Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jane had the following income and expenditure INCOME Salary $25,000 Reimbursement of work-related based on cents-per-kilometres travelled $1900 Army Reserve income $2500 Dividend from

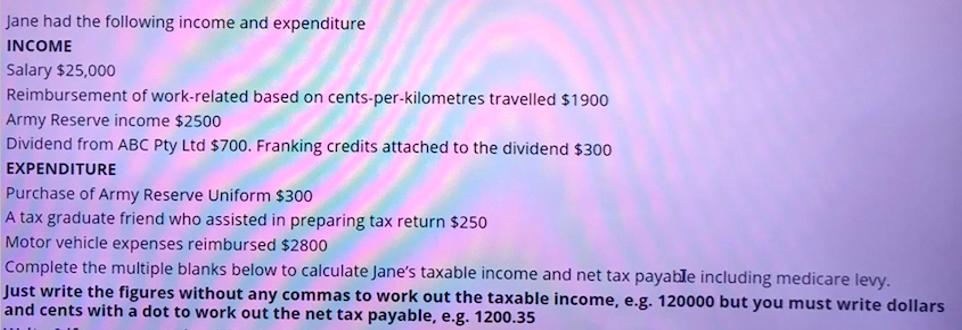

Jane had the following income and expenditure INCOME Salary $25,000 Reimbursement of work-related based on cents-per-kilometres travelled $1900 Army Reserve income $2500 Dividend from ABC Pty Ltd $700. Franking credits attached to the dividend $300 EXPENDITURE Purchase of Army Reserve Uniform $300 A tax graduate friend who assisted in preparing tax return $250 Motor vehicle expenses reimbursed $2800 Complete the multiple blanks below to calculate Jane's taxable income and net tax payable including medicare levy. Just write the figures without any commas to work out the taxable income, e.g. 120000 but you must write dollars and cents with a dot to work out the net tax payable, e.g. 1200.35

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Amo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started