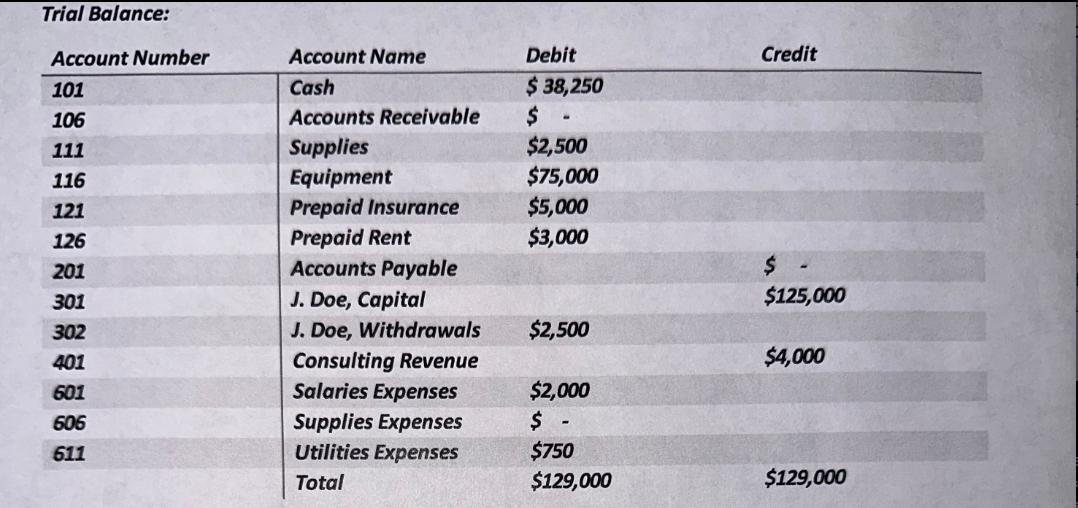

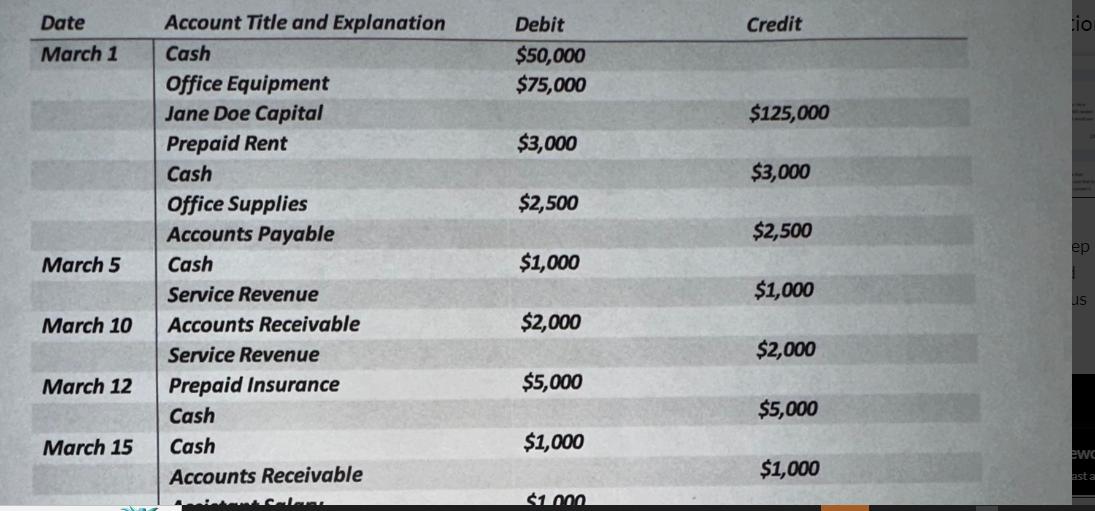

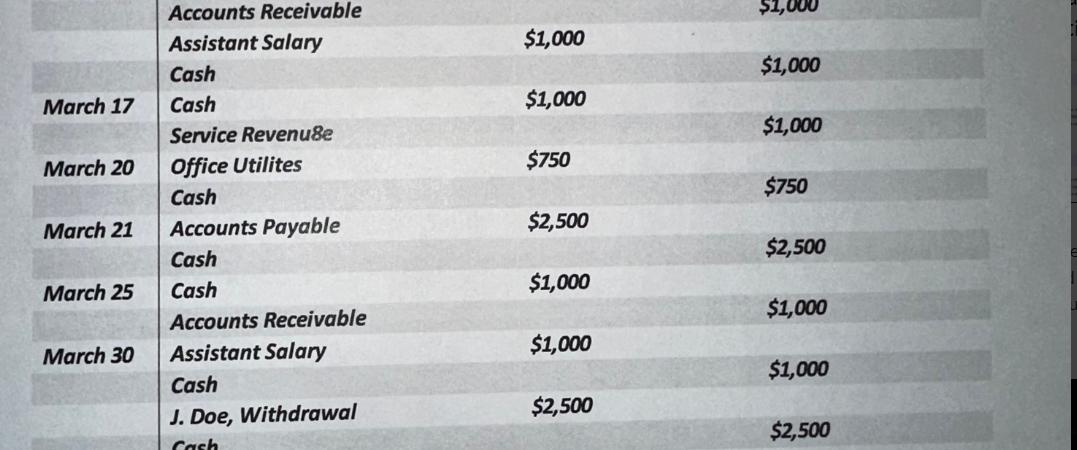

Jane Doe opens a financial consulting company called Doe Co. on March 1, 2003. The company completed the following transactions in March: March 1 1 5 10 12 15 15 17 20 21 25 30 30 Jane Doe invested $50,000 cash and $75,000 worth of equipment. Prepaid $3,000 cash for 3 months of office rent. Made a credit purchase of $2,500 worth of office supplies. Completed services for a client and immediately collected $1,000 cash. Completed services for a client on credit, the services totaled $2,000. Paid $5,000 cash for the premium on a 12-month insurance policy. Received $1,000 cash as a partial payment for the services provided on March 10. Paid $1,000 for an assistant's salary. Completed work for another client for $1,000 cash. Paid $750 cash for office utilities. Paid $2,500 for the supplies purchased on credit on March 1. Received $1,000 cash from a client for the services rendered on March 10. Paid $1,000 for an assistant's salary. Jane Doe Withdrew $2,500 cash for personal use. The following is a partial chart of accounts for Doe Co: Account # 101 106 111 116 121 126 201 301 302 401 601 606 611 Account Name Cash Accounts Receivable Supplies Equipment Prepaid Insurance Prepaid Rent Accounts Payable J. Doe, Capital J. Doe, Withdrawals Consulting Revenue Salaries Expense Supplies Expense Utilities Expense Required 1. Prepare General Journal Entries for the transactions. 2. Prepare T-accounts for each account used in the journal entries in part 1, show the balance of each T-account. 3. Prepare a trial balance. Trial Balance: Account Number 101 106 111 116 121 126 201 301 302 401 601 606 611 Account Name Cash Accounts Receivable Supplies Equipment Prepaid Insurance Prepaid Rent Accounts Payable J. Doe, Capital J. Doe, Withdrawals Consulting Revenue Salaries Expenses Supplies Expenses Utilities Expenses Total Debit $ 38,250 $ - $2,500 $75,000 $5,000 $3,000 $2,500 $2,000 $ - $750 $129,000 Credit $125,000 $4,000 $129,000 Date March 1 March 5 March 10 March 12 March 15 Account Title and Explanation Cash Office Equipment Jane Doe Capital Prepaid Rent Cash Office Supplies Accounts Payable Cash Service Revenue Accounts Receivable Service Revenue Prepaid Insurance Cash Cash Accounts Receivable Calen Debit $50,000 $75,000 $3,000 $2,500 $1,000 $2,000 $5,000 $1,000 $1.000 Credit $125,000 $3,000 $2,500 $1,000 $2,000 $5,000 $1,000 io ep us ewc asta March 17 March 20 March 21 March 25 March 30 Accounts Receivable Assistant Salary Cash Cash Service Revenu8e Office Utilites Cash Accounts Payable Cash Cash Accounts Receivable Assistant Salary Cash J. Doe, Withdrawal Cash $1,000 $1,000 $750 $2,500 $1,000 $1,000 $2,500 $1,000 $1,000 $1,000 $750 $2,500 $1,000 $1,000 $2,500

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

heres the completed chart of accounts for Doe Co with transactions recor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started